Weekly News – June 30

Look Out for our New Feature

2023 Restructuring Symposium

Click through to view the slides from the Symposium

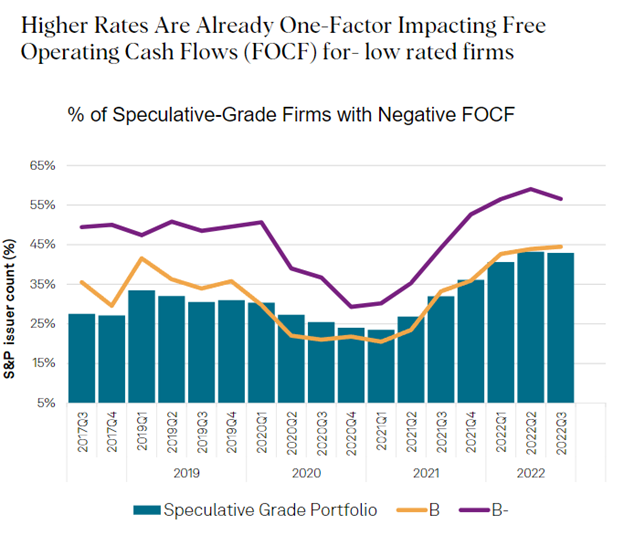

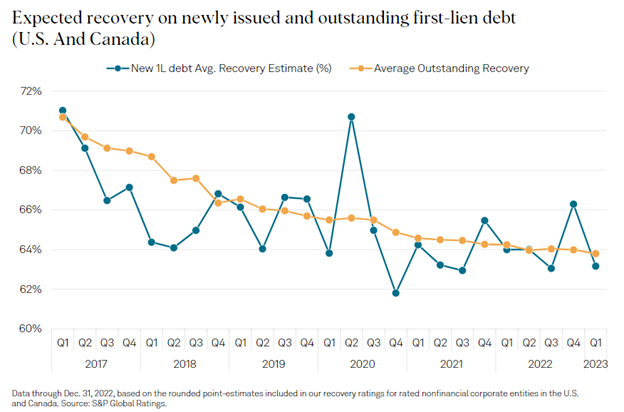

Floating Rate Impact

Source: S&P Global Ratings

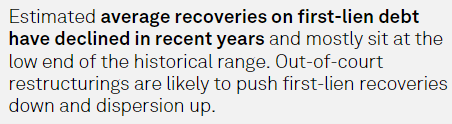

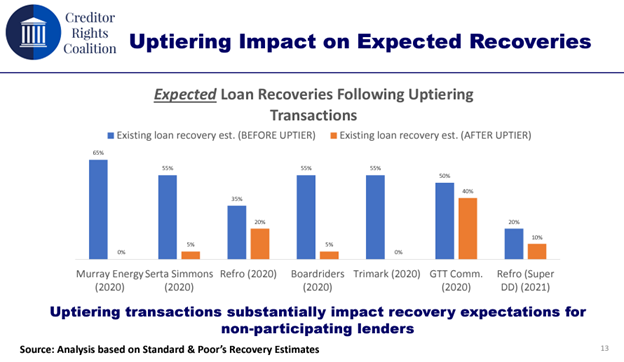

Loan recoveries affected by LMEs

Source: S&P Global Ratings

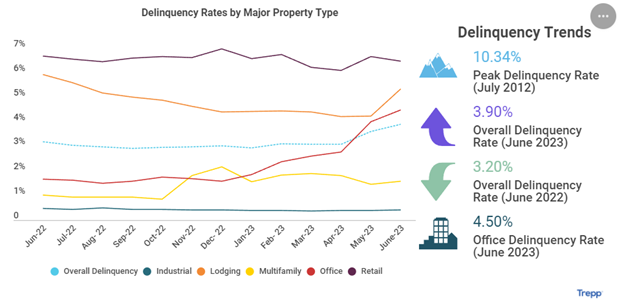

Property Markets Under Pressure

Source: Trepp

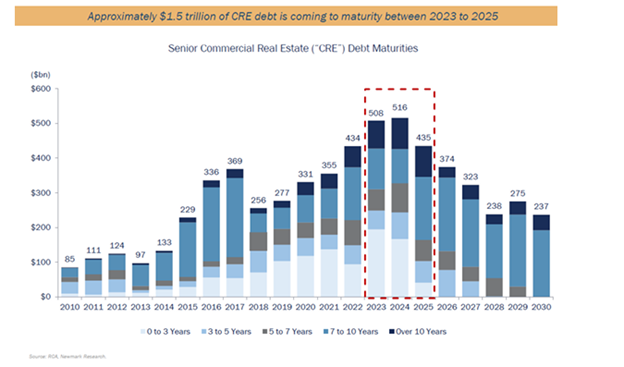

With $1.5 billion of CRE debt coming due

Creditor strategies in the spotlight

Click through to view the slides from the Symposium

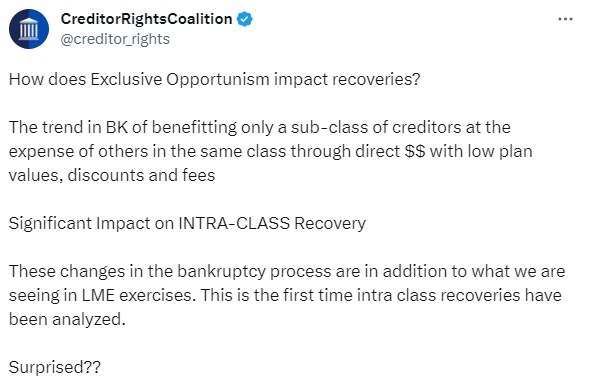

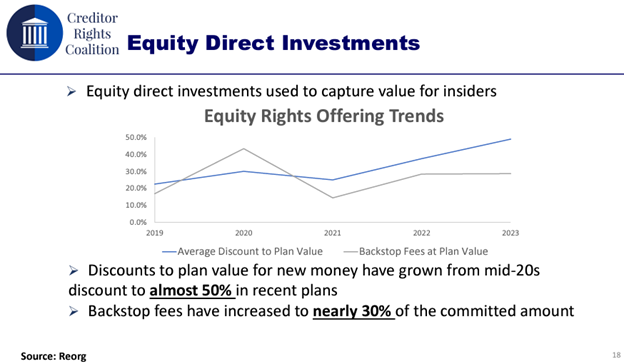

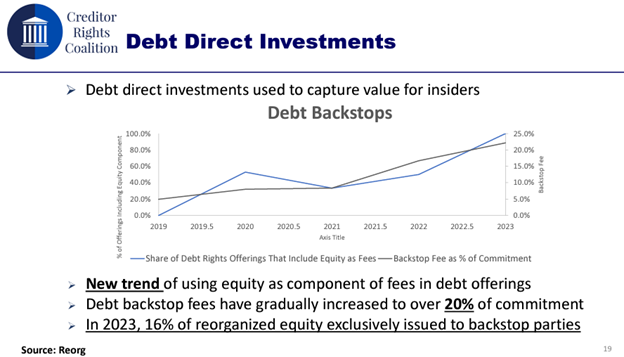

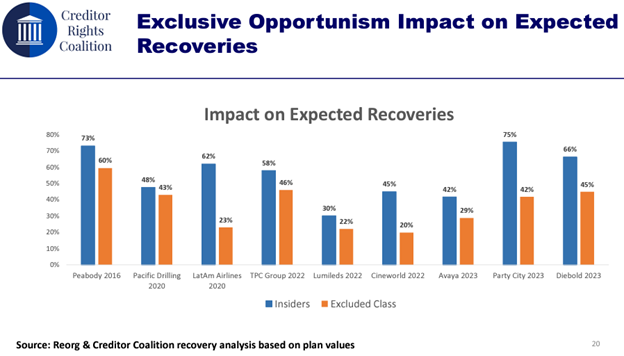

Exclusive Opportunism

Click through to view the slides from the Symposium

Lordstown Enters

Exclusive Content

Cineworld Exits

Congrats to our friend @Maxfrumes on joining 9fin

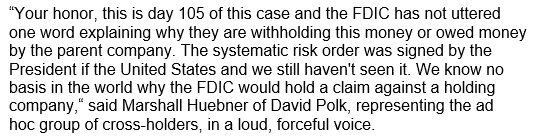

SVB fight is on!

Bailout gone wrong

To the rescue!

What we’re reading…

Source: Morgan Lewis

2023 CRC Allocators Conference

Contributors Speak Up

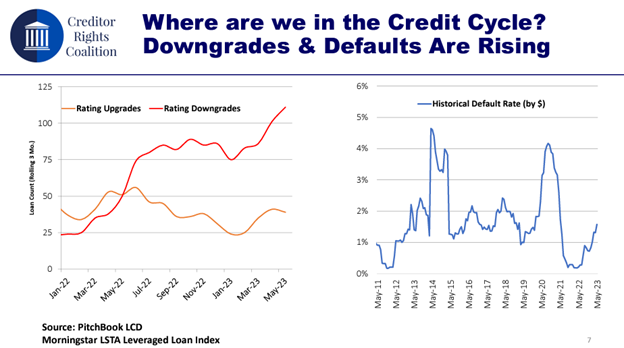

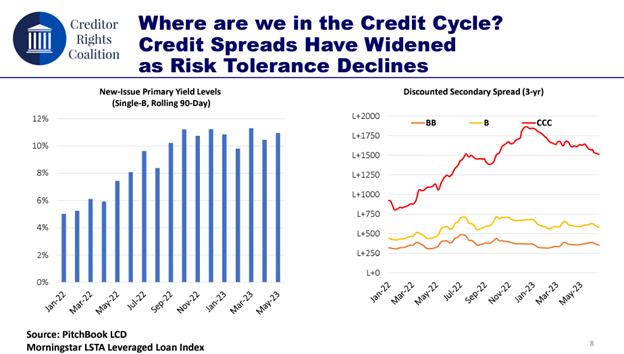

What to expect in the next default cycle

We asked Contributors Bradford Sandler and Sidney Levinson to weigh in on what we should expect in the next default cycle.

Professor Edward Altman recently noted in a paper published with the Creditor Rights Coalition that the Benign Credit Cycle is over. He sees a reversion to the mean in terms of defaults and recoveries in 2023. But he also sees many risks on the horizon making a Stress or even in a “hard-landing†scenario a possibility (with 8-10% default rates). Put your prediction caps on. What do you see and expect? Where do you expect restructuring activity to increase? Are we in for more bankruptcies? Or, more (yawn yawn) extend and pretend? Will RSAs rule the day? Or, will we see more traditional in-court restructurings? What will this new environment look like?

Read our recent coverage:

Third party releases

click through to read the features from our Contributors

Read our recent coverage:

“Open Market” Purchases

Read the full length feature here.

Read our recent coverage:

Where Are We In The Credit Cycle?

Read our recent coverage: Contributor Cliff White on Examiners

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

August 22: ABI/NCBJ: Tackling Emerging and Recurring Mortgage Issues in Individual Bankruptcy Cases