Weekly News – July 28

CRC weighs in on Serta

The CRC may take positions as part of its Advocacy efforts that do not necessarily reflect the individual views of any Board member or Contributor, nor their respective institutions.

#AMCAPES whack-a-mole

(continued)

A revised settlement is already on the table.

We can’t wait to see what happens next!

Will BK professionals celebrate or will MEME stock fever live on??!?

J&J takes a HIT (again…)

Lordstown stalls…

Putting Walrath & Delaware judges on the firing line

Party City deflates…

Contributor Cliff White in Defense of Third Party Releases

Fitch on LMTs

(masters of the obvious…)

CRE coming our way!

What recession????

GDP grows at 2.4%

Earnings stronger than expected…

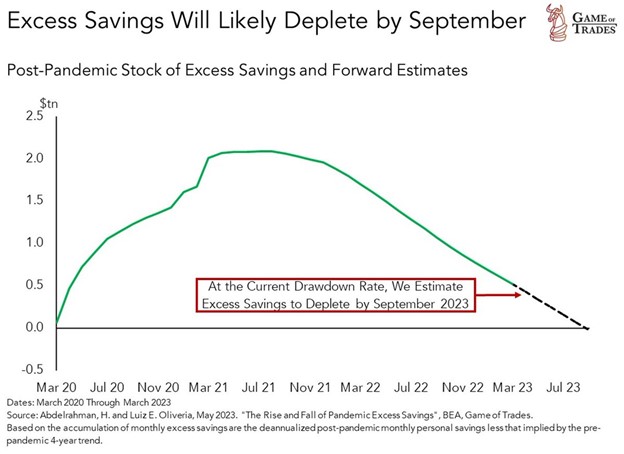

but… the canary in the coal mine

What we’re listening to…

2023 CRC Allocators Conference

Contributors Speak Up

What to expect in the next default cycle

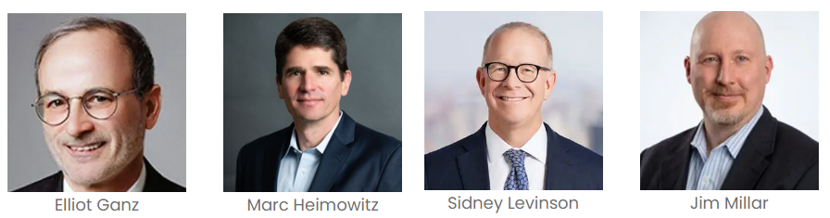

We asked Contributors Bradford Sandler and Sidney Levinson to weigh in on what we should expect in the next default cycle.

Professor Edward Altman recently noted in a paper published with the Creditor Rights Coalition that the Benign Credit Cycle is over. He sees a reversion to the mean in terms of defaults and recoveries in 2023. But he also sees many risks on the horizon making a Stress or even in a “hard-landing†scenario a possibility (with 8-10% default rates). Put your prediction caps on. What do you see and expect? Where do you expect restructuring activity to increase? Are we in for more bankruptcies? Or, more (yawn yawn) extend and pretend? Will RSAs rule the day? Or, will we see more traditional in-court restructurings? What will this new environment look like?

Read our recent coverage:

Third party releases

click through to read the features from our Contributors

Read our recent coverage:

“Open Market” Purchases

Read the full length feature here.

Read our recent coverage:

Where Are We In The Credit Cycle?

Read our recent coverage: Contributor Cliff White on Examiners

Look out for more great features from our Contributors

Look Out for our New Feature

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

August 22: ABI/NCBJ: Tackling Emerging and Recurring Mortgage Issues in Individual Bankruptcy Cases

September 29: ABI: Views from the Bench