Creditor Corner |

|

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 3,400 member subscribers and growing! We welcome new subscribers from our recent webinar with CreditSights

We bring you exclusive content from leading data and research providers Sign Up Here |

|

|

In this Week’s Creditor Corner A deep dive into Spirit Airlines, new guidance issued prohibiting judge shopping, Echostar mega deal surprise, Texas Two Step doesn’t fly in Delaware, and much, much more…

Spotlight Series Leveling the Playing Field: In re Eletson Marc Kirschner & Gordon Z. Novod

Featured Content Bruce Richards on the Markets No Denying This |

Scroll through to read all of ou?r content? |

|

|

|

Tweet Of The Weekthe latest “double-dip” |

|

|

|

|

|

In the news |

well that was quick… |

|

Click above to access content |

|

|

|

|

|

Exclusive Content |

taking a deep dive…. |

|

Click above to access the Report One time registration required |

|

|

|

|

|

|

Advocacy in Action |

|

In January 2024 the Creditor Rights Coalition joined a variety of academics, industry associations and former government officials in urging the adoption of a federal rule of bankruptcy procedure to require random assignment of mega bankruptcy cases to all bankruptcy judges within a particular district.

We are pleased to see that the Committee on the Administration of the Bankruptcy System issued guidance on August 21, 2025 supporting the random assignment of bankruptcy cases among all bankruptcy judges within a particular district to deter judge shopping.

The Judicial Conference statement is consistent with the CRC proposal and long-standing judicial policy that all bankruptcy judges within a particular district should be able to handle the breadth of issues that come before the Court. The new policy does not by itself eliminate the possibility of judge-shopping through manipulation of one-judge divisions. Broader reform to address that and other related issues merits further consideration by the Judicial Conference and legislative action (e.g., district-wide assignment of complex chapter 11 cases; more comprehensive bankruptcy venue reform, etc.) but the Judicial Conference sends a strong message, fully supported by the CRC, that random assignment promotes public confidence in the federal judiciary.

The Advocacy efforts of the Coalition do not necessarily reflect the views of any individual Contributor or Advisory Board Member. |

|

|

|

Click above to access content |

|

|

|

|

|

Exclusive Content |

explosive deal! |

|

Click above to access the Report One time registration required |

|

|

|

|

|

|

Exclusive Content |

recent trends in LMEs |

|

Click above to access the Report |

Our take: Holding out can have high risk but high reward; hold outs in Del Monte who decided to challenge the transactions ended up getting paid off at par while AMC holdouts were offered the opportunity to participate in the main deal. |

|

|

|

|

|

|

Featured Content |

|

As part of our efforts to bring more full-length thought-leadership insights to our member subscribers, we are introducing a new Spotlight Series. Our first Spotlight Series by Marc Kirschner and Gordon Z. Novod analyzes whether the recent Eletson decision has shifted the balance of power too far toward entrenched management and out-of-the money shareholders. We provide a summary below of their thought-provoking piece and you can find the full-length feature here.

The recent Eletson decision is a case study in how Chapter 11 has tilted too far in favor of entrenched management and out-of-the money shareholders, disenfranchising creditors. Despite significant evidence of insider conflicts, questionable asset transfers, and overwhelming creditor support—including the U.S. Trustee—the court declined to appoint a Chapter 11 Trustee under Section 1104. Instead, it leaned heavily on WorldCom, a precedent born out of a massive public accounting scandal, rather than applying a more flexible standard more appropriate for a closely held, insider-driven enterprise.

The consequences were predictable: management clung to control, disputes escalated, recoveries were delayed, and litigation costs multiplied. Even after creditors won confirmation of their plan, they faced continued obstruction—requiring contempt motions, sanctions, and international enforcement actions just to effectuate what should have been a straightforward transition.

For restructuring professionals, the lesson is clear. While Chapter 11 provides creditors with tools like adequate protection, committee oversight, and plan voting rights, these measures are often insufficient when insiders operate with conflicting interests. The trustee mechanism under Section 1104 exists precisely for these situations—yet courts’ reluctance to use it undermines the Code’s core promise of fairness and timely resolution.

Creditors deserve more than theoretical remedies. Experienced independent fiduciaries are well equipped to stabilize complex businesses, safeguard value, and reduce friction. By declining to appoint trustees when warranted, courts risk perpetuating costly delays and eroding confidence in Chapter 11 as a balanced system.

Eletson should serve as a reminder: creditor protections are only as strong as the willingness of courts to enforce them. If Chapter 11 is to remain trusted, the judiciary must be prepared to use all its tools—including trustee appointments.

Copyright 2025 Creditor Rights Coalition |

|

|

| Read the Article Here |

|

|

|

|

|

|

What we’re listening to |

Rx pros be like… |

|

|

Click above to access content |

|

|

|

|

|

Featured Content |

|

No Denying This

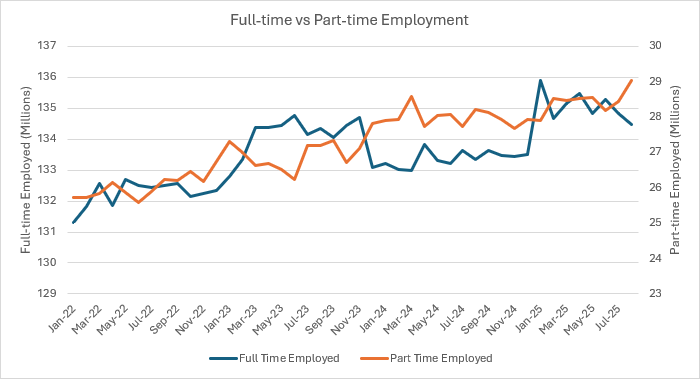

?The August Employment Report is out, showing a slowing labor market, with only 22k jobs added. Fed will re-commence its easing cycle starting September 17th.

Equities markets soar to new hires 6 Key Insights from today’s Jobs report:

1. More job seekers vs. job openings for the first time since April 2021 (JOLTS Report) 2. Market Intel has 1 million migrants volunteering leaving U.S. in past several months, many had been counted in payrolls #’s. 3. Federal Government layoffs contributed to slowdown in labor last month, a trend that will continue. 4. Despite the jobs slowdown, wages growth remains firm: +3.7% y-o-y. 5. Full times jobs fell 357k, while parttime jobs more than offset this number according to the Household survey as shown below in this chart. 6. Just because job growth has slowed, it doesn’t mean GDP will slow. The Fed’s GDPNow forecast +3.0% GDP in Q3 2025.

Credit conditions are optimal, even before the Fed begins easing. Stay long, invest wisely. |

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

|

Exclusive Content |

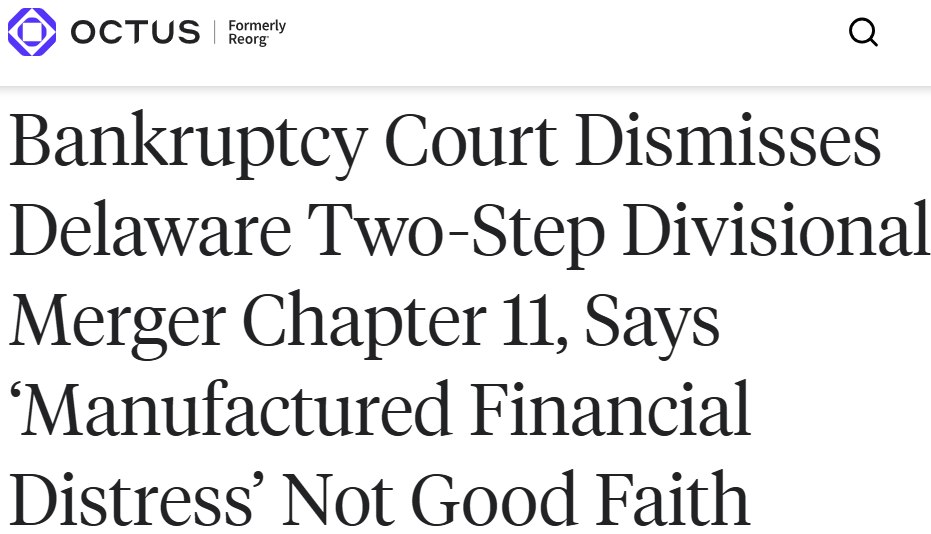

Texas Two Step doesn’t fly in Delaware |

|

Click above to access the Report |

Our take: We are glad to see Delaware Courts wont allow debtors to pick and choose winners and losers… |

|

|

|

|

|

|

Data download |

CMBS stress |

|

|

|

Click above to access content |

|

|

|

|

|

Mayer Brown: Beating Bankruptcy Trustee Claims (Webinar) |

September 9, 2025 |

| Learn More |

|

|

|

Paul Weiss: Transatlantic Perspective on Evolving Strategies on Navigating Distress |

September 10, 2025 |

| Learn More |

|

|

|

New Event: TMA: The ABCs of LMEs (Webinar) |

September 11, 2025 |

| Learn More |

|

|

|

NCBJ Annual Meeting (Chicago) |

September 17, 2025 |

| Learn More |

|

|

|

ABI Bankruptcy Views from the Bench (Washington DC) |

September 26, 2025 |

| Learn More |

|

|

|

New Event: Octus European LMEs: Where are We Now? (webinar) |

September 23, 2025 |

| Learn More |

|

|

|

Linklaters European and Asian Private Credit (New York) |

October 8, 2025 |

| Learn More |

|

|

|

LSTA: Annual Conference (New York) |

October 22, 2025 |

| Learn More |

|

|

|

|

Octus: London Credit Seminar (London) |

October 23, 2025 |

| Learn More |

|

|

|

New Event: ABI: 2025 International North American Insolvency Symposium (New York/ Skadden) |

November 5, 2025 |

| Learn More |

|

|

|

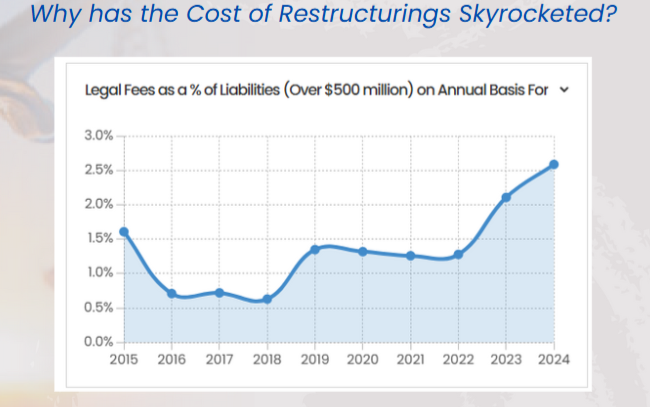

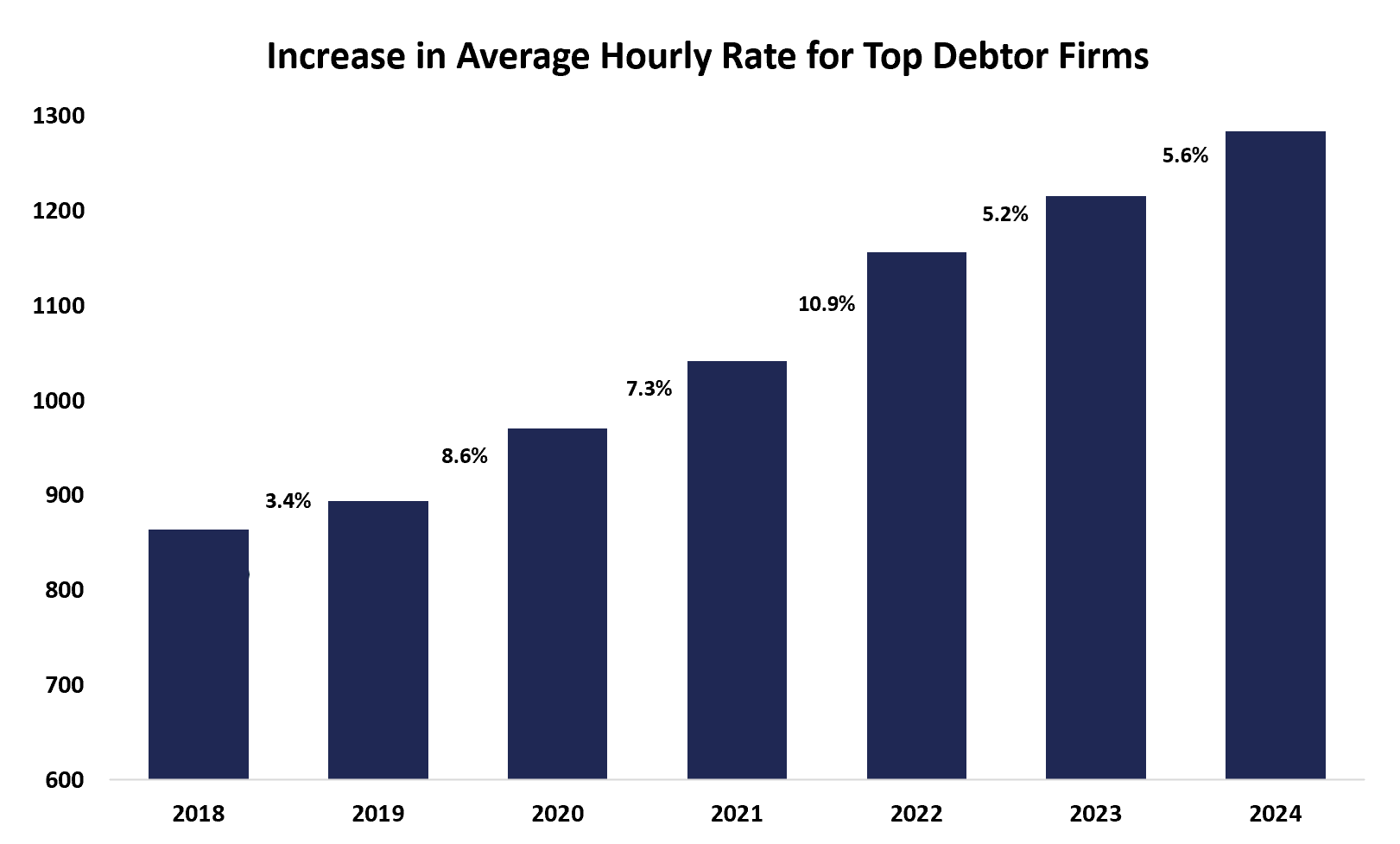

The Data Download |

Bringing Transparency to the Bankruptcy Process |

|

|

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. We took a deep dive to see what is driving up the daily cost of restructurings and the culprit: Increasing Legal Hourly Rates. We analyzed final fee apps for top debtor law firms from 2018 to 2024 and found average hourly legal fees have increased by over 65% since 2018. Maybe a little bit of sunlight is the right disinfectant to help remedy the problem…. |

|

|

|

|

|

Meet Our 2025 Contributors |

|

|

|

|

|

|

|

Thank You to Our 2025 Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|