Special Feature: Purdue Pharma @ SCOTUS

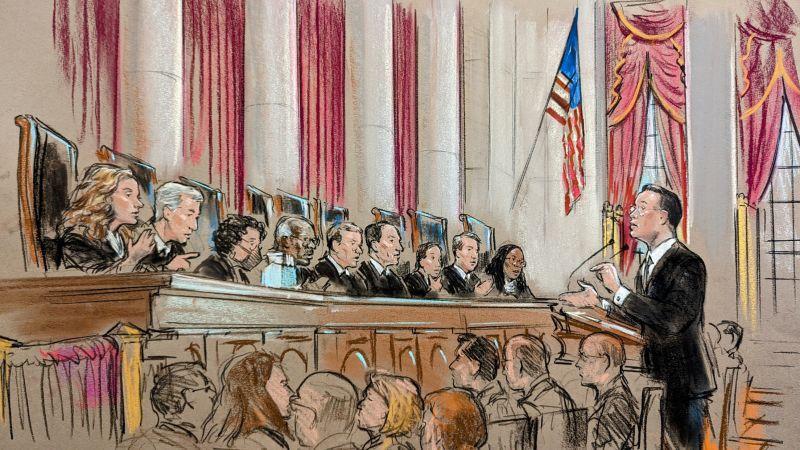

The Supreme Court’s oral argument on December 4, 2023 demonstrated the Supreme Court, as a whole, very much appreciated the business sense of the Sackler deal and was concerned about the uncertain consequences of eliminating it, but wrestled with two main issues, namely (i) how the words “appropriate” and “not inconsistent” in Bankruptcy Code section 1123 can be interpreted to allow coerced releases, and (ii) whether a majority or even super-majority vote of creditors can deprive the minority of constitutional rights.

The Statute: The statutory interpretation question was approached from opposite extremes. Justice Thomas asked how the broad scope of “appropriate” can be narrowed to exclude coerced releases, while Chief Justice Roberts asked why the major question doctrine did not apply. That doctrine would deprive the bankruptcy court of power to make up the rules for coerced releases and would defer to Congress on such an important question. Justice Alito took both sides by asking whether the question should be resolved by Congress or by the Supreme Court. Notably, Justice Alito suggested that if the Sacklers’ funds are unreachable, the court ought to be able to do something about it. Justice Kavanaugh suggested the use of coerced releases the last thirty years can make them “appropriate” when confined to claims for which the released parties would have indemnification claims against the debtor, but conceded the good faith limitation on the Sacklers’ indemnification claims could make a difference. Justice Kavanaugh also asked why “appropriate” should not be read narrowly because of its great economic significance that the Supreme Court would not assume Congress lightly assigned. Justice Jackson noted coerced releases were not allowed under Calloway v. Benton under the Bankruptcy Act, and also stated the Sacklers can settle with 97.5% of creditors, but it is they who demand a release from the others. Justice Barrett attacked the entire relevance of indemnification claims by suggesting the estate would be distributed on liquidation and nothing would be left to pay the Sacklers’ indemnification claims. Justice Barrett also observed bankruptcy courts “stretch the Code” with coerced releases. Justices Gorsuch and Barrett pointed out the Sacklers would not be discharged of fraud claims in their personal bankruptcies, showing an inconsistency with the Bankruptcy Code. Justice Jackson asked that even if coerced releases are allowable, why wouldn’t this be a clear case not to allow them where the Sacklers took their money out of the debtor. Justice Barrett also asked why Congress needed to enact Bankruptcy Code section 524(g) for asbestos cases if section 1123(b)(6) already authorized coerced releases. Justice Jackson asked why section 1123(b)(1)–(5) are necessary if section 1123(b)(6) is so broad.

The Constitution: In respect of some of the constitutional issues, Justice Sotomayor implied that in view of the impracticality of obtaining consents from thousands of victims, perhaps the coerced releases are the only answer and override due process concerns. Of course, that does not speak to those creditors who affirmatively denied consent. Justice Kagan volunteered (later supported by Justice Gorsuch) that one of the US Trustee’s stronger arguments is the basic bankruptcy bargain requires the debtor to put all its assets on the table to get a discharge, and the Sacklers may not have provided “anything near their entire pot of assets.” Justice Kagan reasoned: “it would be a kind of extraordinary thing if we gave the power to—to basically subvert this basic bargain in bankruptcy law.” Justice Gorsuch added that even if the Sacklers put all their current assets on the table, they are still getting a release from claims against their future assets. Justice Gorsuch also confirmed the government agrees with the amici briefs contending the Sackler deal deprives creditors of jury trials under the Seventh Amendment.

It is too treacherous to predict the outcome. But, it appears if the Supreme Court affirms confirmation of the Purdue Pharma chapter 11 plan, the Supreme Court will issue an ultra-narrow ruling designed to avoid wholesale elimination of constitutional rights in other cases. Given the fundamental and constitutional rights at issue, to affirm, the Supreme Court will have to hold the constitutional bankruptcy power is broader than it has ever before ruled because it would allow a majority vote to deprive a minority of fundamental and constitutional rights.

Copyright© 2023 Creditor Rights Coalition. All rights reserved.

We won’t know until the Supreme Court rules, but there is substantial reason to hope that the Court “got it” — that the DOJ’s solo crusade is profoundly adverse to the needs, desires, and best interests of the victims of Purdue/the Sacklers. For many very good reasons, EVERY state attorney general and EVERY victim group — who spent years litigating and mediating against the Sacklers — supports the chapter 11 settlement. Nothing less than American lives are at stake. Very little time was spent on constitutional issues, which is no surprise because those weak arguments would invalidate both 524(g) and over 450 years of common law on the release by the estate of fraudulent transfer claims owned by third-party creditors under state law. The focus was primarily on whether it was a good deal or a bad deal. (This was rather bizarre, because it was never contested at a 41-witness trial that (a) it was a good and fair deal, negotiated by 48 attorneys general, the UCC, and the Debtors opposite the Sacklers, and (b) the alternatives are all terrible and tragic for victims.) Here are the critical quotes:

Justice Kavanaugh: [W]hat the opioid victims and their families are saying is you, the federal government, with no stake in this at all, are coming in and telling the families, no, we’re not going to give you payment, prompt payment, for what’s happened to your family . . . the federal government is not going to allow all this money to go to the states for prevention programs to prevent future overdoses and future victims and in exchange, really, for this somewhat theoretical idea that they’ll be able to recover money down the road from the Sacklers themselves.

Justice Kagan: I mean, it’s 3 percent [of creditors opposed]. You know, what if it were 1 percent, .1 percent? And your — your position would still say, well, no, the Trustee can come in here and blow up the deal and should blow up the deal.

It’s overwhelming, the support for this deal, among people who have no love for the Sacklers, among people who think that the Sacklers are pretty much the worst people on earth, they’ve negotiated a deal which they think is the best that they can get . . . it seems as though the federal government is standing in the way of that as against the huge, huge, huge majority of claimants who have decided that, if this provision goes under, they’re going to end up with nothing.

Justice Thomas: I’m just wondering what exactly is [your] role and why is it that you’re able to come in and undo something that has such overwhelming agreement.

And in the words of the official creditors’ committee: The U.S. Trustee does not speak for the victims of the opioid crisis. Quite the opposite, the Trustee [as required by statute] appointed the official committee, my client, as the fiduciary representing their interests. Every one of the creditor constituencies in this case comprising individual victims and public entities harmed by Purdue overwhelmingly supports the plan. Indeed, it was the creditors that insisted on the release of the creditor claims against the Sacklers for the same injuries to avoid a value-destroying victim-against-victim race to the courthouse that would result in no recovery for virtually all except the United States. That unrebutted finding grounded in a massive record built on years of creditor victim-led efforts refutes the Trustee’s eleventh hour speculation of some magic alternative permitting an equitable victim recovery.

Now we wait, with fingers and toes crossed.

Copyright © 2023 Creditor Rights Coalition. All rights reserved.

Let’s do a vote count. Here are some highlights of the Justices’ questions that may give us a clue —

Chief Justice Roberts: In his first question, he inquired about the Major Questions Doctrine and whether there is clear statutory authorization for the bankruptcy court to exercise sweeping authority to approve non-consensual releases in favor of the Sacklers. The Biden Justice Department is not enthusiastic about the Doctrine so the Government did not use it as a basis for striking the Purdue Pharma releases. Nonetheless, the Chief led with that question because it may be dispositive. That is very good news for the Petitioner.

VOTE: Chief Justice Roberts leans strongly toward REVERSAL.

Justice Thomas: Right out of the box, Justice Thomas asked about the authority of the bankruptcy court to approve even consensual releases. And he came back to it in other questioning. He also acknowledged the Respondents’ opposition to UST standing, asked a question about it, but did not press.

VOTE: Justice Thomas leans strongly toward REVERSAL.

Justice Alito: Similar to the Chief Justice, Justice Alito began by asking whether Congress should decide the issue of third-party releases. He also expressed skepticism about a plan to “redistribute others’ property right because we think that’s the best deal available and it would serve the greatest good for the greatest number.”

VOTE: Justice Alito leans strongly toward REVERSAL.

Justice Sotomayor: Most of Justice Sotomayor’s questions went to practicalities, such as how consent could be obtained with such a large number of victims. She came back to similar points throughout her questioning. She also asked about the possibly pivotal issue of derivative vs. direct claims not owned by the estates and suggested that almost all of the claims are really derivative and under bankruptcy court authority. Interestingly, she inquired about how the Court could make a decision that would not affect related exculpation issues, including the pending Highland Capital case. Towards the end, she also asked one of the Respondents how to counter the Government’s position that denial of the releases will change the leverage of the parties, but not doom a deal.

VOTE: Justice Sotomayor leans toward AFFIRMANCE.

Justice Kagan: In some of the most hard-hitting questioning of both sides, Justice Kagan expressed skepticism that a deal can be reached without the releases. The former Harvard Law School Dean said the Government was relying on “hifalutin principles of bankruptcy law” without recognizing that maximizing payment to creditors is also an important principle. But she gave the Respondents an equally hard time justifying releases to those who never submitted themselves to the bankruptcy process.

VOTE: Justice Kagan is UNDECIDED.

Justice Gorsuch: Justice Gorsuch was true to form throughout in noting the extraordinary relief being given to the non-bankrupt Sacklers, including relief from fraud claims, at the expense of the interests of the hold-outs, including their right to a jury trial. He also focused on the statute and how a general provision of the Bankruptcy Code could be read as authorization to do what otherwise seems at odds with the basic construct of the bankruptcy system.

VOTE: Justice Gorsuch leans strongly toward REVERSAL.

Justice Kavanaugh: Perhaps the most surprising of all the Justices in this case, Justice Kavanaugh focused on the fact that the overwhelming majority of voting creditors favored the plan and there was thirty years of precedent for bankruptcy courts to approve non-consensual releases. He expressly asked about the UST’s standing and said the Respondents’ argument was strong. Near the end of his questioning, however, he expressed his view that the Major Questions Doctrine may be suitable to apply in this case.

VOTE: Justice Kavanaugh leans toward AFFIRMANCE.

Justice Barrett: Most of Justice Barrett’s questions seemed designed to enlighten, but some also betrayed a certain skepticism about granting broader relief to the Sackler family than they could obtain as individuals in bankruptcy. (Justice Kagan and others also made similar points.) Justice Barrett said it might be better to have “Congress do it rather than bankruptcy courts trying to stretch the code.”

VOTE: Justice Barrett leans toward REVERSAL.

Justice Jackson: Justice Jackson was consistent throughout in noting the statutory impediments to the releases. She seemed to pointedly reject Justice Kagan’s reference to “nut case” hold-outs and instead posited that the problem was the Sacklers’ insisting on forcing the deal on all victims. Next to the Office of Solicitor General, she may have been the clearest advocate for the Government’s position.

VOTE: Justice Jackson leans strongly toward REVERSAL.

With all said and done, it is still possible that the Petitioner/Government wins 9-0, but likely will win by at least 6-3.

Copyright 2023 Creditor Rights Coalition

1 Cliff White served as head of the Justice Department’s “bankruptcy watchdog,” the United States Trustee Program, for seventeen years before retiring last year. He is currently an executive with a financial technology company. The views expressed are those of the author only.