Creditor Corner |

for the week ended March May 3, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

FILLING UP FAST 2024 Restructuring Symposium Reserve Your Spot Below! Over 165 registered already!

BREAKING NEWS Davis Polk takes top spot in League Tables, J&J Talc Subsidiary BK (again!), the latest in Altice, BYJU’s is back, and much, much more…

FEATURED CONTENT J.F. Lehman & Company Secondary Trading – Next Big Opportunity in the Direct Lending Market |

Scroll through to read all of our content

|

|

|

|

Tweet of the Week |

too good to pass up… |

|

|

|

|

|

Exclusive Content |

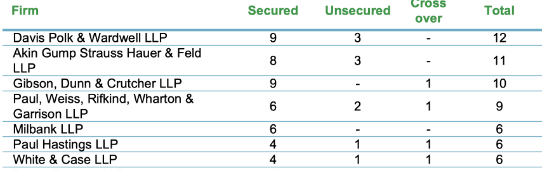

Q1 League Tables Davis Polk eeks out top honors for repping ad hoc groups |

|

|

|

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

|

News of the Week |

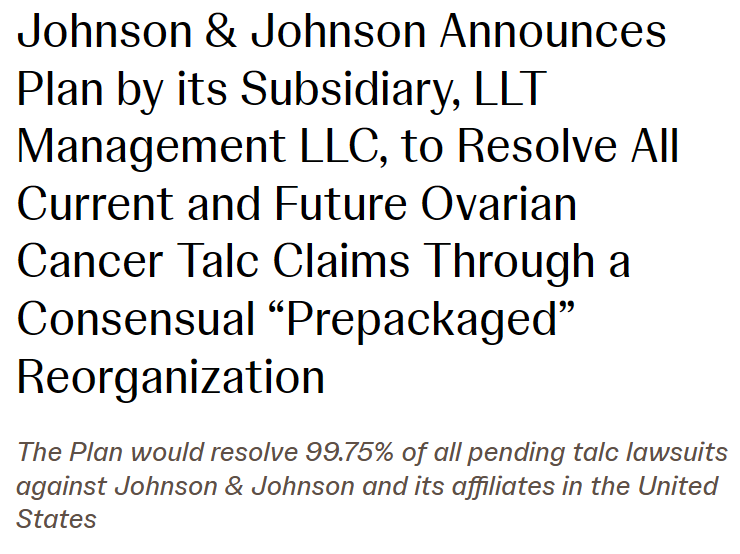

third time’s a charm? |

|

Our take: From North Carolina to New Jersey to…. wait for it… to Texas. Venue shopping is a real problem when companies can pick their jurisdiction of choice. |

|

|

|

Exclusive Content |

the latest in the Altice saga… |

|

|

|

|

Click Above to Access Content |

|

|

|

What We’re Reading |

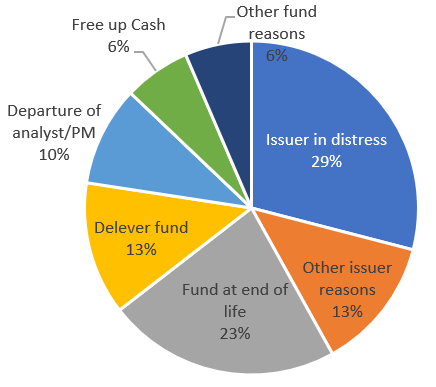

Poster Child for Abuse |

|

|

Our Take: The latest twist and turn in the BYJU’s Alpha, Inc. case. We wrote about this here last December. We noted the emergence of a new tool in the sponsor toolkit, the use of disqualified lender provisions to control restructurings, and how they could be abused. After BYJU’s sued to disqualify a sophisticated distressed fund for exercising its right to accelerate the company’s term loan we find out the company’s sponsor had seemingly absconded with hundreds of millions of dollars. |

|

|

|

Exclusive Content |

then, there’s this! |

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

|

Featured Content |

presented by: |

|

Secondary Trading – Next Big Opportunity in The Direct Lending Market? Summary:

- Direct lenders have historically originated loans with the expectation that they would hold them to maturity.

- We believe this is changing, and that the time has come for liquidity to appear in secondary direct lending.

- We have observed an increasing number of direct lenders, not equipped to deal with the market’s growing complexity, seeking secondary liquidity.

- Limited competition: many direct loans that could come for sale are not worth the time and effort of large direct lending funds.

- Motivated sellers: selling lenders are often non-fundamental and tend to look for a quick response from potential buyers, and, in our experience, tend to be less price sensitive.

- Sales processes kept under-wraps: direct lenders seeking liquidity tend to reach out to a small number of potential buyers who are specialists in the industry/sector, to avoid leaks and protect their reputation.

- Strong sourcing networks and sector expertise are key to acquiring secondary direct loans successfully.

- Legal and restructuring expertise is crucial to protect the investment’s downside and help issuers back to a sustainable path.

Increasing demand for secondary liquidity in private credit

After humble beginnings in a forgotten corner of the leveraged finance market, direct lending is having its day in the sun. While many direct lenders still finance companies that are too small to access the HY or syndicated loan markets, the growth in AUM and number of active direct lenders is transforming the structure of the market and bringing it to the mainstream, with many direct multi-billion deals announced over the past 12 months.

As the direct lending market matures, there is a noticeable convergence with the syndicated loan market, as the two types of lenders increasingly compete for the same deals. While direct lenders have historically been able to capture a several hundred basis point premium to Broadly Syndicated Loans (“BSL”) and keep covenants tight in their credit agreements (while their syndicated peers have almost fully switched to covenant-lite structures), we have seen a steadily increasing number of covenant-lite direct loans issued over the past few years at spreads only slightly better than the BSL market. It has become a race to the bottom between the private direct lending market and the BSL market as those markets converge and lenders compete vigorously for allocations.

One key difference of the direct lending market versus its syndicated peers has been the lack of liquidity and secondary trading activity. Direct lenders have historically originated loans with the expectation that they would hold them to maturity. We believe that this is changing, and that the time has come for liquidity to appear in secondary direct lending.

Propitiously, this complete lack of secondary liquidity of direct lending is starting to look like a thing of the past. Two new marketplaces are emerging, offering liquidity to participants in private debt markets:

- Trading in private credit funds’ LP stakes

- Trading in individual loans

Secondary private credit funds stakes

Last week, Bloomberg (based on an Ely Place Partners survey) reported that as many as $15 bn of private credit portfolio sales are expected to close in 2024, triple the amounts closed in each of 2022 and 2023. Another financial news providers, Finsum, estimates that this market will exceed $50 bn by 2027.

While the secondary stake market has been very active in private equity for years, it became active over the past 12-18 months in private credit, as credit investors/LPs look for ways to raise money in an environment where realizations have been slower than anticipated (partly due to slow M&A activity).

According to Bloomberg/Ely Place, portfolios are currently selling at discounted prices of 85 cents on the dollar on average.

Secondary liquidity in individual direct loans

While the sale of secondary stakes addresses LPs’ liquidity needs, private credit fund managers are also increasingly looking to sell/reduce existing loans in their portfolios.

Traditional larger direct lending funds are structured to source, diligence and manage the risks associated with their portfolios. They also have access to more stable and resilient leverage solutions (e.g., non-mark-to-market credit facilities). However, hundreds of smaller players who have entered the direct lending market do not have access to the same resources. They operate with smaller research teams and do not have an operational team or restructuring experience needed to work with business owners/management through periods of stress. As market conditions have evolved or their own situations changed, we have observed an increasing number of direct lenders seeking secondary liquidity to rebalance their portfolios or exit a loan when their borrowers face transient operational or balance sheet disruptions.

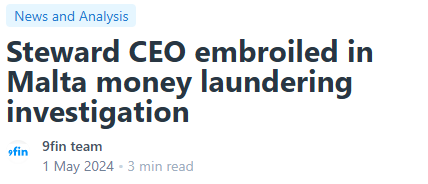

Direct lending vs. syndicated loans & HY bonds

|

|

|

|

Source: JFL Credit estimates

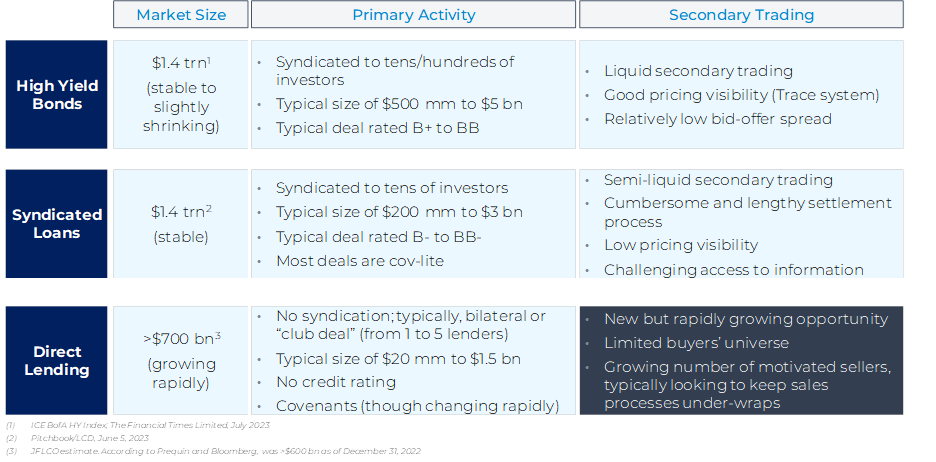

Who are the sellers of direct loans?

The first comment we hear when we discuss direct loans that we have acquired in the secondary market is: “who are the sellers? Every direct lender we talk to tells us that they never sell.”

Until now, secondary trading of direct loans has been a well-kept secret, as lenders did not want anybody to know that they were selling. There has been a strong negative stigma around sellers of loans that were never meant to be resold when this market first came together. Direct lending funds are typically worried that the news of a sale could be taken as a broader sign of trouble in their portfolio by their investors or competitors. In addition, lenders tend to worry that sponsors or borrowers might take their decision to sell a loan as a sign that they are a less stable partner, leaving them out of new financing processes in the future.

Obviously, these attempts to keep transactions under-wraps are beneficial to potential buyers, as it means that the sellers only reach to 1 or 2 buyers, instead of advertising broadly that they have a loan they need to exit. It certainly allows us to price this “illiquidity” attractively.

Interestingly, the sellers we have come across are not perfectly representative of investors in private credit. While Morgan Stanley recently estimated that Direct Lending Funds, BDCs and CLOs represent 86% of the direct lending market, they represented only 55% of the transactions we have taken a look at over the past year. In fact, hedge funds and family offices were at least as large as BDCs in our experience.

Diverse background of sellers of direct loans

|

|

Source: Morgan Stanley estimates, ICE, Pitcbook LCD JFL Credit estimates; based on proposed transaction we have across over past year

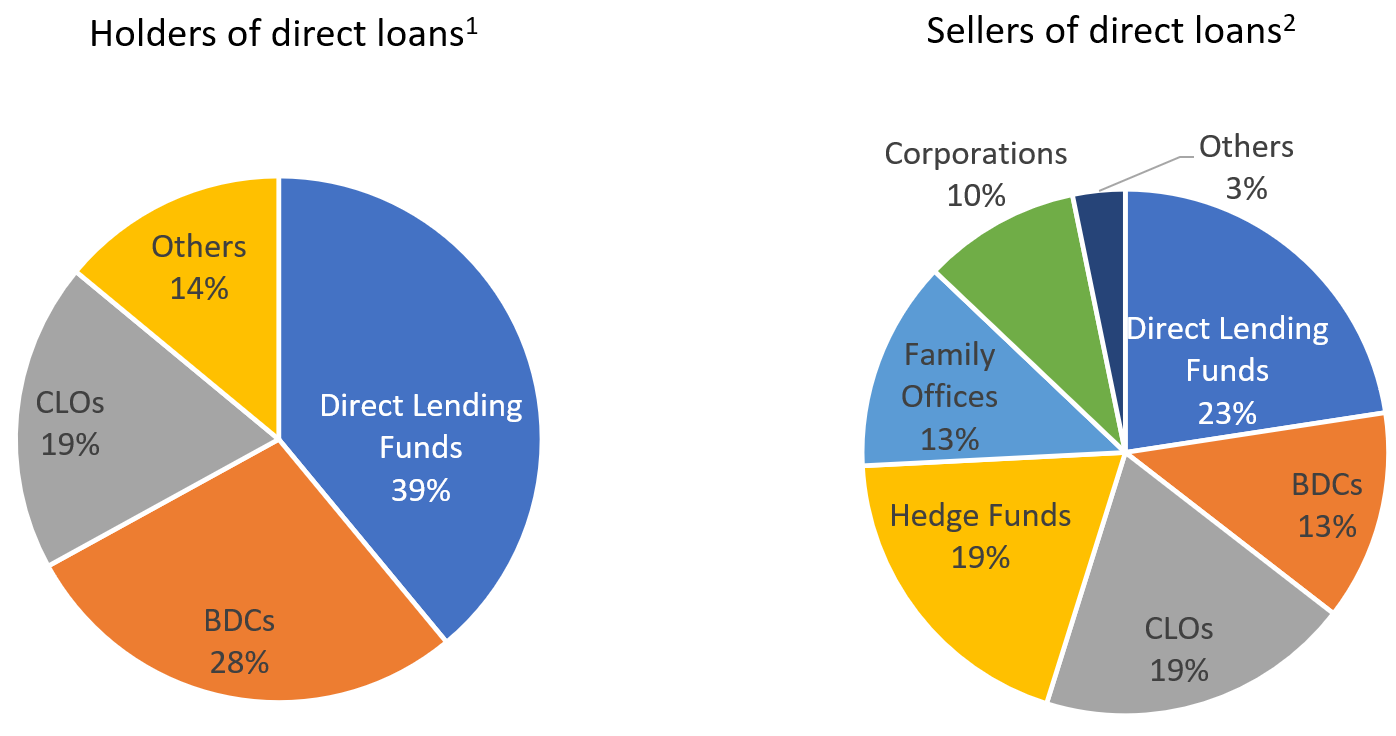

Why are lenders selling?

We believe that secondary trading opportunities in direct loans are triggered by two main catalysts:

- Changes in lender’s situation: while new direct loans are generally originated with the expectation that they will be held to maturity, lenders need to manage their portfolios, including monitoring their single name concentrations and sector exposure. As portfolios evolve and mature, lenders might look to rebalance their existing positions and free up cash for new deals if they are offered the opportunity to do so.

- Changes in borrower’s condition: while credit has performed well over the past decade, the rise in interest rates is reducing the margin of error for loan-only borrowers. This is particularly true for direct loans, which have historically had weaker credit profiles and are more levered than their syndicated peers. While direct loans are not rated, S&P assigns credit estimates (confidential indication of S&P’s likely rating) to thousands of private loans. At the start of 2020, close to 90% of S&P’s credit estimates were B- or lower (including 20% of CCC+ or below), while only 42% of US speculative-grade non-financial companies were rated B- or below. Lenders underwrite new loans with an expectation that they will perform and be paid down at par at maturity. As borrowers deviate from plan and become stressed or distressed due to balance sheet or operational issues, some lenders recognize that they do not have the required in-house skill set to deal with this volatility and would prefer to exit the position.

When we look at the proposed secondary sales we came across over the past year, changes in the lender’s situation dominate in almost 60% of the cases. In many cases, the borrower was performing well, but the lender needed to sell because the fund was reaching the end of its life (23% of cases), there was a need/decision to delever (13%) or the fund had lost key personal (10%).

Drivers of selling decision |

|

Source: JFL Credit estimates; based on proposed transaction we have across over past year

Large and still untapped opportunity to buy loans at a discount

When considering secondary trading in direct loans, you may ask yourself, what is the big deal? Syndicated loans, including smaller and less liquid tranches, trade through the desks of Goldman Sachs, Jefferies and their peers every day. However, the structure of direct lending is quite different, and many existing market participants are not keen on having traditional trading desks send runs with prices on their direct loans (or even club deals). As mentioned by a Bloomberg article earlier this year, lenders “warn that regular price discovery could force shops to mark down the value of their debt during periods of financial stress, increasing volatility.”

We believe the combination of a growing number of direct lenders looking for liquidity and the need to transact more discreetly away from regular trading venues is creating a compelling opportunity to buy direct loans in the secondary market at a discount.

- Large market opportunity, still untapped: the direct lending market has grown significantly over the past decade to reach over $700 bn. Even if a few percentage points of that total end up trading annually at first, the opportunity would be sizeable. In addition, few managers are focused and equipped to capture this opportunity.

- Limited competition: many direct loans that could come for sale are not worth the time and effort of large direct lending funds (who are increasingly looking to deploy hundreds of millions in each trade). And smaller funds / asset managers rarely have the required combination of sourcing, diligence, and legal and restructuring capabilities.

- Motivated sellers: direct lenders are set up for a “hold-to-maturity” strategy. When they reach the decision to sell a loan in their portfolio, a significant change has occurred in their fund structure, portfolio or one of their holdings. Accordingly, selling lenders tend to look for a quick response from potential buyers, and, in our experience, tend to be less price sensitive.

- Sales processes kept under-wraps: we believe there is a negative stigma associated with lenders selling a position before maturity. Direct lending funds are typically worried that the news of a sale could be taken as a broader sign of trouble in their portfolio by their investors or competitors. In addition, lenders tend to worry that sponsors or borrowers might take their decision to sell a loan as a sign that they are a less stable partner, leaving them out of new financing processes in the future. As a result, direct lenders seeking liquidity tend to reach out to a small number of potential buyers who are specialists in the industry/sector, in an attempt to avoid leaks and protect their reputation. For similar reasons, we believe sellers will continue to favor working away from trading desks at large investment banks and instead rely on their networks to source liquidity.

For more information, please contact Lionel Jolivot at lj@jflpartners.com. |

| Tell us what you think here |

|

|

|

|

|

Click Above to Access Content |

|

|

|

News of the Week |

but risks remain in credit |

|

Source: Bloomberg, & Thank you to JFL Credit |

|

|

|

News of the Week |

not a good sign when Diameter getting out of credit |

|

|

|

|

2024 Restructuring Symposium |

Registration Filling Up Fast Free for Subscribers to the Creditor Corner |

|

|

|

|

|

NYU Stern Bankruptcy Workshop |

Register Now! Space is Limited Discounted Before May 1 |

|

|

|

An unprecedented opportunity for young legal & finance professionals to learn in-depth fundamental credit and legal analysis through seminar and case-study format over intensive 3-day format.

Network with participants from Citadel, Oak Tree, Houlihan Lokey, Franklin Mutual, among others.

Taught at NYU Stern from August 5 to 7, 2024.

Participants will receive Certificate of Completion from NYU Stern and in-depth reference materials for their future careers. Participants already include leading asset managers and law firms.

Workshop program here.

Expert Faculty: Edward Altman, Dan Kamensky, Donald Bernstein, Saul Burian, Judge Robert Drain (ret.), Christian Fischer, Michael Friedman, Max Frumes, Michael Gatto, Larry Halperin, Mo Meghji, Andy Rosenberg, David Smith, Robert Stark, Nick Weber, Jay Weinberger with featured speakers: Lisa Donahue, Holly Etlin, Lauren Krueger & Jared Parker

Registration fees apply |

| Register Here |

|

|

|

|

|

**NEW EVENT** Credit Sights: DISH State of Play |

May 6, 2024 |

| Learn More |

|

ABI: New York City Bankruptcy Conference |

May 9, 2024 |

| Learn More |

|

|

LSTA: Direct Lending & Middle Market Conference (FL) |

May 9, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|