Weekly News – June 2

Historic US default averted!

Exclusive Content

Another “PET” (a/k/a uptier) bites the dust!

Exclusive Content

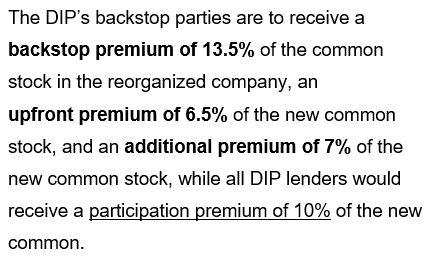

DIPs are the new exit

and why not with these fees!?!?!

Our take:

It’s hard to be a creditor when 27% of the common is reserved for a DIP to exit facility.Â

KKR-backed Genesis files for BK

Third party releases are back!

Wachtell, Lipton, Rosen & Katz on the Purdue opinion

Tell us what you think:

FTX examiner decision up to 3rd Circuit

Double-dip financing is back!

What we’re watching

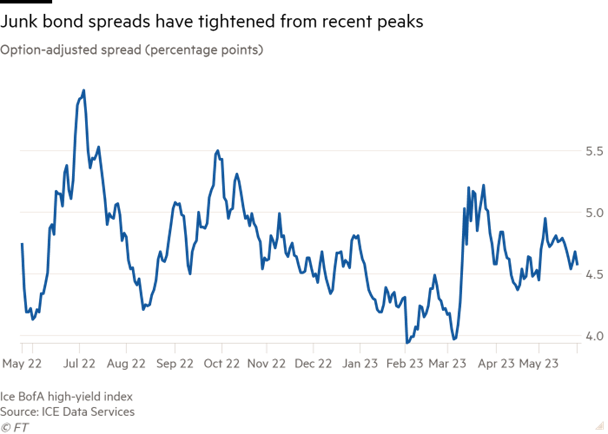

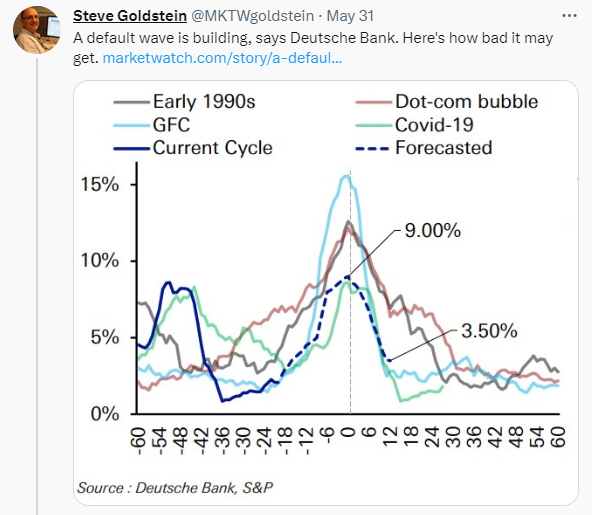

Resilient HY market?

Or, just the calm before the storm?

Read our recent coverage:

“Open Market” Purchases

Read the full length feature here.

Read our recent coverage:

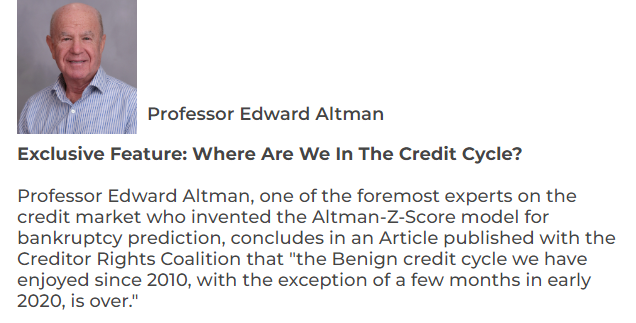

Where Are We In The Credit Cycle?

Read our recent coverage: Contributor Cliff White on Examiners

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

June 7: Navigating Uncertainty: Insights on the Global Economic Outlook

June 8: INSOL: Recent Developments in the Chinese Real Estate Market

June 8: LSTA: After the Failures–What’s Next for the Banking Sector and Venture Lending?

June 27: REGISTRATION NOW CLOSED: Creditor Rights Coalition & LSTA 2023 Restructuring Symposium

August 22: ABI/NCBJ: Tackling Emerging and Recurring Mortgage Issues in Individual Bankruptcy Cases