Weekly News – September 1

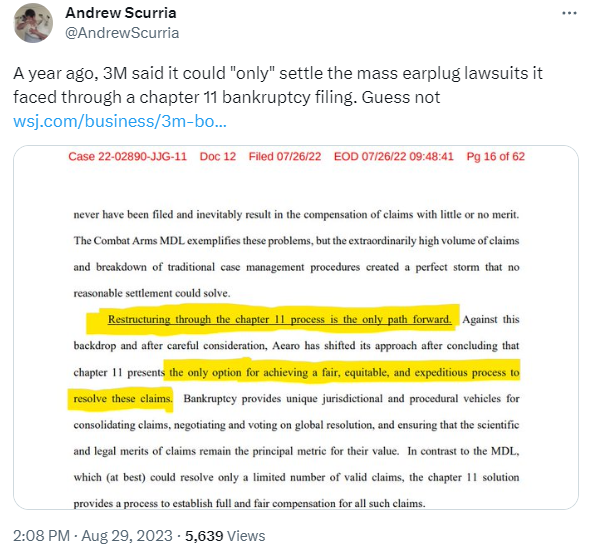

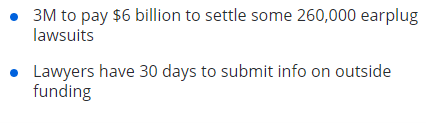

3M settles!

Bellweather BK tort case settled in MDL

Purdue SCOTUS review, now this…

Is BK losing its luster?

But see

Our take:

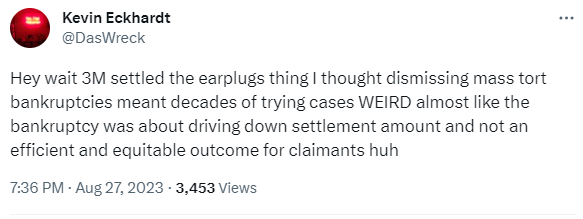

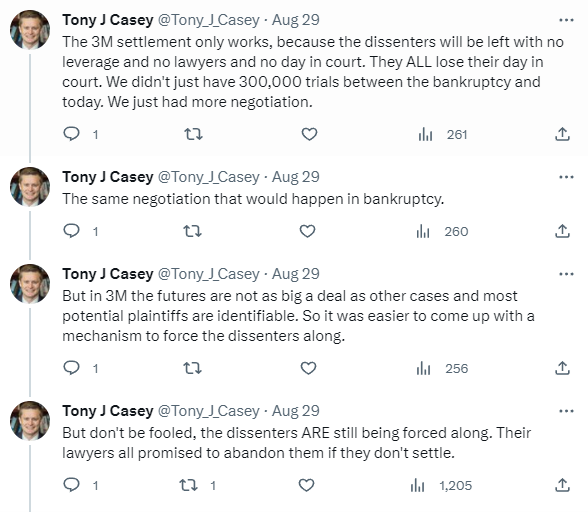

Surprise, surprise, surprise…

Maybe it just costs more to settle outside of BK.

Maybe it will just cost more for the Sacklers to settle outside of BK. But there’s no parade of terribles here.

Just an old-fashioned allocation of risk.Â

Tell us what you think.

Is BK the preferred forum for mass tort cases?

Even more 3M news…

Our Take:

Would the victims even have had a day in court without strong financial backing? Don’t cut off your nose to spite your face….

Federalist Society takes on Purdue Pharma with two CRC Contributors

September 6

finally, a road to somewhere!

MNK DIP fees under scrutiny

Exclusive Content

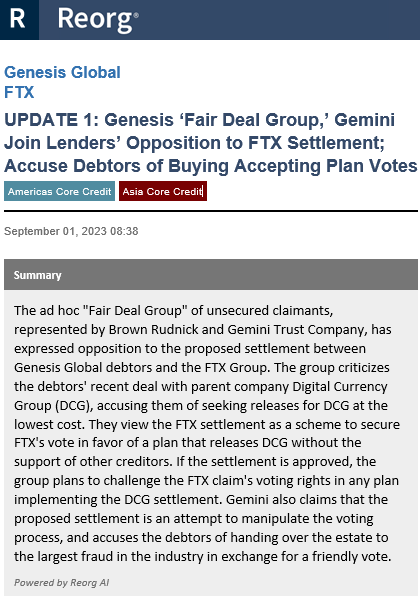

Genesis settlement under pressure

Exclusive Content

Grayscale court ruling stirs the pot

Goldilocks again…

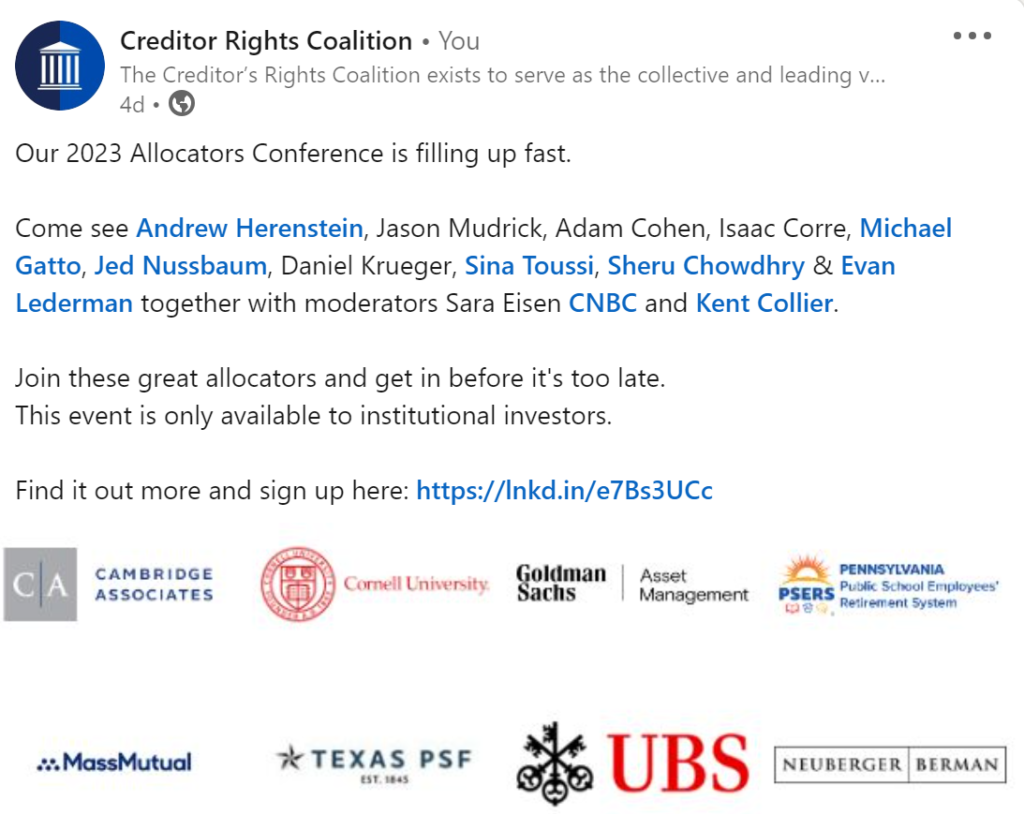

2023 CRC Allocators Conference

Beard Investing Conference

Read our recent coverage:

The Academics Speak Up

Purdue Pharma is the gift that keeps on giving. This is our third installment on the twists and turns this case has taken through the Courts. You can read our first installment here, and our second here.

All bets came off the table when the Supreme Court decided to reshuffle the deck by taking on the appeal of the 2nd Circuit’s decision. Not only did SCOTUS take the unusual step of taking on this big ticket issue in BK cases but it also stopped the lower court’s decision in its tracks putting the breaks on the entire enchilada. We decided to consult with our expert Academic Contributors for our inaugural feature the Academics Speak Up to get their takes on the latest developments.

We are excited to bring you the varying perspectives of Prof. Tony Casey, Prof. Samir Parikh and Prof. Ralph Brubaker.

Read on here, you won’t be disappointed.

Read our recent coverage of Purdue Pharma

click through to read the features from our Contributors

CRC weighs in on Serta

Contributors Speak Up

What to expect in the next default cycle

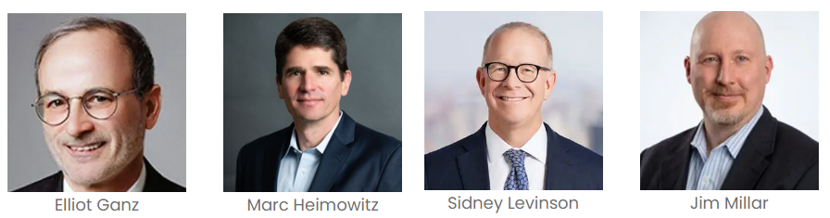

We asked Contributors Bradford Sandler and Sidney Levinson to weigh in on what we should expect in the next default cycle.

Professor Edward Altman recently noted in a paper published with the Creditor Rights Coalition that the Benign Credit Cycle is over. He sees a reversion to the mean in terms of defaults and recoveries in 2023. But he also sees many risks on the horizon making a Stress or even in a “hard-landing†scenario a possibility (with 8-10% default rates). Put your prediction caps on. What do you see and expect? Where do you expect restructuring activity to increase? Are we in for more bankruptcies? Or, more (yawn yawn) extend and pretend? Will RSAs rule the day? Or, will we see more traditional in-court restructurings? What will this new environment look like?

Read our recent coverage:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

September 13: TMA: Views from the Bench

September 29: ABI: Views from the Bench