Creditor Corner |

for the week ended March April 12, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

BREAKING NEWS McConnell takes on BK judge shopping, the next chapter in LMEs, Robertshaw sharp elbows, DQ lists hit Europe, and much, much more…

FEATURED CONTENT Bruce Richards on the Markets: In Bankruptcy, Time is Not Your Friend |

Scroll through to read all of our content

|

|

|

|

Tweet of the Week |

The Golden Age in Credit |

|

|

|

|

|

In the News |

Republicans Act on Judge Shopping |

|

|

“It also addresses the problem of venue selling in bankruptcy and patent cases. Venue abuse in those specialized areas of law comes less from litigants seeking advantage than from judges creating artificially attractive venues in order to enrich their friends in the local bar. The SHOP Act would impose uniform standards for where bankruptcy and patent cases should be heard to solve this problem.” |

| Read the Bill Here |

|

|

Our take: The CRC has joined industry stakeholders to address judge shopping in bankrupty courts (here). It comes as no surprise to us to see bipartisan receptivity to these concerns. More to come…

The Advocacy efforts of the Coalition do not necessarily reflect the views on any individual Contributor or Advisory Board Member. |

|

|

|

Exclusive Content |

the next generation of LMEs… |

|

|

|

|

Click Above to Access Content One Time Registration Required |

Our take: We are already in a post-Serta/Incora World: combining a downtier transaction with the benefits of a double-dip transaction to obtain 100% participation. |

|

|

|

Exclusive Content |

why can’t we all be friends??!? |

|

|

|

|

Click Above to Access Content |

|

|

|

Exclusive Content |

and no surprises here… |

|

|

|

Click Above to Access Content |

|

|

|

Exclusive Content |

Europe playing catch up… |

|

|

|

|

Click Above to Access Content One time registration required |

Our take: We have written about DQ provisions here. The evolution of these provisions has wide-ranging implications for market behavior, enforcing creditor rights, liquidity and pricing. Where do we go from here?? |

|

|

|

NYU Stern Bankruptcy Workshop |

Register Now! Space is Limited Discounted Before May 1 |

|

|

|

An unprecedented opportunity for young legal & finance professionals to learn in-depth fundamental credit and legal analysis through seminar and case-study format over intensive 3-day format.

Taught at NYU Stern from August 5 to 7, 2024.

Participants will receive Certificate of Completion from NYU Stern and in-depth reference materials for their future careers. Participants already include leading asset managers and law firms.

Workshop program here.

Expert Faculty: Edward Altman, Dan Kamensky, Donald Bernstein, Saul Burian, Judge Robert Drain (ret.), Christian Fischer, Michael Friedman, Max Frumes, Michael Gatto, Larry Halperin, Mo Meghji, Andy Rosenberg, David Smith, Robert Stark, Nick Weber, Jay Weinberger with featured speakers: Lisa Donahue, Holly Etlin, Lauren Krueger & Jared Parker

Registration fees apply |

| Register Here |

|

|

|

|

|

|

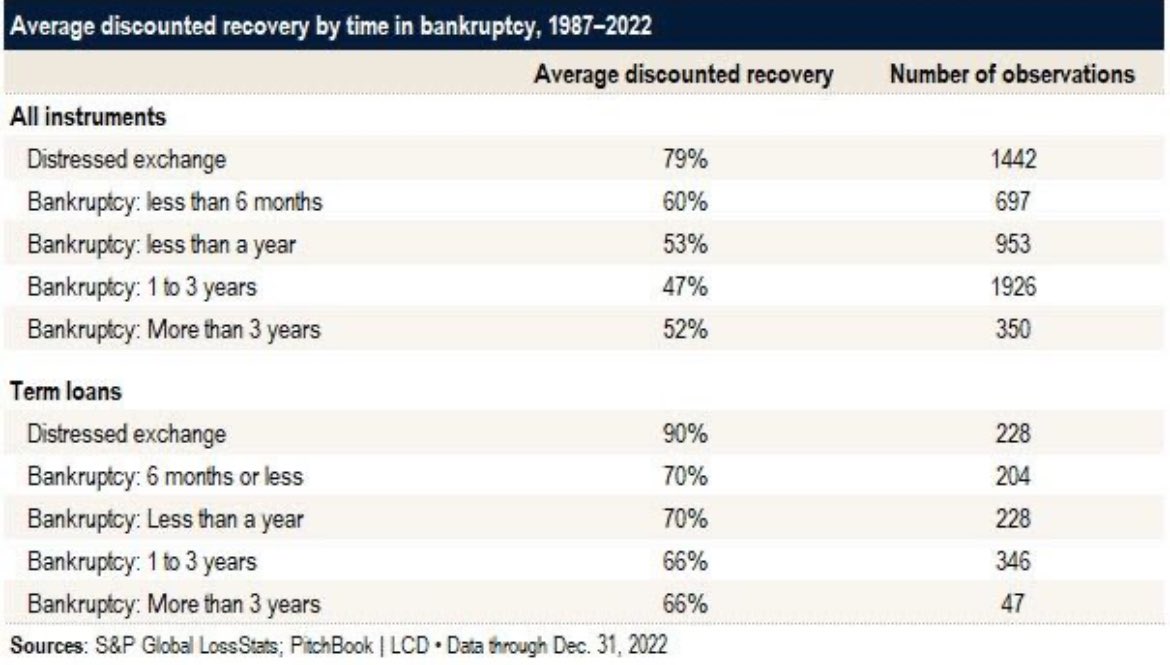

In Bankruptcy, Time Is Not Your Friend

When it comes to Bankruptcy, time is not your friend since legal/advisory cost of BK combined with business interruption can be significant. The running joke is “What is the only cost that has increased consistently for the past 30 years? The cost of hiring a bankruptcy lawyer.” According to this data set from 1987- 2022 (below) reported by S&P Global Ratings, the longer the company remains in BK, the lower the recovery rate. Distressed Exchanges historically have shown higher recovery rates and are preferrable from the Company perspective when possible. When filing for BK, a well-planned prepackaged Chapter 11 is optimal relative to a long-drawn our process, allowing the debtor to enter-exit in short order (often in less than 6 months) by negotiating and gaining acceptances by creditors prior to the filing, which has typically led to stronger recovery rates as shown herein. Having said this, Marathon Asset Management has invested in numerous restructurings where the company is in BK for 1-3 years, where the outcomes have produced strong results for investors and the businesses. Investing is hugely idiosyncratic, so please take these numbers with a grain of salt as the results have huge variability (from low recovery to recoveries 2x the value of par when investing through the fulcrum!)

The All-Instruments category carries an average recovery rate for distressed exchanges of 79% or 19 points higher than the average of 60% when a company enters/exits bankruptcy for less than 6 months, or 26 points higher if the debtor is in BK for up to one year. For bankruptcies lasting 1-3 years, the average discounted recovery drops to 47% across all instruments. A similar pattern can be seen specifically in loans, although loans have historically had greater recovery rates v. bonds. |

|

To follow Bruce’s thoughts on the markets, investing and more follow @bruce_markets |

|

|

|

Podcast of the Week |

@CRC talks about high yield and distressed markets |

|

|

|

|

|

In the News |

what?!!? |

|

|

|

|

TMA: NYC Distressed Investing Breakfast |

April 16, 2024 |

| Learn More |

|

|

ABI: Distressed Real Estate Symposium |

April 30, 2024 |

| Learn More |

|

ABI: New York City Bankruptcy Conference |

May 9, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|