Creditor Corner |

for the week ended February 16, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition

President’s Day Edition! |

Over 2,400 member subscribers and growing! Sign Up Here |

BREAKING NEWS Robertshaw LME sh*tsh*w, WeWork Examiner Sought, Boy Scouts stopped in their tracks, Ergen against the ropes, Private credit versus broadly syndicated market, Houston continues to have a PO Box issue, and much, much more!

SPECIAL FEATURE

Ed Neiger & Nick Brown Speak Up

Committee Standing

FEATURED CONTENT Bruce Richards on the Markets: Retail Sales Fall |

Scroll through to read all of our content

|

|

|

|

Tweets of the Week |

New Apollo and Old Apollo |

|

|

|

|

|

Exclusive Content |

LME SH*TSH*W |

|

|

|

|

Click on the Image to Access the Full Report One-time registration required |

|

|

|

Exclusive Content |

Two wrongs don’t make a right! |

|

|

|

|

Click on the Image to Access the Full Report One-time registration required |

|

|

|

|

|

Earlier this month a Delaware bankruptcy judge ruled that a creditors’ committee has standing to pursue breach of fiduciary duty claims on behalf of a Delaware limited liability company’s bankruptcy estate against the company’s officers. This holding is significant because at least three prior Delaware bankruptcy court cases held that creditors were barred from pursuing such derivative claims by operation of Delaware state law.

Prior to the court’s decision in In re Pack Liquidating, LLC, bankruptcy courts in Delaware had rejected creditors’ requests for derivative standing to bring lawsuits belonging to an LLC’s bankruptcy estate. Those courts pointed to the Delaware Limited Liability Company Act, which expressly requires that a member or assignee of the company must bring such claims. These decisions left few vehicles for recovering on claims of managerial misconduct where the managers themselves remained in control of the debtor. Without the ability to pursue such claims derivatively, creditors hoping to monetize these claims were forced to consider more extreme avenues such as appointing a trustee or converting the case outright.

Breaking with his peers, Judge Goldblatt found that the Bankruptcy Code implicitly authorizes courts to grant derivative standing to pursue estate causes of action which the estate’s fiduciaries refuse to bring. Judge Goldblatt relied on the Third Circuit’s decision in In re Cybergenics, which held that a committee’s standing is derived from federal bankruptcy law. As such, a state statute imposing limitations on derivative standing has no impact on the bankruptcy court’s authority to grant standing to a creditors’ committee to pursue claims on behalf of the bankruptcy estate.

The decision in Pack Liquidating furthers bankruptcy’s goal of maximizing value for the benefit of the estate and is a victory for creditors. It remains to be seen if other bankruptcy judges will follow this court’s lead, however, Judge Goldblatt’s opinion makes a compelling case that the bankruptcy court’s authority to grant derivative standing to committees is dictated by binding Third Circuit precedent and the Bankruptcy Code itself.

|

| Read the Opinion Here |

|

|

|

In The News |

whoa… read-through to Purdue no bueno! |

|

|

|

|

|

Exclusive Content |

This should be juicy… |

|

|

|

|

Click on the Image to Access the Full Report

|

|

|

|

In The News |

Ergen against the ropes? |

|

|

|

|

|

Exclusive Content |

Private credit versus broadly syndicated market |

|

|

|

|

Click on the Images to Access the Full Report |

|

|

One to Watch |

pull up a chair… |

|

|

|

|

Houston has a P.O. Box Issue Part 2 U.S. Trustee seeking to dismiss Sorrento or transfer the case because Jackson Walker created venue just hours before filing for BK. |

| Read the UST’s Filing Here |

|

|

|

|

What We’re Reading |

Read Petition on Double Dips |

|

|

|

|

|

Click on the Image to Access the Full Report |

|

|

|

Data Download |

Exclusive Content |

|

|

|

|

Click on the Image to Access the Full Report One-time registration required |

|

|

|

|

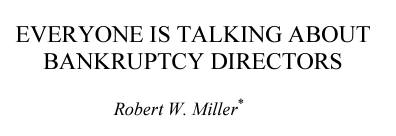

What We’re Reading |

|

Prof. Miller Tops our List Two Weeks in a Row! |

| Read it Here |

|

|

|

Data Download |

Margins ARE the story |

|

|

|

|

|

Data Download |

Bad news is actually good news for Bulls |

|

|

|

Source: S&P Global, Prequin. Data as of Sept 30, 2023 |

|

|

|

|

|

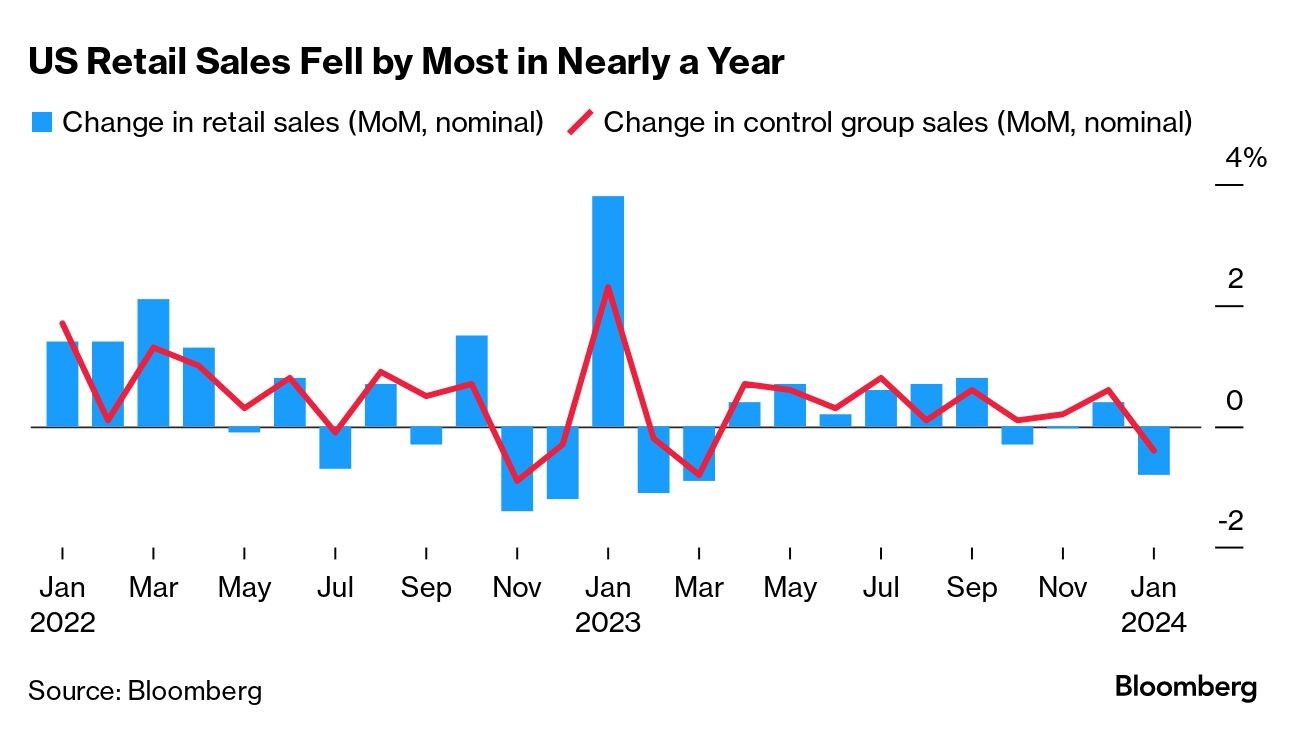

Bruce Richards on the Markets |

|

Retail Sales Stall

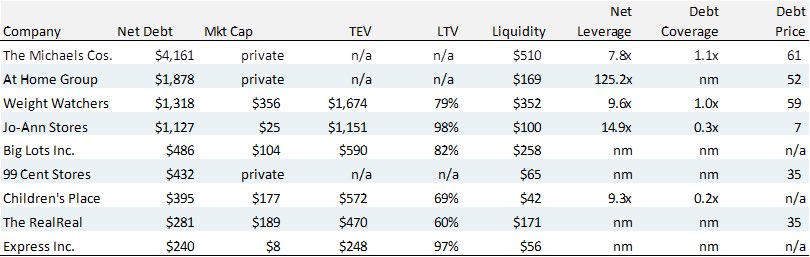

Retail sales dropped by 0.8% in January, well below the consensus (-0.2%). Net revisions from the prior two months were -0.5%, despite the +0.7% uptick for food (restaurants, grocery). Retail Sales for in-store declined even sharper, -3%. While LVMH, Gucci, and Hermes and department stores such as Neiman Marcus are performing well while capturing the high-end wallet, successful online clothing retailers such as Temu, who gamifies shopping and gets the medal for biggest spend on Super Bowl Sunday ads ($21 million), and Mytheresa are also capturing greater market share. In contrast, low-income consumers, are starting to tighten their belt given their inflation pinch and this is being felt by retailers who service this cohort. Under-capitalized/highly leveraged/sub-scale retailers are experiencing a more challenging time. For example, Express Inc. has retained law firm Kirkland & Ellis to consider how to restructure ~$280 million of debt amid declining sales while its equity share price is down 98% from 2021 (price decline from 125 to 2.5).

Buyer Beware: When investing in distressed, my rule is to seek Good Company, Bad Balance Sheet opportunities since you can fix a balance sheet by restructuring, but it’s too hard to fix a company that is going through structural decline. When a Good Company emerges from bankruptcy, it should not only be a going concern, but it should also be on a path of profitability and with strong operating margins. It has been my opinion, that highly levered apparel/household goods retailers perform poorly post-bankruptcy, that impairs the unsecured creditors, even when they re-cap the company. Conclusion, avoid low-end retailers who are in the process of/have filed for BK. |

|

Stressed Retailers’ Watchlist: (Source: Marathon Asset Management) |

|

|

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Featured Event

February 23

|

The must-attend event! |

|

|

|

|

|

|

ACFA: Liability Management Transactions Program |

March 14, 2024 |

| Learn More |

|

ABF Journal: 15th Annual Philadelphia Restructuring Summit |

March 21, 2024 |

| Learn More |

|

|

|

|

|

|

|

|