Weekly News – June 16

An uptier by any other name still hurts!

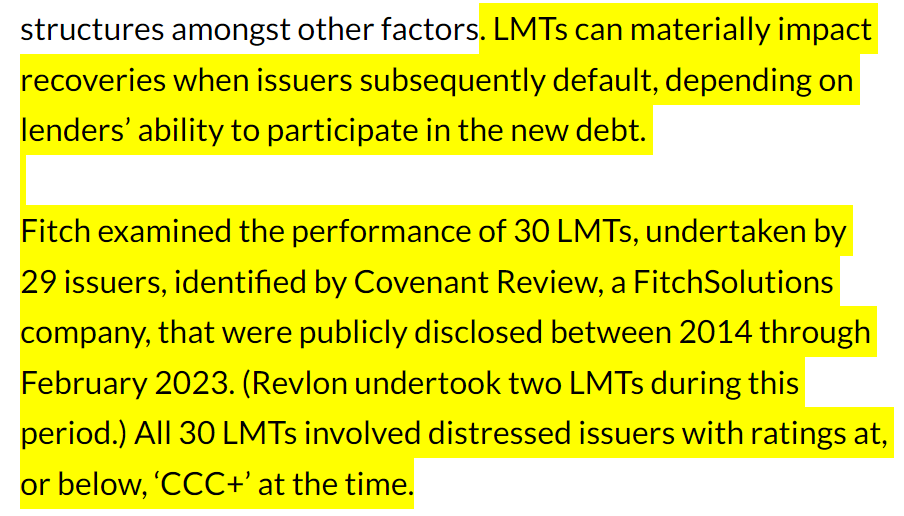

We say it again… LMEs bad

Mallinkrodt against the ropes

HUGE claim in Samson tossed

Exclusive Content

Judge Shannon on an “open market”

3M appeals directly to 7th Circuit

BBBY limping along

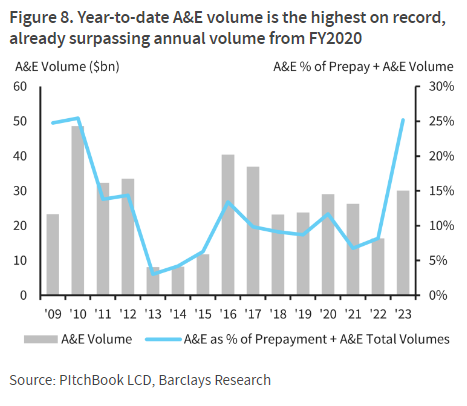

The return of extend and pretend

Default rates jump

Contributors Speak Up

What to expect in the next default cycle

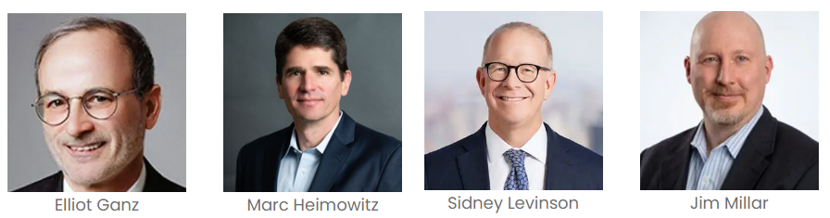

We asked Contributors Bradford Sandler and Sidney Levinson to weigh in on what we should expect in the next default cycle.

Professor Edward Altman recently noted in a paper published with the Creditor Rights Coalition that the Benign Credit Cycle is over. He sees a reversion to the mean in terms of defaults and recoveries in 2023. But he also sees many risks on the horizon making a Stress or even in a “hard-landing†scenario a possibility (with 8-10% default rates). Put your prediction caps on. What do you see and expect? Where do you expect restructuring activity to increase? Are we in for more bankruptcies? Or, more (yawn yawn) extend and pretend? Will RSAs rule the day? Or, will we see more traditional in-court restructurings? What will this new environment look like?

Read on.

Bradford J. Sandler

Pachulski

The question is a little deceptive because we are currently in a default cycle, and the better question is how long the current cycle will last and what can we expect as it progresses. To answer that question, and putting aside the unprecedented and resilient labor market, the U.S. economy and global economy will continue to be challenged by numerous factors, variables, and unknowns, including (i) persistently high inflation; (ii) increasing interest rates and cost of capital; (iii) the scaling back or elimination of stimulus programs in response to the pandemic; (iv) geopolitical uncertainty arising from the ongoing Russia-Ukraine war (with little prospect of resolution in the short term) and the U.S. and China chess match over politics, trade, technology, and military superiority; (v) the continued disruption from technological developments and innovations, such as AI, and (vi) the neurotic investment behavior arising from a possible (probable?) recession later this year.

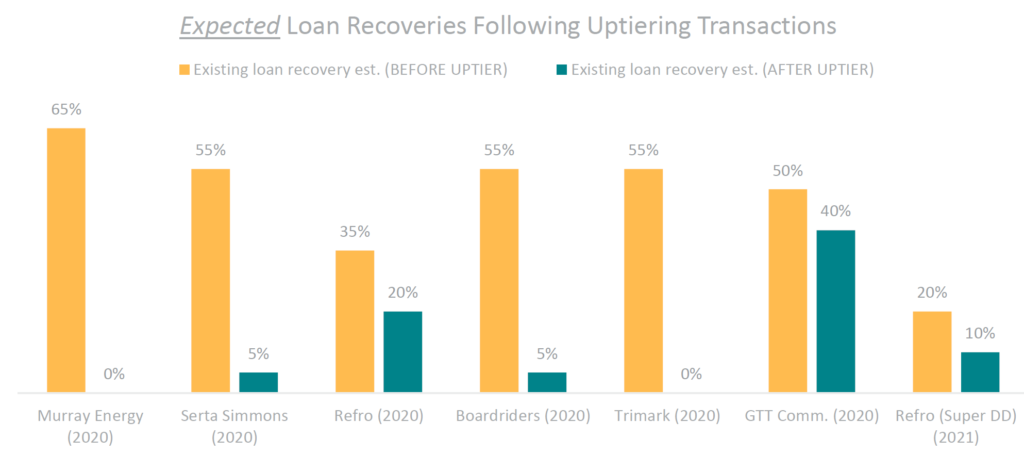

The confluence of these challenges likely will lead to more private equity (PE) backed companies in a variety of sectors, including commercial real estate, healthcare, consumer products and retail, media and entertainment, and capital-intensive industries, being forced to restructure after enjoying many years of loose credit that enabled them to soften the adverse impact of any operational dysfunction and liquidity constraints. During the loose money pandemic years, many stressed businesses were able to address their liquidity needs with rather simple and gracious amend-and-extend transactions or increasing borrowings with willing lenders, which led to higher leverage ratios. However, nothing lasts forever, and, absent meaningful operational improvement, the increased leverage in a rising cost of capital environment combined with the other macro- and micro-economic pressures leads to reduced liquidity, making restructuring negotiations with lenders and investors in the capital structure substantially more complex and frequently confrontational as those parties jockey to preserve their investment. This jockeying will force investors to pull out all the stops to protect their investments and engage in more creative liability management transactions, leading to more “lender-on-lender violence.â€

We expect to see more lender-on-lender violence in the short term, especially as some recent court decisions have justified creative lender machinations leading to more inter-creditor disputes and litigation. That said, we view this as a temporary transformative situation as investors and lenders promptly draft governing documents to provide more robust protections against potential “lender-on-lender violence†transactions and reduce the risk that investors do not get the consideration for which they bargained.

While none of us have a clear crystal ball and each credit cycle is unique in its cause, course, and characteristics, one thing is certain: restructuring professionals will continue to have a busy 2023 that most likely will continue into 2024.

Sidney Levinson

Debevoise & Plimpton

During the 2020s, the economy has withstood multiple shocks from events—such as the pandemic, hyper-inflation, and the most recently, the failure of Silicon Valley Bank—that, in other times, might have led to financial meltdowns of the kind suffered in 1929 (Great Depression), 1973 (OPEC) or 2007-08 (housing bubble). The difference in those outcomes can be attributed in large part to the willingness of the federal government to move quickly and forcefully, such as: 1) enacting the CARES Act that propped up, among other industries, domestic airlines and small businesses, 2) the Fed’s aggressive increase in interest rates coupled with the Biden administration’s release of strategic oil reserves that together helped slow the inflation rate, and 3) the invocation of the systemic risk exception to protect uninsured depositors of SVB, Signature Bank and others.

It is difficult to predict (at least correctly) what event(s)s will cause the next shock(s) to the economy. Potential candidates include, on a large scale, calamities such as wars, civil unrest, terrorism, cyber malfunction (induced by humans, artificial intelligence, or otherwise), natural disasters (earthquakes, volcanoes, hurricanes, tornadoes, floods, locusts, drought and famine), environmental disasters (nuclear plants, toxic outbreaks, oil spills), another pandemic, or any of the ten plagues not already listed.

The difference between the impact of the events that opened this decade and those to come may depend heavily on the willingness and ability of the federal government to respond as it has in recent years. Given the current fractured political environment, it is anybody’s guess whether the government will act, particularly if Congress and the executive branch remain divided, or if there is widespread, credible doubt as to the legitimacy of the elections that will occur in 2024 or breakdown in the proper application of rule of law. The recent showdown over the debt ceiling, which went to the brink before being resolved, highlights the peril that may face the economy if the government cannot or will not respond to the future shocks that will surely occur. The government’s ability or inability to respond to those calamities will, in my view, determine whether the next default cycle is lengthy and widespread, circa 1929, 1973 or 2008, or more limited and quick, circa 2020-23.

Tell us what you think:

How will the next default cycle play out? What strategies will we see?

What we’re listening to…

Leveraged loans losing popularity contest

Read our recent coverage:

Third party releases

click through to read the features from our Contributors

Read our recent coverage:

“Open Market” Purchases

Read the full length feature here.

Read our recent coverage:

Where Are We In The Credit Cycle?

Read our recent coverage: Contributor Cliff White on Examiners

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

June 27: REGISTRATION NOW CLOSED: Creditor Rights Coalition & LSTA 2023 Restructuring Symposium

August 22: ABI/NCBJ: Tackling Emerging and Recurring Mortgage Issues in Individual Bankruptcy Cases