Weekly News – January 12

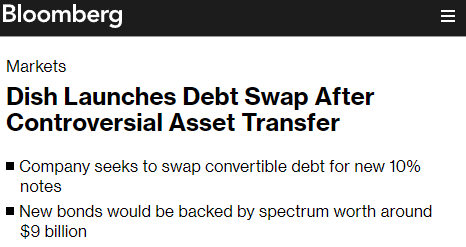

Dish asset swaps…

Exclusive Content

Find it here on LevFin Insights

leading to strong-armed tactics…

Exclusive Content

Find it here on LevFin Insights

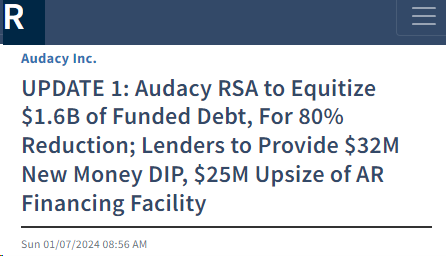

Audacy files for BK in SDTX

Exclusive Content

Find it here on Reorg

Find the Company’s announcement here

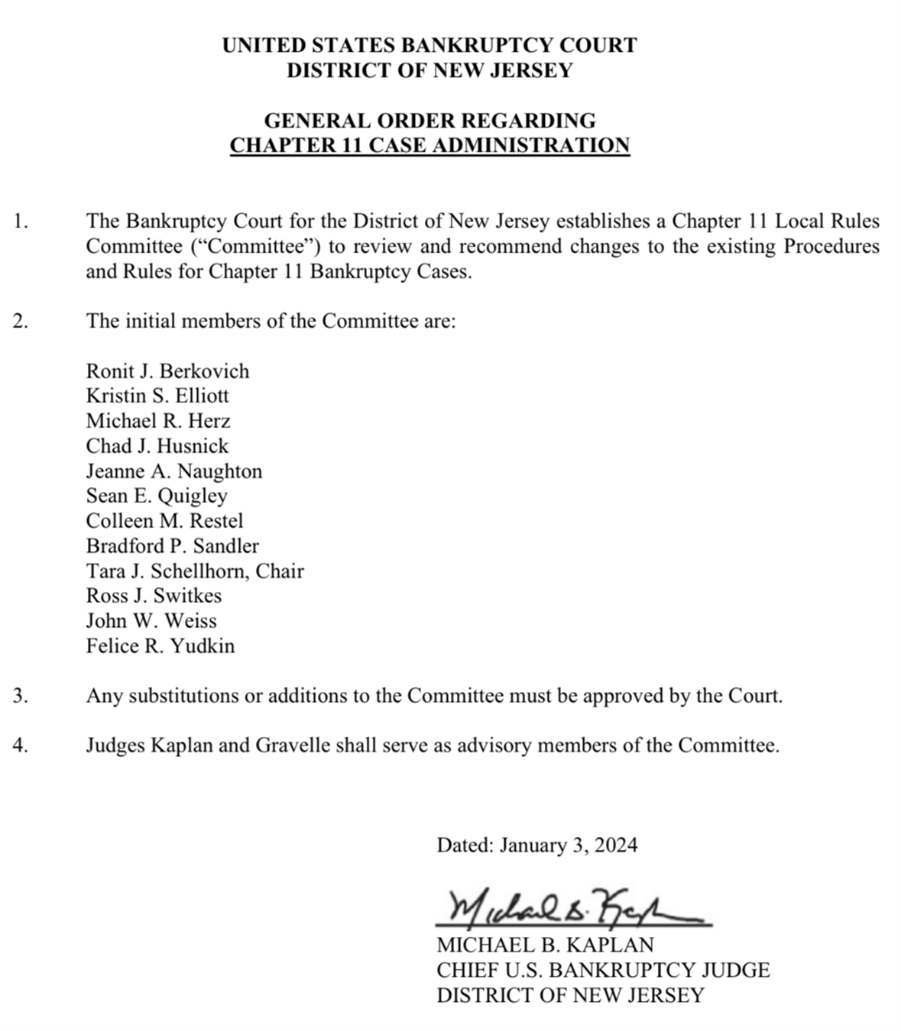

Competition heating up in NJ

Our take:

This is how it starts… like a carnival barker looking for kids to get on the newest ride at the amusement park.

Tell us what you think here

9fin shares their roadmap for 2024

Exclusive Content

FTX on the asset hunt

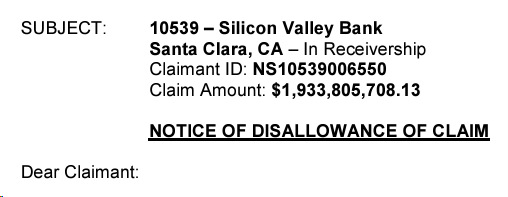

FDIC rejects SVB’s claim

Refunds looking unlikely….

Read the SCOTUS oral argument transcript here

Featured Content

Bruce Richards on the Markets

Bruce Richards, CEO

Marathon Asset Management

insights on markets, investing and more!

Inflation: More Work To Do

Mr. Market is pricing a 67% probability the Fed will cut rates in March, with six rate cuts during calendar ’24, down from 90% probability and 7 rate reductions just two weeks ago. Treasury rates have adjusted marginally higher, and credit spreads have increased as the market has begun to adjust to an overly rosy rate outlook. Strong employment gains with inflation stuck at 3%-plus does not provide the Fed with adequate cover or necessary data to justify reducing rates in Q1. Fed Funds should eventually be +100bp to +150bp above the inflation (PCE), creating a Real Funds Rate of 1 to 1.5%%, which implies inflation of 2%, the Fed will bring its Fed Funds rate to 3% – 3.5%, or 200bp lower than where it is today. I believe the Fed will be slow and steady, maintaining its current posture until job growth slows to a trickle and inflation is comfortably sitting at around 2% and not risk re-stimulating inflation. (Note 1: The election has nothing to do with the Fed; the Fed is data dependent and wants no part of influencing a political election. Period.)

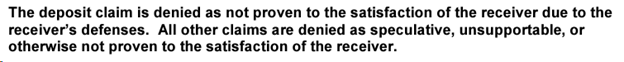

Headline and Core CPI picked up from last month, exceeding survey expectations. Headline and Core CPI is growing at a 3.4% and 3.9% annualized pace, respectively. Goods inflation was flat, which ends a 6-month streak of falling goods prices, led by both new and used vehicles. OER and rent, which together account for more than a third of CPI, remain at elevated levels of 5.7% 3-month annualized pace. Non-housing services remained strong coming in at a 4.3% 3-month annualized pace, led by airfares and medical care.

Loretta Mester, Cleveland Fed President, said “I think March is probably too early in my estimate for a rate decline because I think we need to see some more evidence….the December CPI report just shows there’s more work to do, and that work is going to take restrictive monetary policy.†There are two more CPI prints between now and the March meeting, not enough time, or data points to alter the firm employment or inflation data being reported. I am thankful to our Federal Reserve for taking the action they took to get inflation under control, and applaud the Fed for diligence, even if it means Higher for Longer.

(Special Note: Argentina has seen its inflation sour from 120% to 150% in the most recent month, which is clearly unsustainable; while Turkey has taken specific measures to address its high rate of inflation with Turkey CPI declining from 85% to 65% over the past few month).

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets

What we’re reading…

Goldman on Earnings Season

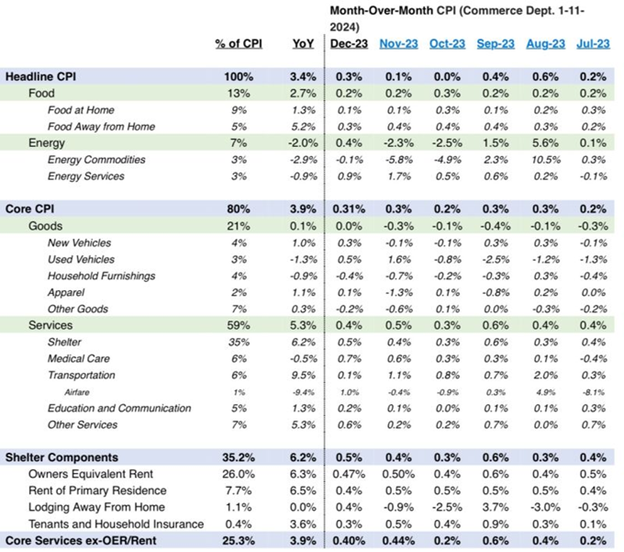

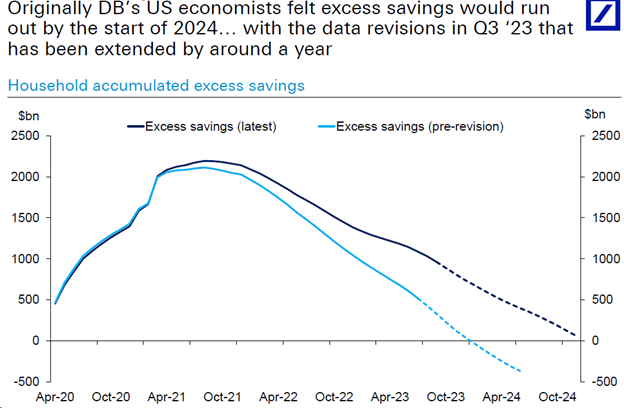

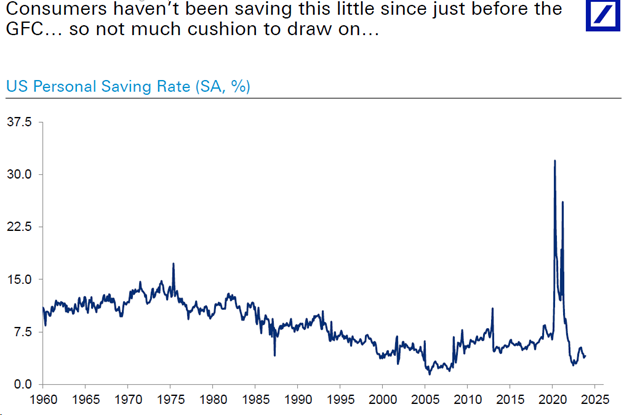

DB sees consumer weakness in Q2 2024

DQ provisions in the news…

Our take:Â

If you want to read more on DQ provisions, look no further than our latest feature!

Featured Content

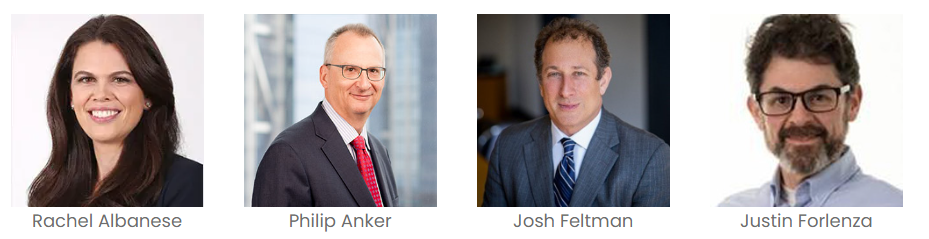

Contributors Speak Up:

Our Contributors take on DQ provisions

We take on Disqualified Lender provisions. We were shocked by what we learned, Not only are distressed investors targeted but usually weeks if not months after a trade occurs. Serta, Packers and Bijyu’s are the latest examples of a troubling trend.

Read what Contributors Paul Silverstein, Justin Forlenza, Sid Levinson and Jim Millar have to say about this topic.

Some excerpts below:

Aggressive sponsors want the option to disqualify distressed investors from owning their portfolio company’s loans.

a fundamental practical problem lies in the lack of transparency as to who is disqualified from owning a loan because DQ Lists are generally not available at time of trade notwithstanding that many credit agreements provide for the lists to be made available to lenders.

But buyer consent is not obtained until closing, which can be many weeks or even months after the date the trade actually occurred. If the loan buyer is on the DQ List, the borrower can then reject the trade well after-the-fact.

2024 Sponsorships Now Available

Please Consider Sponsoring CRC’s Content

Click Here

Meet our 2023 Sponsors

The CRC is funded through sponsorships from these organizations:

Featured Content

Contributors Speak Up:

Venue Reform in the Spotlight

click here to read the features from our Contributors analyzing Venue Reform

Featured Content

Contributors Speak Up:

SCOTUS takes on Purdue

click here to read the features from our Contributor analyzing what happened @SCOTUS

CRC weighs in on Serta

Special Feature:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

January 17: Arnold & Porter: Exploring Bank Liquidity Requirements

January 17: **NEW EVENT** III: New Year, New Solutions in Insolvency Proceedings

January 22: Reorg & Proskauer: Private Credit Restructurings: Opportunities and Pitfalls

January 31: NYIC: 17th Annual Women in Achievement Awards

February 6: SFNET: Las Vegas Asset-Based Capital Conference

February 7: Arnold & Porter: Navigating Issues in Distressed Real Estate

February 8: TMA: 2024 Las Vegas Distressed Investing Conference

February 13: City Bar Bankruptcy Committee & ACFA: Hot Topics in Bankruptcy

February 15: ABI: Paskay Tampa Memorial Bankruptcy Seminar

February 23: **NEW EVENT** Wharton Restructuring Conference

March 14: ACFA: Liability Management Transactions Program

March 21: ABF Journal: 15th Annual Philadelphia Restructuring Summit