Creditor Corner |

for the week ended August 9, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,600 member subscribers and growing! Sign Up Here |

|

|

CRC Roundtable Discussioncoming September 10, 2024 |

BREAKING NEWS

Wild Wild Week! Del Monte dashes expectations, NJ adopts rules for “complex cases”, Cineworld restructures (again), private credit rankings, and much, much more…

FEATURED CONTENT

Bruce Richards on the Markets: BDCs: A bug or a feature?

|

Scroll through to read all of our content |

|

|

|

Featured Event |

September 10, 2024Limited Capacity Registration Now Open |

|

|

Join the Creditor Rights Coalition and Cooley for a Roundtable Discussion on:

LMEs Revisited: Incora and its aftermath with Kobre & Kim Emerging retention and independent director issues The Day After: Third-Party releases and Purdue Pharma |

| Register Here |

|

|

|

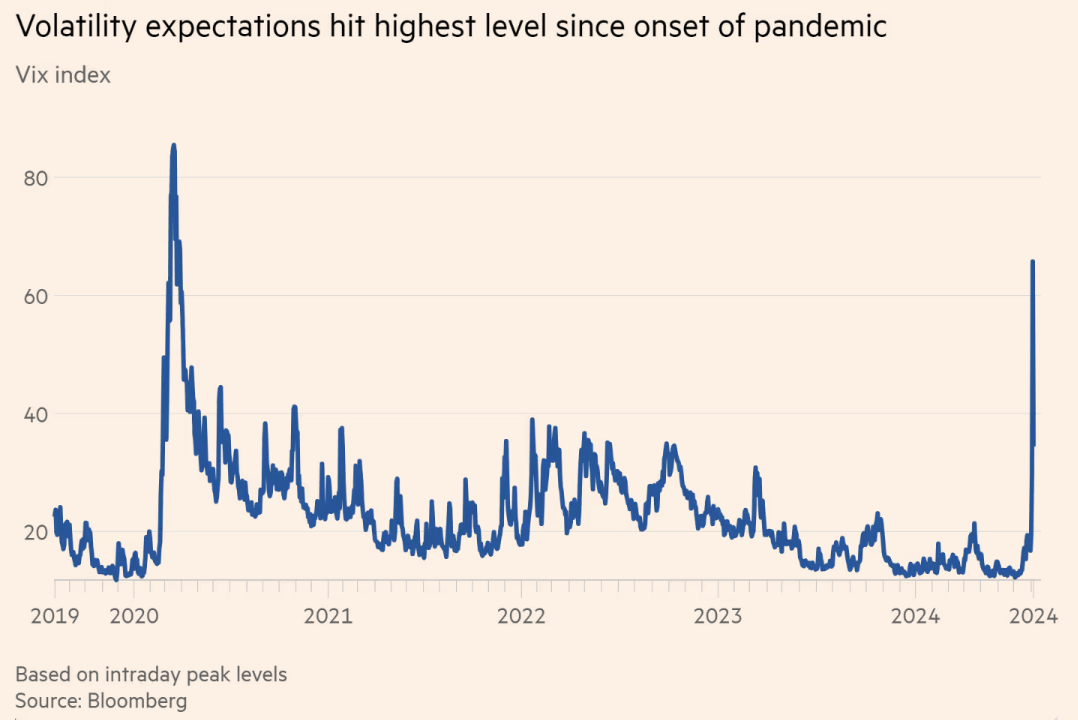

Wild , Wild Week! |

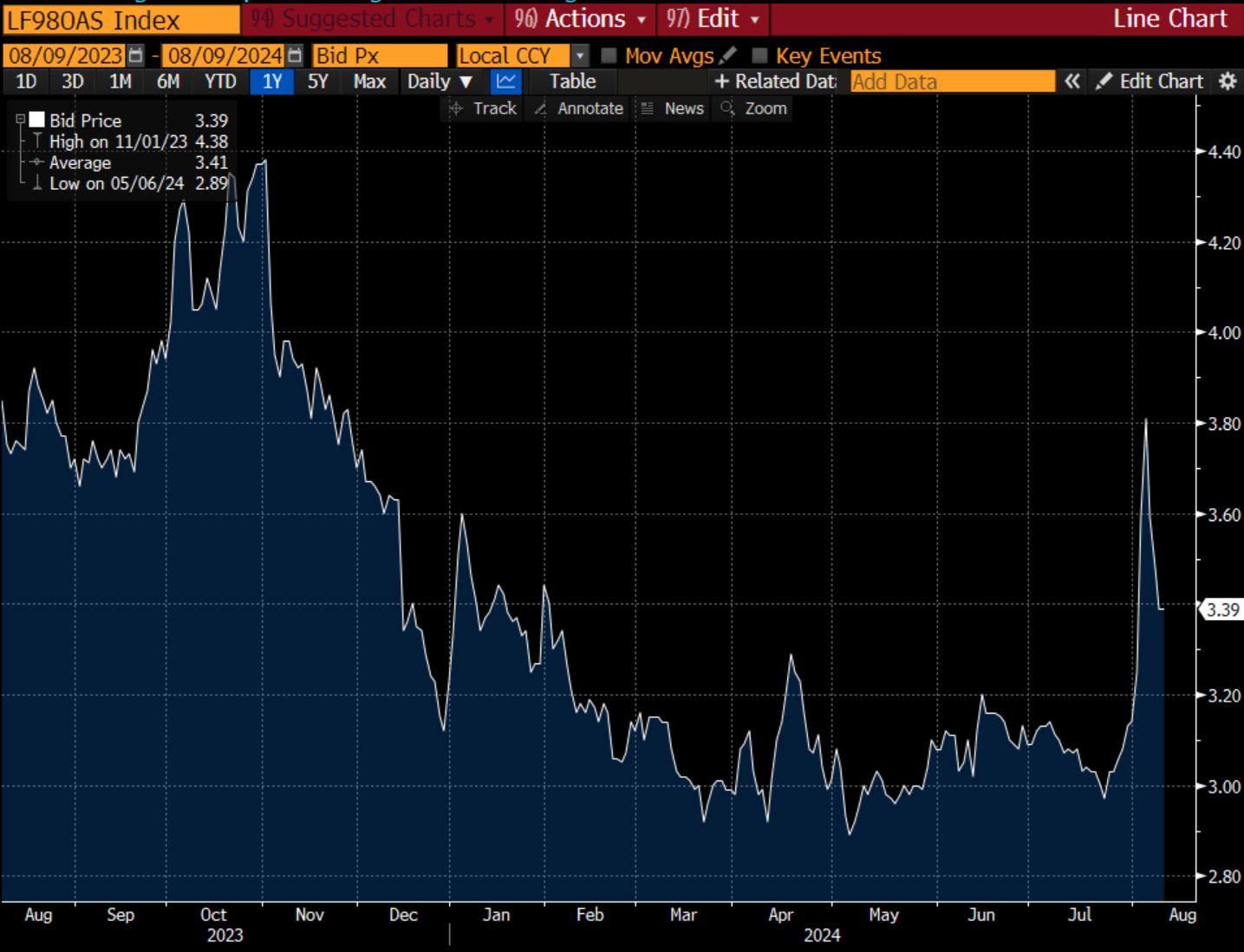

credit spreads widen on the week |

|

|

|

|

Exclusive Content

|

the week in credit explained… |

|

|

|

Click Above to Access Content free access to subscribers |

Our take: HY only widened 15bp on the week despite spreads gapping 62 bp to 372 bp as treasurys offset losses. This is a key relationship to watch. As treasurys normalize will spreads remain elevated indicating wider concerns in the “canary in the coal mine” credit markets? |

|

|

|

Tweet of the Week |

so much for a “kinder-gentler” LME |

|

|

|

|

|

Exclusive Content

|

Del Monte explained… |

|

|

|

|

Click Above to Access Content free access to subscribers |

Our take: Our friends at 9fin said it best: “Either the arc of the LME universe is long and will bend towards friendly with some twists and turns, or it’s a pendulum — because more “violent” transactions are brewing with starkly different outcome for similarly situated lenders.” |

|

|

|

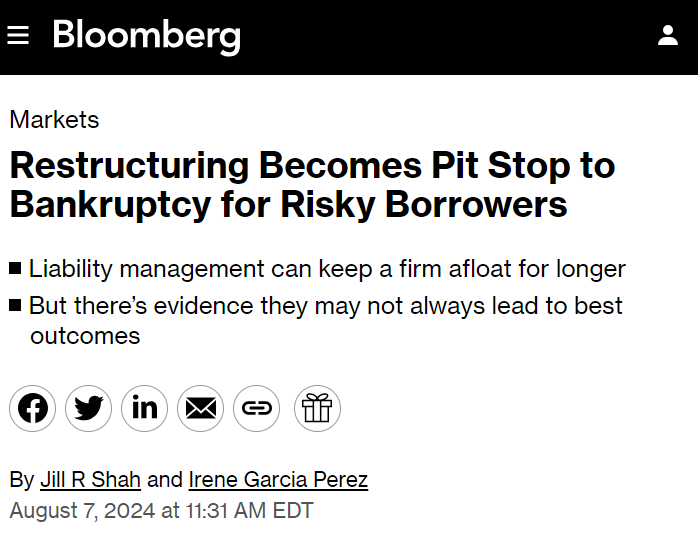

In the News |

no surprises here…. |

|

Click Above to Access Content additional registration required |

|

|

|

Exclusive Content

|

not all theater chains are meme stocks |

|

|

|

|

Our take: For all the focus on AMC meme’s stock frenzy and LMEs, some have forgotten how restructuring tools can right-size a company’s balance sheet. Cineworld will emerge a much stronger competitor with a revamped business model after restructuring its lease portfolio…too bad AMC couldn’t do the same. just saying…. |

Click Above to Access Content one-time registration required |

|

|

|

In the News |

New NJ Complex Case Procedures |

|

|

In a statement to the Creditor Rights Coalition, Judge Kaplan stated:

“I expect our new rules and guidelines will ensure consistent procedures among our nine judges, as well as an even playing field among all stakeholders in complex cases that are filed in our District. In this regard, we had tremendous input from our Clerks office, the Office of the US Trustee, and counsel who regularly represent committees, lenders and debtors. I would hope it doesn’t take another 20 years to revisit the rules and that we will have periodic reviews by our Lawyers Advisory Committee.” |

| New Complex Case Procedures Here |

|

|

|

|

|

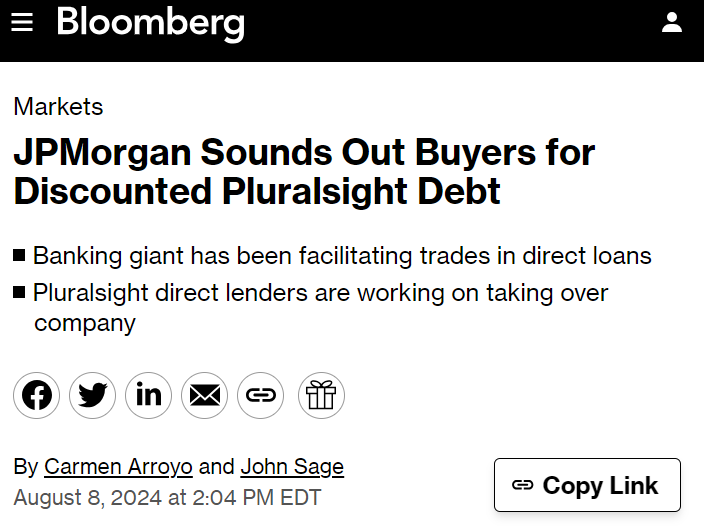

In the News |

Carnival Barking Private Credit |

|

|

|

Click Above to Access Content additional registration required |

|

|

|

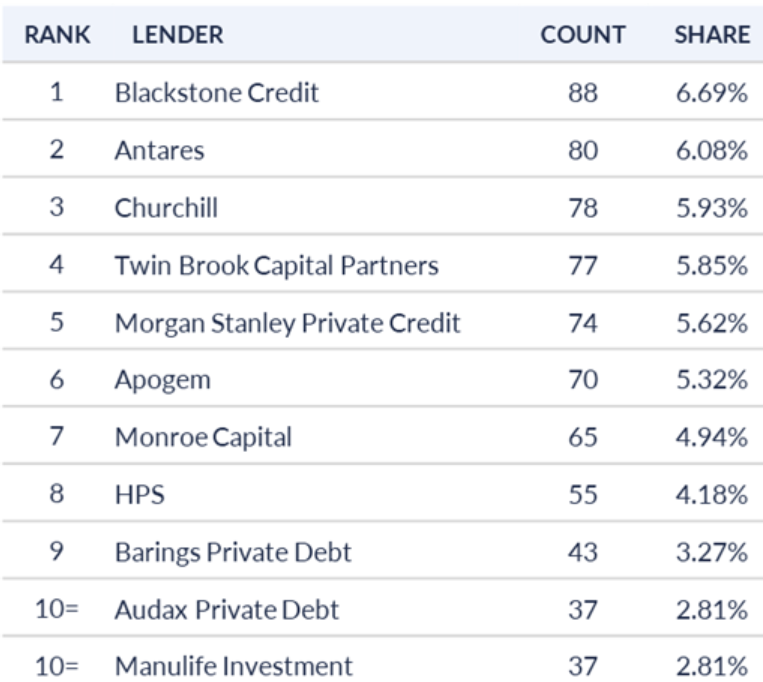

Exclusive Content |

Top Private Credit Lenders – 1st Half 2024 |

|

|

|

|

|

|

|

Featured Content |

|

BDCs: A Bug or a Feature?

Top 30 BDCs: 23 of the top 30 (76%) trade below book value with an average discount to book value of 11%. As these BDC underperform, it’s painful for investors to sell shares less than asset value. The dividend yield for listed BDC that trade at book value or above is ~9%, which is ~250bps less than middle market lending closed-end funds. Bloomberg News ran a feature article providing great insight into the workings of one such BDC, the worst performing BDC of the entire lot, which is trading at ~45% discount to book value, down ~20% y-t-d.

Performance is measured by dividend yield, price performance and its discount/premium to book value. For investors allocating to listed BDCs, I prefer the 7 BDCs that trade above book value, but to purchase the shares of these ‘winners’ one must pay an average premium that is often too high relative to the underlying assets. BDC investors assume the risk of selling shares below book value to access liquidity; or contrary, pay too much above book value to invest with the 7 strong performing BDC managers. Many BDC investors measure yield, yet the highest yielding BDCs today are the worst performing representing a bug, not a feature. BDCs investments belong within a diversified public equity portfolio, not as a component of private credit allocation.

My recommendation to Capital Allocators investing in Private Credit is to choose private credit closed-end funds (or private BDCs) so that one can avoid the price volatility of the stock market and the discount/premium issue that defines much of the performance metrics for listed BDCs. For long term holders, why be subject to this volatility, especially since middle market private credit funds have generated ~100bps higher yields. Private credit valuations are equivalent to the NAV or book value of the fund. In the case of Private Credit, the price for liquidity should be taken into consideration, but investors should earn a return premium for locking up capital in a longer-term vehicle. I consider this to be a feature, not a bug as it allows the manager to focus on long-term value creation, not the vagaries of the listed markets and structural requirements of BDCs.

The best BDCs are down ~5-10% over the last week (average), giving back their entire yearly price gains (y-t-d). From the asset manager’s perspective, it is wonderful to have permanent capital, but from an investor’s perspective, I prefer the performance consistency and yield premium of Private Credit all day, every day. Both invest in the same general asset class, but I believe private credit provides greater performance and consistency.

Below is the BDC ETF (BIZD), which is down ~2.7% y-t-d (includes most of the listed BDCs):

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

Data Download |

hold on! |

|

|

Click Above to Access Content additional registration may be required |

|

|

|

Featured Event |

|

|

September 10, 2024Limited Capacity Register Now |

Click image above to register now |

|

|

|

|

|

INSOL: Private Credit (Singapore) |

August 26, 2024 |

| Learn More |

|

|

|

INSOL: Singapore Meeting |

August 27, 2024 |

| Learn More |

|

NCBJ: Annual Meeting |

September 18-20, 2024 |

| Learn More |

|

|

IMN: Distressed CRE Forum |

September 19, 2024 |

| Learn More |

|

ABI: Views from the Bench |

September 24, 2024 |

| Learn More |

|

|

|

GRR: Restructuring in the Americas |

October 15, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Announcing New Data Initiative to Analyze Bankruptcy Costs |

Bringing Transparency to the Bankruptcy Process |

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. Our proprietary analysis supports anecdotal evidence that bankruptcy has gotten more expensive. We will be providing additional analysis in the future to show how other factors affects fees. We hope our database will help make bankruptcy a more efficient forum for all stakeholders. |

|

|

|

Special Feature |

Implications of the Purdue Pharma case |

|

|

|

|

Special Feature |

Recent disqualification decisions and conflicts in BK |

|

|

|

|

Special Feature |

Where we are in the credit cycle |

|

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|