Creditor Corner |

for the week ended March May 10, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

2024 Restructuring Symposium Reserve Your Spot Below! Over 200 registered already!

BREAKING NEWS Steward Health Care and retailer Sam Ash hit BK, FTX recoveries to the moon, retention battles heat up, Adam Neumann out, Tony Yoseloff speaks up, CRE stress, and much, much more…

FEATURED CONTENT Bruce Richards on the Markets: Levers Owners can Control: Corporate Direct Lending vs. Commercial Real Estate Loans |

Scroll through to read all of our content

|

|

|

|

Tweet of the Week |

Dumbledore to Texas! |

|

|

|

|

|

Exclusive Content |

Hospital chain into BK |

|

|

|

|

Click Above to Access Content One time registration required |

|

|

|

In the News |

More retail pain… |

|

|

|

|

News of the Week |

FTX recoveries to the moon! |

|

|

|

|

|

But, then there’s this… |

crying over spilt milk! |

|

|

|

Our take: maybe FTX was bailed out by the market, and maybe a certain law firm played fast and loose with conflicts, but it’s hard to quibble with the outcome… |

|

|

|

|

|

Click Above to Access Content One Time Registration Required |

Our take: we don’t buy into the argument that representing affiliated and conflicted insiders happens all the time. It’s time for a change. |

|

|

|

In the News |

we have a feeling the train has left the station… |

|

|

|

|

|

Exclusive Content |

Private Credit League Tables |

|

|

|

|

Click Above to Access Content |

|

|

|

|

|

Data Download |

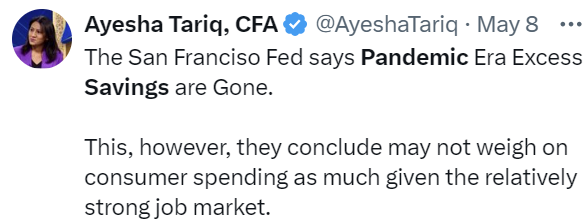

consumers under pressure… |

|

|

|

|

|

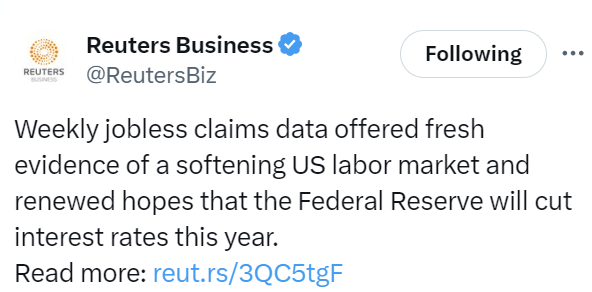

Data Download |

amid softening labor market…. |

|

|

|

|

|

|

|

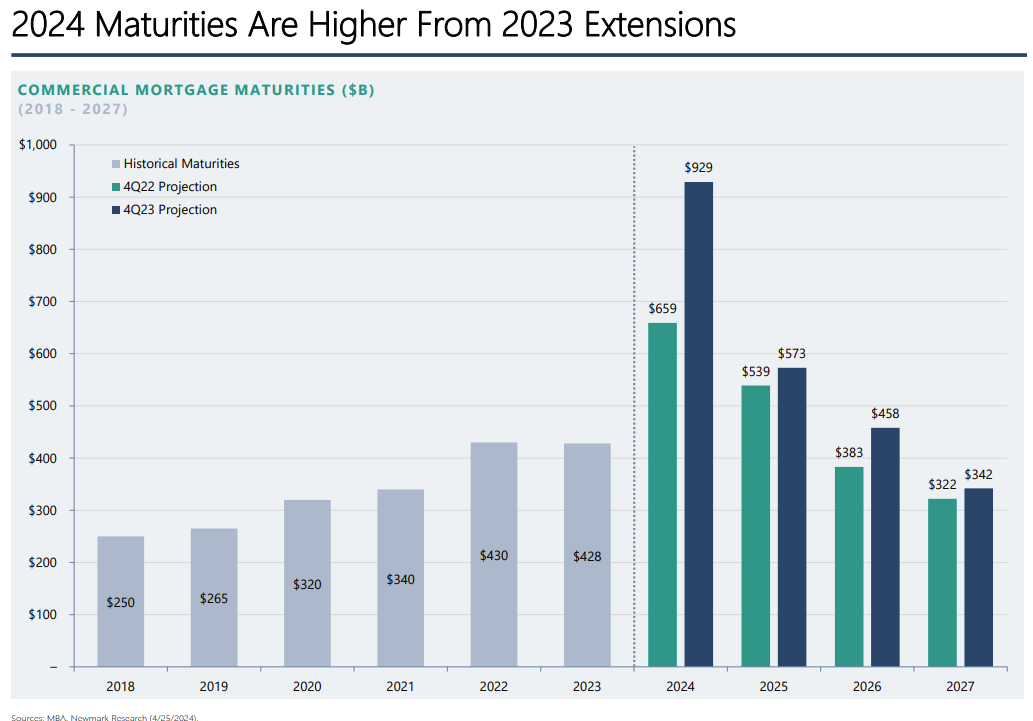

Data Download |

CRE under pressure |

|

|

|

|

|

|

|

Featured Content |

|

Levers Owners can Control: Corporate Direct Lending vs. Commercial Real Estate Loans

Revenues have contracted for the past 4 quarters for Private Credit corporate loans, but impressively EBITDA growth has improved as operating margins strengthened.

Now compare this with the net operating income for many CRE properties where lower revenues create lower NOl, full stop, bottom line. Real Estate, in general can not make the same adjustments that companies can make. Today’s post examines this dynamic. Real Estate is a local market, with each sub-sector subject to its own dynamics, where footfall, location, supply-demand dynamics, and quality of the asset are key differentiating factors. Yet, there is a huge difference in the flexibility a company typically has vs. a single asset CRE property.

Companies have the flexibility to adapt various strategies to cut expenses to improve operating margins/enhance profitability that insures long-term viability. Management can reduce SG&A, optimize headcount, negotiate contracts/payment terms with suppliers, outsource certain activities, reduce CapEx, adjust advertising spend, restrict T&E as well as increase productivity, sell non-core divisions, eliminate unprofitable business lines. Holding all things constant, the LBO sponsor has more flexibility when a portfolio company struggles under the weight of Higher for Longer vs. a CRE sponsor.

Commercial Real Estate has few levers to push on since the property manager can do little to reduce its cost structure as it provides basic service with minimal room in adjusting variable costs & personnel expense. To improve operating efficiency for the property it typically requires additional CapEx such as lighting upgrade, water conservations systems, maintenance & repairs, building automation, which is highly capital intensive. So, when revenue falls (vacancy rises) there is little the property manager can do to increase NOl (the equivalent of EBITDA) away from leasing.

Weak companies and properties will struggle in this environment. My team at Marathon Asset Management avoids the “weak” as the focus is to wisely invest capital and be a thoughtful & creative partner to companies and asset owners that will make it through the trough.

As time goes on and both sectors feel the stress, there is a huge need for tailored capital solutions, a condition that should prove ideal for teams with deep expertise and an established presence across opportunistic credit. Marathon has never been busier as we are “Open for Business” – a willing, disciplined, and thoughtful lender for both sponsors financing LBOs and sponsors financing their CRE properties. The BIG Delta is cash-out refi is possible for LBOs as EBITDA increases and valuations rise vs. many property owners require cash-in refi as cap rates have expanded and property values have declined over the past 2 years.

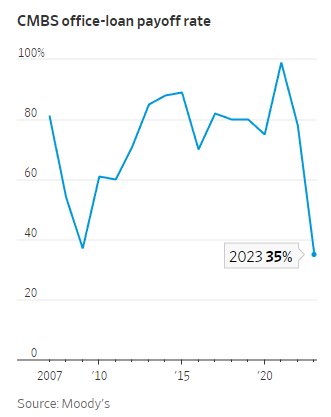

Best to avoid Office: only 35% of Office Loans can refinance according to Moody’s:

|

|

|

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

2024 Restructuring Symposium |

Registration Filling Up Fast Free for Subscribers to the Creditor Corner |

|

|

|

|

|

NYU Stern Bankruptcy Workshop |

Register Now! Space is Limited

|

|

|

|

An unprecedented opportunity for young legal & finance professionals to learn in-depth fundamental credit and legal analysis through seminar and case-study format over intensive 3-day format.

Network with participants from Citadel, Oak Tree, Houlihan Lokey, Franklin Mutual, among others.

Taught at NYU Stern from August 5 to 7, 2024.

Participants will receive Certificate of Completion from NYU Stern and in-depth reference materials for their future careers. Participants already include leading asset managers and law firms.

Workshop program here.

Expert Faculty: Edward Altman, Dan Kamensky, Donald Bernstein, Saul Burian, Judge Robert Drain (ret.), Christian Fischer, Michael Friedman, Max Frumes, Michael Gatto, Larry Halperin, Mo Meghji, Andy Rosenberg, David Smith, Robert Stark, Nick Weber, Jay Weinberger with featured speakers: Lisa Donahue, Holly Etlin, Lauren Krueger & Jared Parker

Registration fees apply |

| Register Here |

|

|

|

|

|

TMA: Understanding Distressed Real Estate |

May 14, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|