Weekly News – October 13

Fifth Circuit finds ‘probable cause’

Click here to review the complaint

Cliff White Speaks Up on

Needed Bankruptcy Reform

Recent Ethics Controversy Highlights Needed Bankruptcy Reforms

By Clifford J. White III1

The Chief Judge of the United States Court of Appeals for the Fifth Circuit filed a complaint last Friday against a noted bankruptcy judge that has created shockwaves that will reverberate in the days, weeks, and months ahead. The consequences will be far-reaching and highlight several important and needed areas of bankruptcy reform. Some of these issues have been percolating for quite a long time. The allegations in the complaint, some of which are admitted, pertain to the ethical implications of a relationship between the judge and an attorney whose law firm frequently appeared in the judge’s court. The purpose of this comment is not to address the facts and allegations in the complaint, but to point out how the controversy shines a light on the need for the following four reforms in the bankruptcy system:

Forum Shopping and Judge Shopping: The bankruptcy venue statute is very lenient and has been the subject of much criticism. Perhaps the most controversial andhighly criticized provision allows a company to create an affiliate on the eve of bankruptcy so that the main debtor may obtain a more favorable forum. 28 U.S.C. section 1408. Over time, forum shopping became judge-shopping as some districts created small panels of judges within the larger district to hear mega-chapter 11 cases.

After it was revealed that Purdue Pharma was able to select a judge known to be favorable to the debtor’s position on a pivotal issue in the case, two of three districts which limited the random assignment of judges within a district changed their rules. Today, the Southern District of Texas remains alone in limiting assignments of larger cases to only two judges in the entire district. Perhaps, as a result, debtor’s counsel have flocked to the district when they believe they will have a sympathetic judicial ear on key issues. This is not corrupt, but it is terrible public policy because it raises the appearance of a conflict of interest that others have noted.

The controversy in question accentuates the problem with judge-shopping. One single judge has a disproportionate impact on the largest corporate reorganizations in the entire country. That is bad enough. But when that judge’s ethical judgment is called into question, whether with validity or not, then the public’s confidence in the integrity and independence of the Judiciary is undermined and the whole system suffers a big black eye. Hopefully this controversy will put an end to this practice.

Furthermore, if a judge who hears a disproportionate share of the most complex cases is found to have breached her ethical obligations, the remedy becomes all the more problematic. It is easier to review and un-ring a bell in a handful of cases. It is a far different matter to resolve hundreds of cases involving billions of dollars in debt and thousands of employees.

Mediation Conducted by Judges: Although mediation can help resolve complex disputes far more efficiently than litigation, it is inherently coercive when the presiding judge suggests mediation by another judge in the same district. This happens routinely in some districts hearing the largest bankruptcy cases. If the mediating judge pushes one party toward settlement, it is very difficult for counsel for that party to push back with knowledge that she has other cases filed and to be filed before the mediating judge. There are sometimes quietly expressed concerns about the practical separation between the mediating and presiding judges, as well as about other aspects of mediation. In the current judicial ethics controversy, the question has arisen about the mediator-judge’s relationship with counsel for an interested party. Rules governing judicial mediation should be detailed and uniform throughout all bankruptcy courts. It should be crystal clear that the same core ethics rules that apply to a judge when presiding over a case also apply when the judge is mediating.2

Judicial Canon 3C: This canon of judicial ethics pertains to disqualification of a judge. It applies to all federal judges, including bankruptcy judges. Among other things, the canon provides that “[a] judge shall disqualify himself or herself in a proceeding in which the judge’s impartiality might reasonably be questioned . . . .†Many examples follow and some pertain to spousal interests.

Importantly, the Commentary to Canon 3C clearly states: “Recusal considerations applicable to a judge’s spouse should also be considered with respect to a person other than a spouse with whom the judge maintains both a household and an intimate relationship.†In other words, the lack of a marriage certificate does not provide an escape from the disqualification rules.

In light of the recent controversy and the implicated judge’s reliance on the lack of a legal spousal relationship, the Commentary probably should be part of the Rules. Additionally, other judicial canons of ethics should be reviewed to eliminate any other possibly problematic loopholes.

Federal Rule of Bankruptcy Procedure 2014(a): Finally, any professional who wishes to be employed in a bankruptcy case and be paid from the estate is subject to a far-reaching disclosure of connections. Under Rule 2014(a), the bankruptcy professional is required to disclose “all of the person’s connections with the debtor, creditors, any other party in interest, their respective attorneys and accountant, and the United States [T]rustee, or any person employed in the office of the United States [T]rustee.â€

I recall one case on my watch as head of the USTP when we objected to fees based upon a non-disclosed personal relationship between a professional whose firm was investigating a transaction and a professional whose firm represented interests directly at issue. The judge denied all fees.

According to the Fifth Circuit complaint, the judge approved fees billed by the lawyer with whom he has an intimate relationship. The undisclosed connection is with the judge himself. This reveals an omission that should be corrected. The Rule 2014 mandatory disclosure should also encompass connections with the court.

Conclusion

More than 400,000 bankruptcy cases will be filed this year. Many millions of parties in interest will be directly affected by the outcomes of these proceedings. Beyond that, these cases will have an impact on the entire American economy. As Professor Melissa Jacoby and others have written, public perceptions and confidence in any judicial system are central to its success. The current controversy may have a silver lining if it focuses attention by policymakers and practitioners on some important reforms necessary to restore and enhance the credibility of the bankruptcy system.

1 Cliff White served as head of the Justice Department’s “bankruptcy watchdog,†the United States Trustee Program, for seventeen years before retiring last year. He is currently an executive with a financial technology company. The views expressed are those of the author only.

2 The United States Trustee has already cited the current judicial ethics controversy in support of its objection to the disclosure statement and other relief in Tehum Care Services, Inc., saying that “recent admissions by the judicial mediator concerning counsel for one of the settling parties that received valuable assets in the divisional merger that left Tehum with little other than liabilities may raise issues about the propriety of the mediation that serves as the basis for the global settlement – and thus about the very propriety of the settlement and plan itself.†Case no. 23-90086 (Bankr. S.D. Tex.).

Copyright © 2023 Creditor Rights Coalition. All rights reserved.

Ligado on the ropes (again)

**BREAKING NEWS**

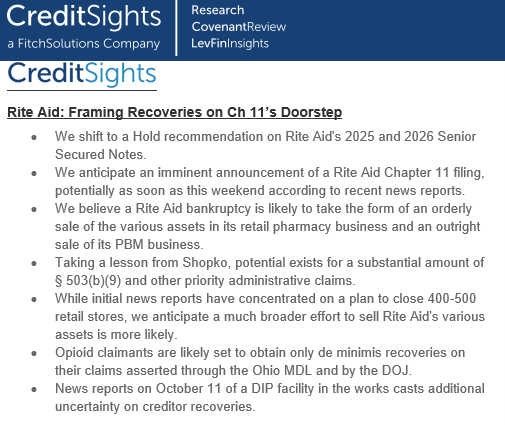

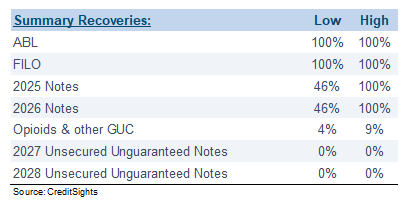

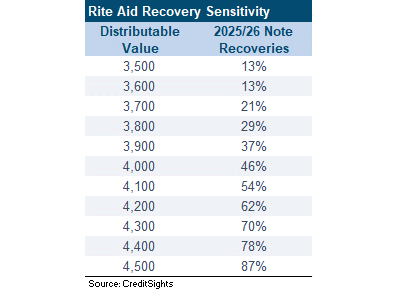

Rite Aid seeks BK fundin

Exclusive Content

Country Garden teeters

Mallinckrodt exits (again)

Liability Management 101

Exclusive Content

LSTA Conference insights on LMEs

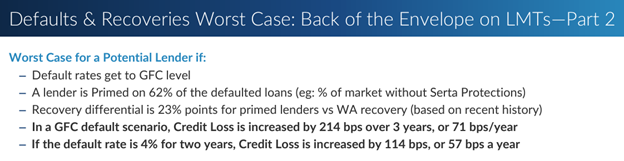

Our take:

While a 23% recovery differential for primed lenders seems severe, our experience would imply much worse. Are lenders adequately compensated for this risk?

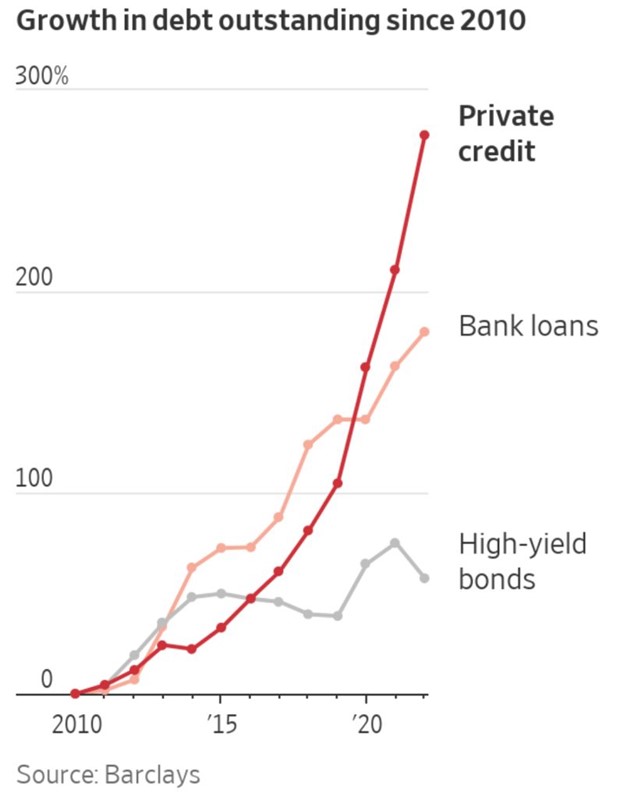

Private Credit to the moon!

While defaults go to the moon!

What we’re listening to…

Resilient consumer!

Only a few spots remaining!

Sign up today

2023 CRC Allocators Conference coming up

This event is available to institutional investors only

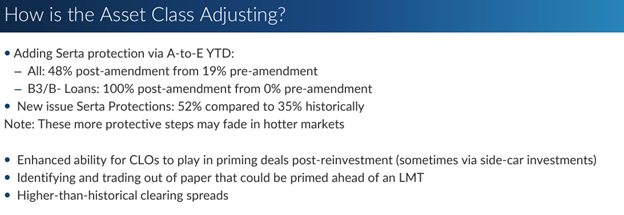

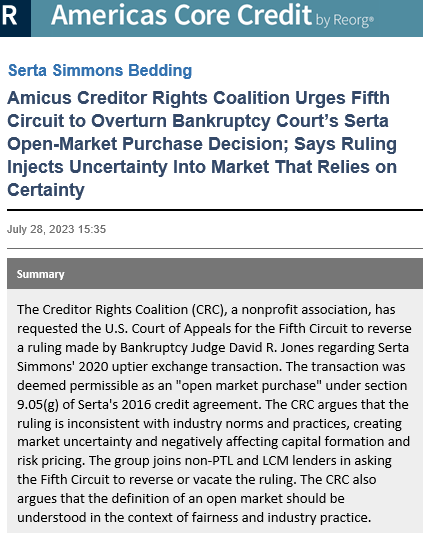

CRC weighs in on Serta

The Academics Speak Up

Purdue Pharma

Purdue Pharma is the gift that keeps on giving. This is our third installment on the twists and turns this case has taken through the Courts. You can read our first installment here, and our second here.

All bets came off the table when the Supreme Court decided to reshuffle the deck by taking on the appeal of the 2nd Circuit’s decision. Not only did SCOTUS take the unusual step of taking on this big ticket issue in BK cases but it also stopped the lower court’s decision in its tracks putting the breaks on the entire enchilada. We decided to consult with our expert Academic Contributors for our inaugural feature the Academics Speak Up to get their takes on the latest developments.

We are excited to bring you the varying perspectives of Prof. Tony Casey, Prof. Samir Parikh and Prof. Ralph Brubaker.

Read on here, you won’t be disappointed.

Read more on Purdue Pharma

click through to read the features from our Contributors

Read our recent coverage:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Featured Event: Beard Investing Conference

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

October 18: **New Event** NYC Bar: Plan Confirmation Issues: Recent Decisions and Hot Topics

October 24: ABI: Cross-Border Insolvency Program

October 26: Chicago Conference on Litigation Finance