Creditor Corner |

for the week ended March April 26, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

ANNOUNCING Registration Now Open for our 2024 Restructuring Symposium Reserve Your Spot Below! Over 125 registered already!

BREAKING NEWS Vulture investors beware, Express to BK, Venny default on horizon, McKinsey on firing line, Adler chpt. 22, DISH bondholders sue, and much, much more…

FEATURED CONTENT Bruce Richards on the Markets: Pricing Liquidity |

Scroll through to read all of our content

|

|

|

|

2024 Restructuring Symposium |

Registration is Now Open Free for Subscribers to the Creditor Corner |

|

|

|

|

|

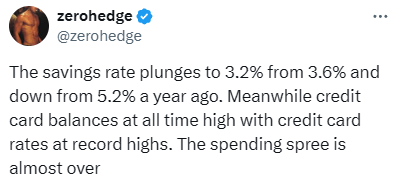

Tweet of the Week |

crying over spilt milk… |

|

|

|

|

|

News of the Week |

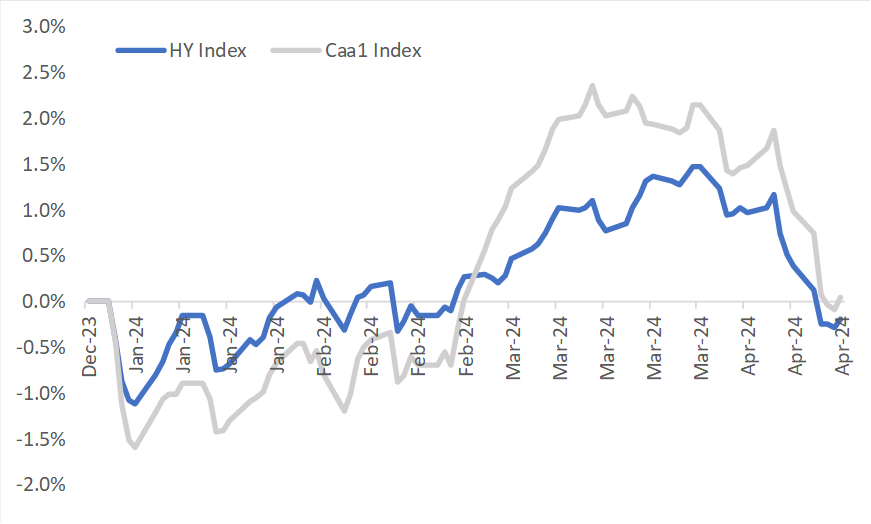

HY returns turn negative YTD |

|

Source: Bloomberg, & Thank you to JFL Credit |

|

|

|

Exclusive Content |

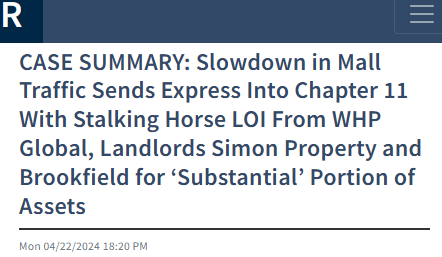

Express to BK |

|

|

|

Click Above to Access Content |

|

|

|

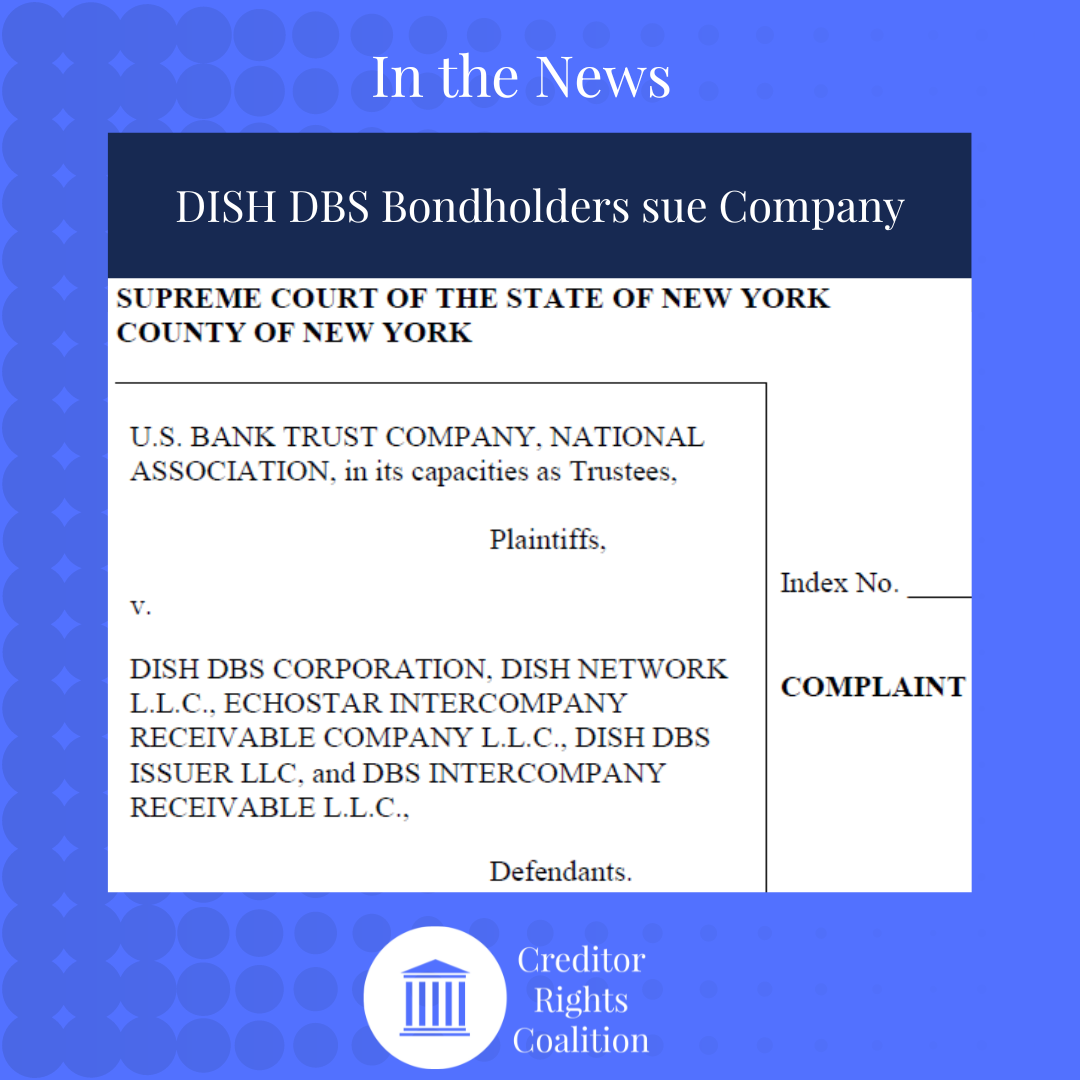

In the News |

Retail carnage far from over…. |

|

|

|

|

In the News |

BK Pros Salivating! |

|

|

|

|

|

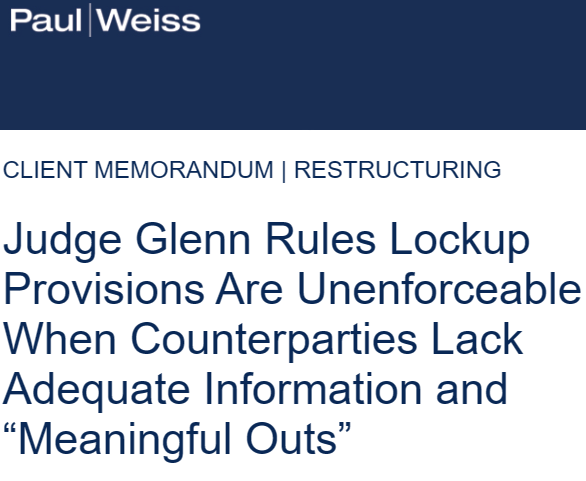

What We’re Reading |

SDNY sticking up for creditor rights |

|

|

|

|

Exclusive Content |

McKinsey on the firing line… |

|

|

|

|

Click Above to Access Content One time registration required |

|

|

|

Exclusive Content |

wow… twists and turns! |

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

|

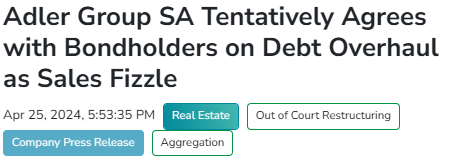

Exclusive Content |

real estate chapter 22 already?? |

|

|

|

|

Click Above to Access Content One time registration required |

|

|

|

Exclusive Content |

the next generation of LMEs… |

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

|

|

Pricing Liquidity

Calculating liquidity premium can be theoretical, quantitative, or subjective. Capital allocators commonly discuss, yet rarely quantity this for their investors, offering a subjective guesstimate. CB: big shoutout for asking this question: What is the liquidity premium an investor should earn for Private Credit and how do you determine the appropriate level? As I was pondering your question, I produced this equation:

Private Credit Fund IRR = BR + LAS + CRD + SC – EL + Liquidity Premium

– BR = Base Rate (SOFR) – LAS = Liquid Asset Spread (BSL spread) – CRD = Credit Risk Differential if any v. BSL – SC = Structural Considerations (spread give/pick-up for improved Covenants, Creditor Rights vs. BSL) – EL = Expected Loss

Economic theory tells us longer life funds deserve a greater liquidity premium. Therefore, the liquidity premium for a 10–12-year Private Equity Fund should be greater than the premium one earns for Private Credit Fund with a 7-year term. In addition to stated fund life, the actual weighted average duration for the capital deployment must be considered. PE Funds may have an average 6-year hold period, whereas a PC Funds are closer to 3-year average holding period. In today’s market I put the magic number at +200bps. I believe the benchmark premium capital allocators should earn is 1.25x vs liquid asset IRR. Example: if BSL yield is 8%, then PC is 10% (8% x 1.25x = 10%).

Markets are not perfect so when one compares BSL v. the same issuer in a clubbed-up Private Credit Loan the spread has compressed to 75-100bp liquidity differential, a difficult value proposition. Large managers putting huge sums of money to work accept this spread. This is exactly why I believe the best value is found in the Middle Markets. MMLs earn 200-300bp premiums and a portion of this is alpha derived from sourcing truly-value added loans. Private credit with strong covenants, lower-LTVs/debt-to-EBITDA ratios at +200bp pick-up in yield is ideal.

It is also worth noting that closed-end PC funds help match liquidity, but can also maximize recovery for the small number of loans within a portfolio that become non-accrual given the time the manager has to work-out compared to a fund manager offering quarterly liquidity (e.g. recovery premium for private credit funds v. open ended more liquid structures).

The average premium for corporate IG private placement bonds is ~25bps, primarily purchased by insurance companies. Even in the most liquid market in the world, a liquidity premium exists. The US Treasury market has on-the-run v. off-the-run within the yield curve where less liquid treasuries trade ~5bps cheap.

Benjamin Graham famously stated: “In the short run, the market is a voting machine but in the long run, it is a weighing machine,” and there is no doubt that since the days of Mr. Graham, the advent of alternatives offers a tremendous value proposition and significant weight. |

To follow Bruce’s thoughts on the markets, investing and more follow @bruce_markets |

|

|

|

|

As alleged in the complaint:

Through a brazen series of related transactions, EchoStar Corporation (“EchoStar”) transferred billions of dollars of assets from DISH Network Corporation (“DISH Network”) and its subsidiary, DBS, out of the reach of existing creditors, in exchange for nothing. Defendants then offered the stolen property back to creditors of DISH Network and DBS, but only on the condition that they accept steep discounts on their claims. Defendants’ offer was rejected. Through this action, Plaintiffs now seek to recover those wrongfully acquired assets. The scheme was concocted to attempt to protect EchoStar’s controlling shareholder, Charles Ergen, in the event Defendants cannot manage their upcoming debt maturities and need to reorganize. |

|

|

|

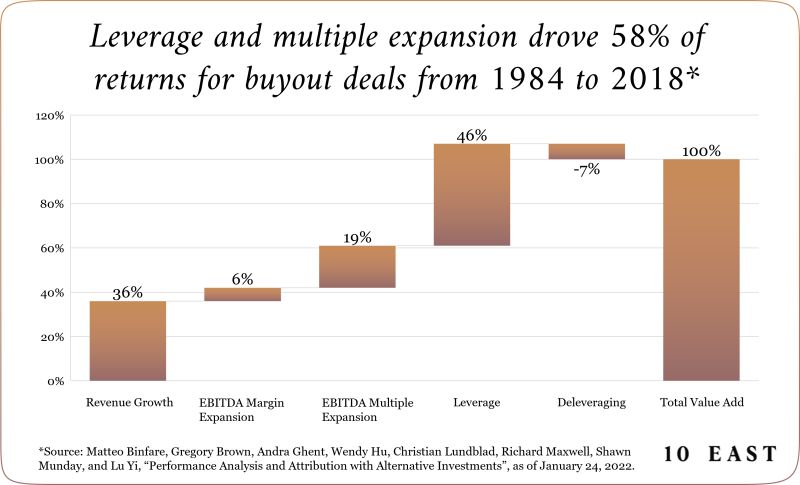

Data Download |

why we continue to see Sponsor-led creditor-on-creditor violence |

|

|

|

|

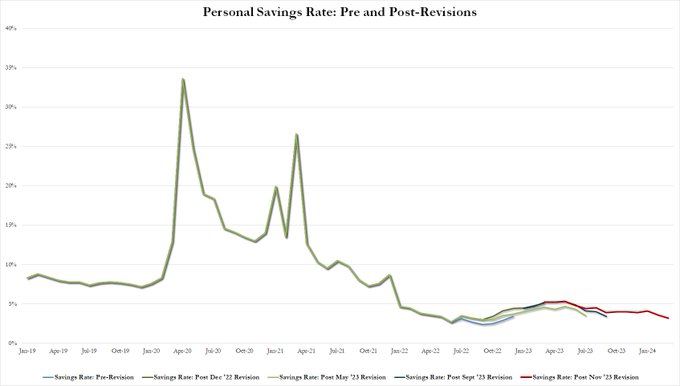

Data Download |

end to the consumer-led expansion |

|

|

|

|

|

In the News |

leading to stagflation fears… |

|

|

|

|

NYU Stern Bankruptcy Workshop |

Register Now! Space is Limited Discounted Before May 1 |

|

|

|

An unprecedented opportunity for young legal & finance professionals to learn in-depth fundamental credit and legal analysis through seminar and case-study format over intensive 3-day format.

Taught at NYU Stern from August 5 to 7, 2024.

Participants will receive Certificate of Completion from NYU Stern and in-depth reference materials for their future careers. Participants already include leading asset managers and law firms.

Workshop program here.

Expert Faculty: Edward Altman, Dan Kamensky, Donald Bernstein, Saul Burian, Judge Robert Drain (ret.), Christian Fischer, Michael Friedman, Max Frumes, Michael Gatto, Larry Halperin, Mo Meghji, Andy Rosenberg, David Smith, Robert Stark, Nick Weber, Jay Weinberger with featured speakers: Lisa Donahue, Holly Etlin, Lauren Krueger & Jared Parker

Registration fees apply |

| Register Here |

|

|

|

|

|

ABI: Distressed Real Estate Symposium |

April 30, 2024 |

| Learn More |

|

ABI: New York City Bankruptcy Conference |

May 9, 2024 |

| Learn More |

|

|

LSTA: Direct Lending & Middle Market Conference (FL) |

May 9, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|