Weekly News – January 5

Incora steamroller coming

Exclusive Content

Find it here on LevFin Insights

Audacy preps for BK

No, not again…

Find it here on LevFin Insights

Rumble in the Jungle!

Our take:

Sounds like the banks are whining to us…

Tell us what you think here

Goldman 2024 Predictions

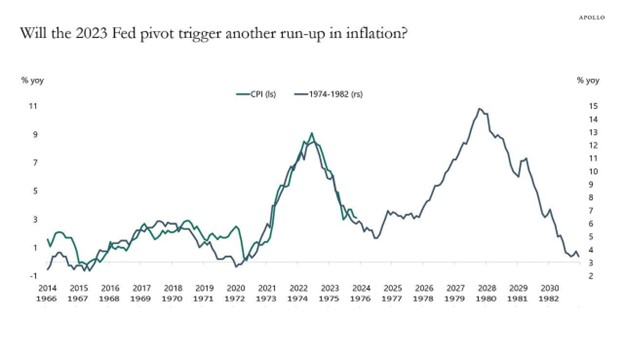

Inflation debate

to be or not to be the early 1970s,

that is the question

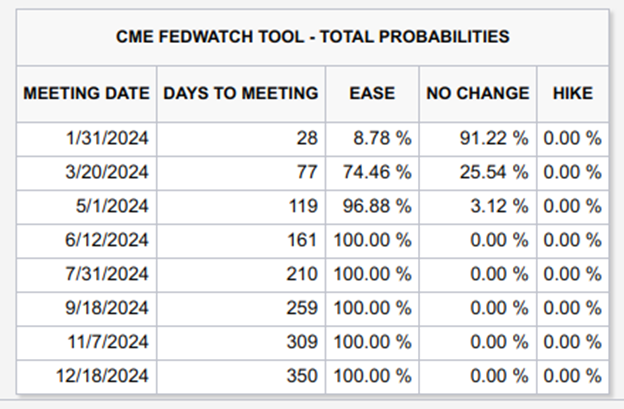

Markets predict easing cycle in 2024

Yet, similarities with 1974-1982 resurgence brings back bad memories

Leading some to say inflation is here to stay

While others argue it is merely transitory

Tussle continues

Our take:

Seems like an obvious one for an independent third party… just saying

Tell us what you think here

Featured Content

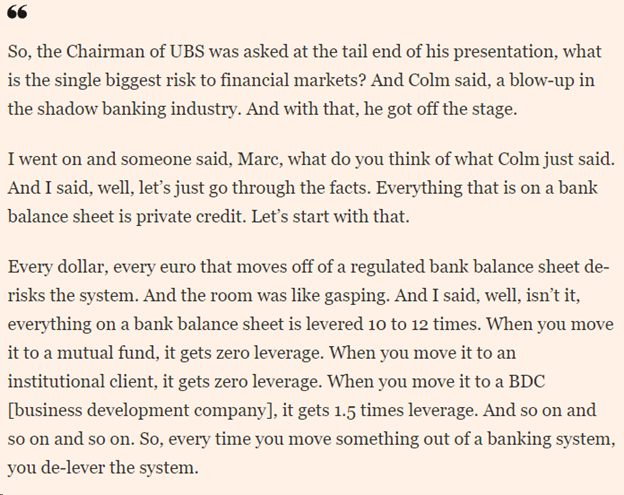

Bruce Richards on the Markets

Bruce Richards, CEO

Marathon Asset Management

insights on markets, investing and more!

Basel Ill Endgame, Coming to a Theater Near You!

The Fed, OCC and FDIC are rolling out Basel Ill Endgame [which] will require the 30 largest banks to maintain additional capital to strengthen their respective balance sheets. Regulators want to ensure a healthy banking system that protects depositors by increasing capital requirements for large banks given the 2023 bank failures that occurred (SVB, Signature, First Republic all failed with assets >$100B).

Many bank CEOs believe regulators are overstepping, creating conditions that will prove prohibitive for banks to lend, warning Congress that consumers, companies, and property owners will see their borrowing costs rise when banks are forced to comply with new rules. Although the big banks are pushing back, they have no choice but to comply as the U.S. will be stronger in the long run with a depositor-safe banking system.

Basel III Endgame will have a profound impact on the top 30 banks in the U.S. and there will be ripples felt as a result.

Large and midsized banks will be required to hold ~20% more capital largely as a result of two elements in Basel III Endgame:

1. Changes to RWA weightings including consumer loans, mortgages, CRE loans, C&I loans, corporate loans, revolving lines of credit and ABL (U.S. government securities are exempt).

2. The need to recognize unrealized losses in a bank’s available-for-sale (AFS) portfolio, a major issue at SVB with its large fixed-income portfolio of underwater treasuries & mortgages.

The major implications of Basel III Endgame:

– Build buffer capital with retained earnings; don’t expect increases in dividends or stock buybacks until buffer is built.

– Bank Issuance of long-term debt and preferred in order to be less dependent on deposits and short-term debt.

– U.S. Treasuries and Ginnie Mae’s become more attractive on relative basis for Bank’s to own as these securities are exempt from RWA calculation.

– Banks engaging in capital relief transactions known as Credit Risk Transfer (CRT).

– Adjust securitization framework to a new standard, called SEC-SA.

– Standardized Risk Models required reporting under one format for regulatory oversight in addition to current Internal Bank risk models.

– The new models will require liquidity tests to be run over longer time horizons and under a wider range of risk scenarios.

– With ~20% additional capital required against current assets, the banking system will likely shrink its risk weighted assets (RWA), growing by less in future years.

The U.S. plans for full compliance by 2028, while for European Banks under their largely similar program, CRR3, will have till 2030 to comply.

“For every action, there is an equal and opposite reaction” – Sir Issac Newton’s Third Law

Private Credit lenders will raise substantial capital to fill the void that will result from Basel III Endgame – Marathon Asset Management, House View.

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets

What we’re reading…

2024 Sponsorships Now Available

Please Consider Sponsoring CRC’s Content

Click Here

Meet our 2023 Sponsors

The CRC is funded through sponsorships from these organizations:

Featured Content

Our Contributors take on DQ provisions

We take on Disqualified Lender provisions. We were shocked by what we learned, Not only are distressed investors targeted but usually weeks if not months after a trade occurs. Serta, Packers and Bijyu’s are the latest examples of a troubling trend.

Read what Contributors Paul Silverstein, Justin Forlenza, Sid Levinson and Jim Millar have to say about this topic.

Some excerpts below:

Aggressive sponsors want the option to disqualify distressed investors from owning their portfolio company’s loans.

a fundamental practical problem lies in the lack of transparency as to who is disqualified from owning a loan because DQ Lists are generally not available at time of trade notwithstanding that many credit agreements provide for the lists to be made available to lenders.

But buyer consent is not obtained until closing, which can be many weeks or even months after the date the trade actually occurred. If the loan buyer is on the DQ List, the borrower can then reject the trade well after-the-fact.

Featured Content

Contributors Speak Up:

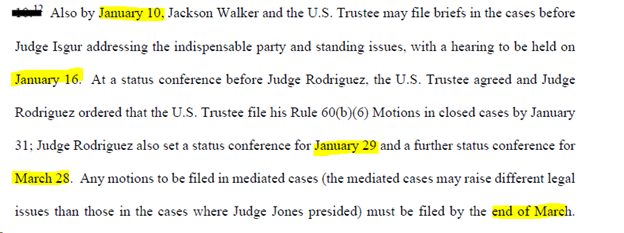

Venue Reform in the Spotlight

click here to read the features from our Contributors analyzing Venue Reform

Featured Content

Contributors Speak Up:

SCOTUS takes on Purdue

click here to read the features from our Contributor analyzing what happened @SCOTUS

CRC weighs in on Serta

Special Feature:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

January 10: Fitch Solutions: Credit Outlook North America

January 17: Arnold & Porter: Exploring Bank Liquidity Requirements

January 31: NYIC: 17th Annual Women in Achievement Awards

February 6: **NEW EVENT** SFNET: Las Vegas Asset-Based Capital Conference

February 7: **NEW EVENT** Arnold & Porter: Navigating Issues in Distressed Real Estate

February 8: **NEW EVENT** TMA: 2024 Las Vegas Distressed Investing Conference

February 13: City Bar Bankruptcy Committee & ACFA: Hot Topics in Bankruptcy

February 15: **NEW EVENT** ABI: Paskay Tampa Memorial Bankruptcy Seminar

February 23: **NEW EVENT** Wharton Restructuring Conference

March 14: ACFA: Liability Management Transactions Program

March 21: **NEW EVENT** ABF Journal: 15th Annual Philadelphia Restructuring Summit