Creditor Corner |

for the week ended March 1, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition

|

Over 2,400 member subscribers and growing! Sign Up Here |

BREAKING NEWS McDermott makes it to the finish line (again), NYCB in flames, Dentons slush fund, SDTX fallout continues, FTX Examiner takes on S&C, and much, much more!

FEATURED CONTENT Bruce Richards on the Markets: Ring in Spring |

Scroll through to read all of our content

|

|

|

|

Tweet of the Week |

Welcome to the Golden Age (again!) |

|

|

|

|

|

Exclusive Content |

Quote of the Week |

|

|

|

|

|

|

Justice Green quote of the week: “I was horrified to discover that [McDermott] has spent around $150m on professional fees in negotiating with its secured creditors from December 2022 and then putting forward the plan and taking it to this hearing.†The judge seconded the discomfort expressed by Baupost partner Richard Carona, a witness for the creditors, at this “enormous†sum of money. “I agree with his comment that there seems to something wrong with the restructuring industry, particularly in the US, where the costs appear to be out of control.†|

|

|

Click on the Image to Access the Full Report One-time registration required |

|

|

|

In The News |

NYCB hits the skids…. again… |

|

|

|

|

|

In The News |

We can’t wait to see what happens next! |

|

|

|

|

|

Exclusive Content |

our favorite legal drama |

|

|

|

|

Our Take: Regardless of the outcome here, and we hope we see an opinion at the end of this, the lawyering here has been a master class in courtroom drama. Kobre Kim’s Rosenbaum is giving Perry Mason a run for his money. |

|

|

Click on the Image to Access the Full Report One-time registration required |

|

|

|

In the News |

More fallout from SDTX |

|

|

|

|

Click on the Image to Access the Complaint |

|

|

|

Data Download |

Private Credit Primer |

|

|

|

|

|

Data Download |

no Fed rate cuts in 2024?? |

|

|

|

|

|

Bruce Richards on the Markets |

|

Ring in Spring:

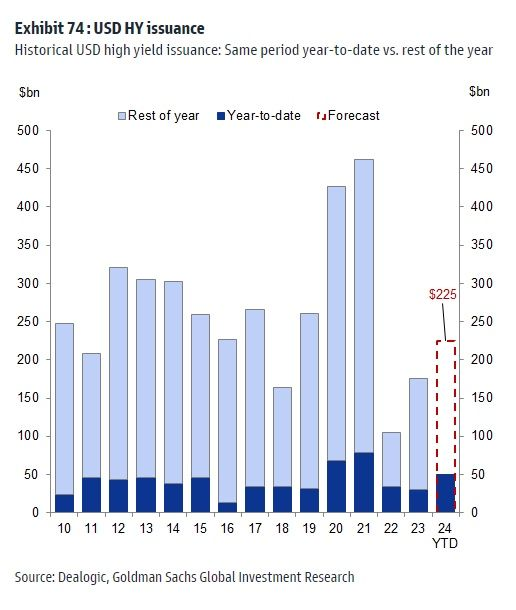

Happy March. Markets are feeling happy, relieved that Higher for Longer (rates) hasn’t stopped the S&P 500 from setting new highs as the economy (jobs & GDP) is strong as bull. Corporate financing needs have also moved in sync. After a slow 2022-2023 period for investment-grade corporate issuance, 2024 is providing to be a blockbuster year with ~$380B issuance y-t-d (first two months). It is also noteworthy that BBB-rated debt is nearly $4T of the total $7T IG market, with ~$1T rated BBB- (one notch above high yield, which has a total market size of ~$1.3T), leaving little margin for error and a big potential list of so-called fallen angels. Russell 2000 (IWM), however, is -16% lower than its all-time highs and has index constituents more representative of leveraged borrowers who have directed more cash flow to debt investors at higher rates. HY issuance has also been active, with ~$58B priced y-t-d (Goldman Sachs bar chart, below). In broadly syndicated loans (BSL), most of the action has been re-pricing, not refinancing, meaning that these borrowers are reducing their all-in rate with relatively low friction costs.

Tactical investors might want to reduce exposure to HY with spreads approaching ~300bp. Constructing a portfolio of improving credit stories, higher coupon cash flowing bonds and opportunistically trading the primary market is my recommendation at the current juncture, and for those allocators that want exposure, it is best to consider active managers that can produce index+ results with relatively low tracking error. Multi-asset credit solutions that include each of HY Bonds, BSLs, EM debt, and Structured Credit is what I recommend, to optimize for all seasons and active capital markets. It’s a new beginning, so let’s Ring in Spring.

Spreads today are:

AAA: +39bp

AA: +53bp

A: +80bp

BBB: +120bp

BB: +195bp

B: +317bp

CCC: +886bp

IG Index: +96bp

HY Index: +323bp |

|

|

|

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets |

|

|

|

Exclusive Content |

Irrational exuberance?? |

|

|

|

|

Click on the Image to Access the Full Report |

|

|

|

Exclusive Content |

One to watch…. S&C in the hot seat… |

|

|

|

|

Click on the Image to Access the Full Report |

|

|

|

Exclusive Content |

Practice Pointer: Buyside Beware! |

|

|

|

|

Click on the Image to Access the Full Report |

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reorg: Wesco and Robertshaw: Uptiers Get Their Day in (Bankruptcy) Court |

March 13, 2024 |

| Learn More |

|

|

ACFA: Liability Management Transactions Program |

March 14, 2024 |

| Learn More |

|

ABF Journal: 15th Annual Philadelphia Restructuring Summit |

March 21, 2024 |

| Learn More |

|

|

|

|

|

|

|

|