Weekly News – September 8

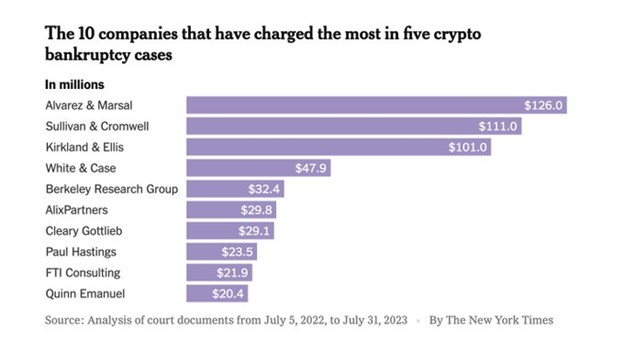

BK fee bonanza winners

BK fee bonanza losers

Our take:

Fees are outrageously out of hand and threaten the entire BK eco-system… Congressional hearings anyone???

getting out of dodge…

dodging a bullet…

struck twice… aka Chapter 22

Exclusive Content

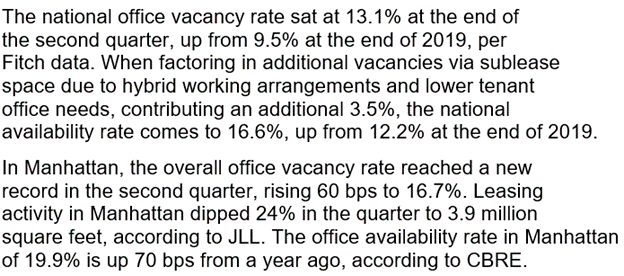

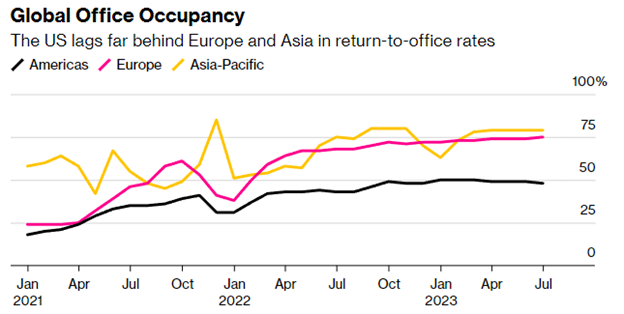

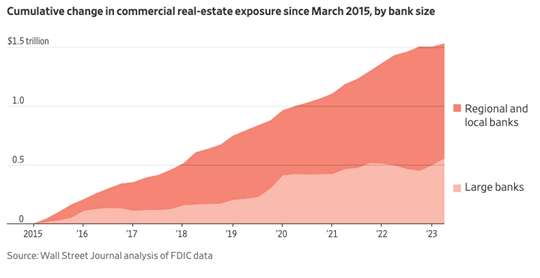

WeWork skids

causing CRE pain

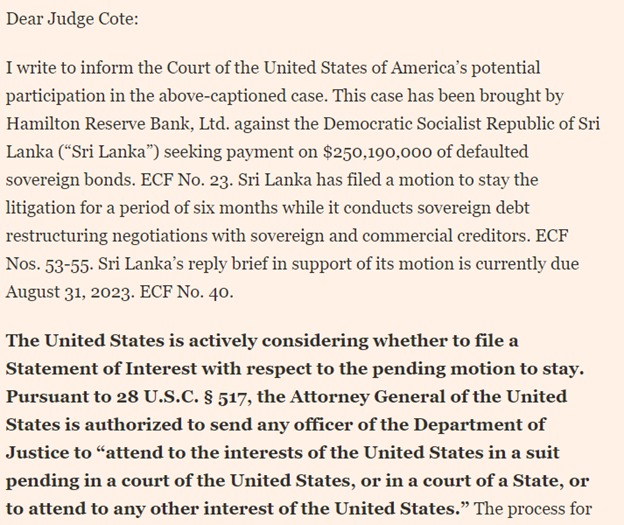

US enters HRB/Sri Lanka bond dispute

The mystery man behind HRB revealed**

Ares accused of rigging auction….

need we say more?

Exclusive Content

Private credit

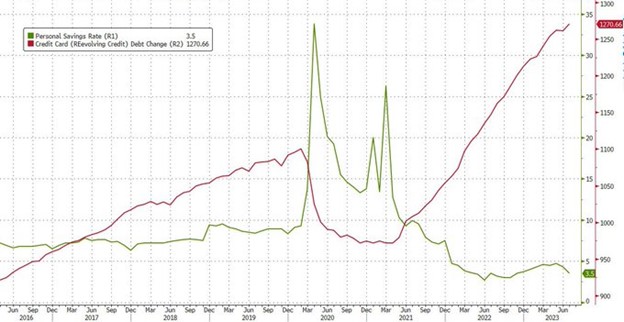

Consumers levering up…

CRC attends Wharton-Harvard Insolvency & Restructuring Conference

2023 CRC Allocators Conference

The Academics Speak Up

Purdue Pharma

Purdue Pharma is the gift that keeps on giving. This is our third installment on the twists and turns this case has taken through the Courts. You can read our first installment here, and our second here.

All bets came off the table when the Supreme Court decided to reshuffle the deck by taking on the appeal of the 2nd Circuit’s decision. Not only did SCOTUS take the unusual step of taking on this big ticket issue in BK cases but it also stopped the lower court’s decision in its tracks putting the breaks on the entire enchilada. We decided to consult with our expert Academic Contributors for our inaugural feature the Academics Speak Up to get their takes on the latest developments.

We are excited to bring you the varying perspectives of Prof. Tony Casey, Prof. Samir Parikh and Prof. Ralph Brubaker.

Read on here, you won’t be disappointed.

Read our recent coverage of Purdue Pharma

click through to read the features from our Contributors

CRC weighs in on Serta

Contributors Speak Up

What to expect in the next default cycle

We asked Contributors Bradford Sandler and Sidney Levinson to weigh in on what we should expect in the next default cycle.

Professor Edward Altman recently noted in a paper published with the Creditor Rights Coalition that the Benign Credit Cycle is over. He sees a reversion to the mean in terms of defaults and recoveries in 2023. But he also sees many risks on the horizon making a Stress or even in a “hard-landing†scenario a possibility (with 8-10% default rates). Put your prediction caps on. What do you see and expect? Where do you expect restructuring activity to increase? Are we in for more bankruptcies? Or, more (yawn yawn) extend and pretend? Will RSAs rule the day? Or, will we see more traditional in-court restructurings? What will this new environment look like?

Read our recent coverage:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Featured Event: Beard Investing Conference

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

September 13: TMA: Views from the Bench

September 29: ABI: Views from the Bench

October 5: CreditSights: Global Markets Update

October 24: ABI: Cross-Border Insolvency Program