Weekly News – May 20

Upcoming Symposium on Intra-Creditor Class Warfare

What is class warfare?

How we got here?

Where do we go from here?

Held June 21 from 1:00pm until 4:30pm

Followed by Reception

Brought to you by:

The Symposium will bring together leading academics, practitioners, investors and market participants to discuss the rise of intra-creditor conflict and where we go from here.

Confirmed participants:

Professor Ken Ayotte, Berkeley Law; Assoc. Professor Vince Buccola, Wharton; Chris Chaice, Brigade Capital Management; Professor Elisabeth de Fontenay, Justin Forlenza, Covenant Review; Duke University; David Golub, Golub Capital; Assoc. Professor Greg Nini, Drexel University; Jeff Ogden, Natixis CIM Americas; Erica Weisgerber, Debevoise & Plimpton

More to come

Space is limited/proof of vaccination required.

Registration is filled for this event.

Email info@creditorcoalition.org to be added to the wait-list

Reception Sponsor

Supporters

Please contact info@creditorcoalition.org for sponsorship opportunities

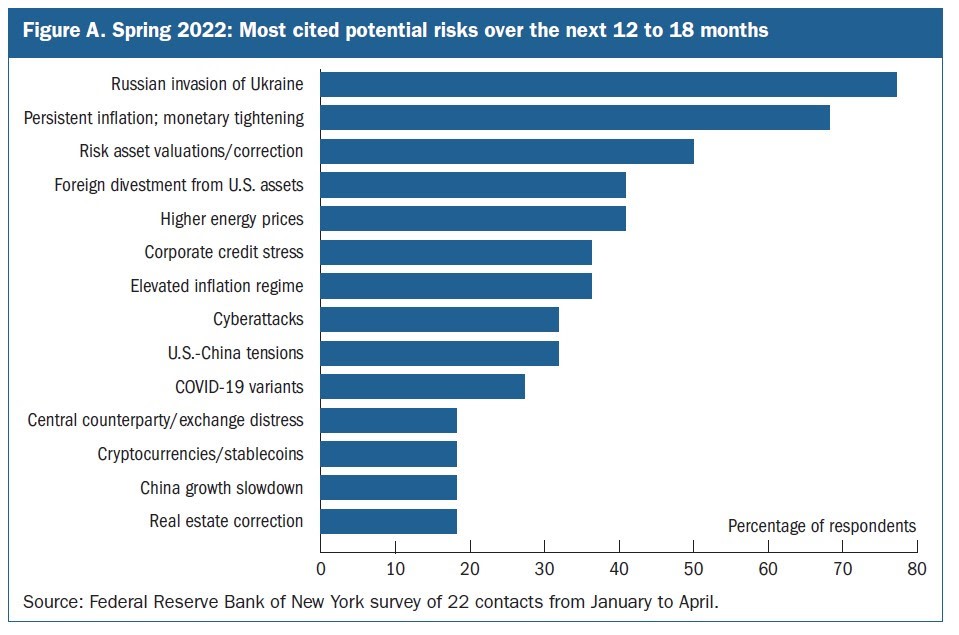

Risks in the system

Financial (in)stability

Just in time: Federal Reserve Releases its May 2022 Financial “Stability” Report

Speaking of (in)stability: The Last of Lehman Brothers

Junk bonds are showing signs of liquidity strains

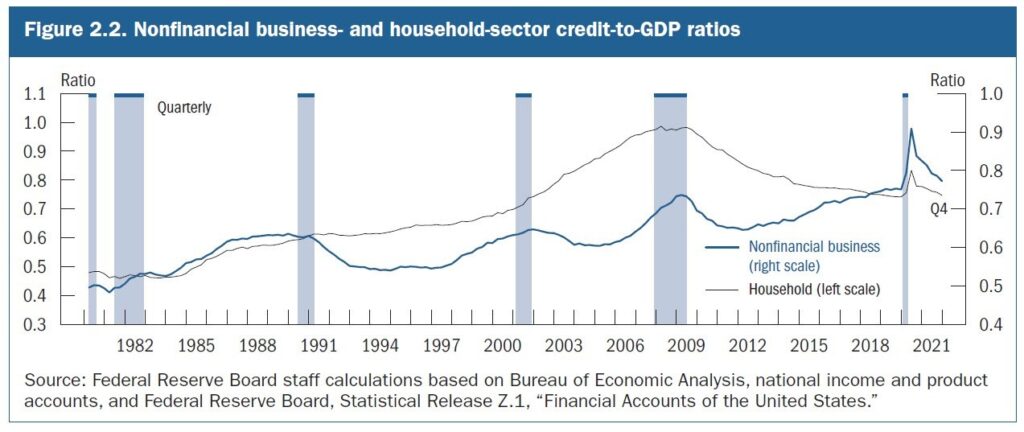

Corporate Leverage at 20-year highs

Household Leverage at 20-year lows

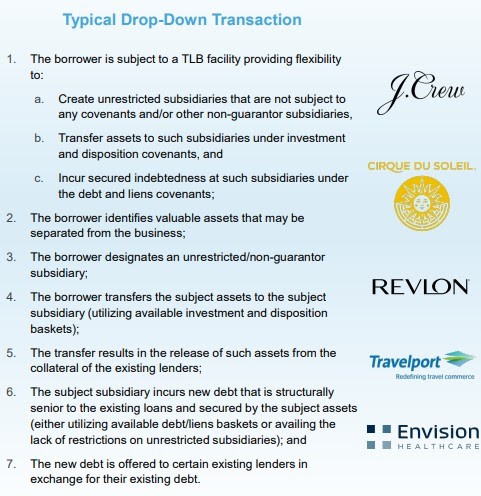

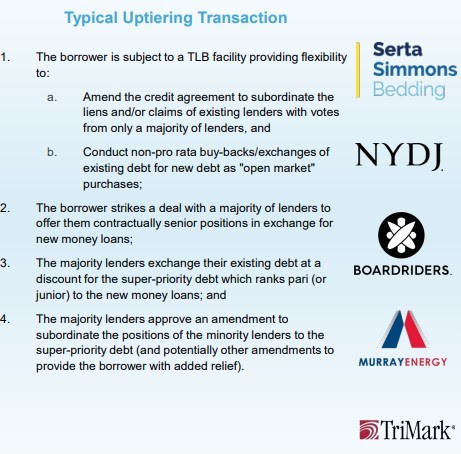

Creditor-on-Creditor Violence

(Teaser for our upcoming symposium)

Thank to our friends at Clifford Chance for providing such great slides here

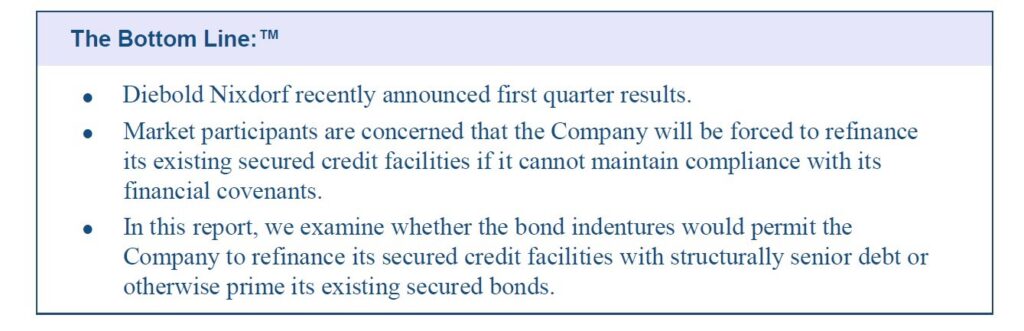

More priming in the works?

Tackling Sovereign Debt

Cleary Gottlieb’s look at transparency in the sovereign debt markets

New York State Senate Bill to allow sovereigns to restructure debt under state law

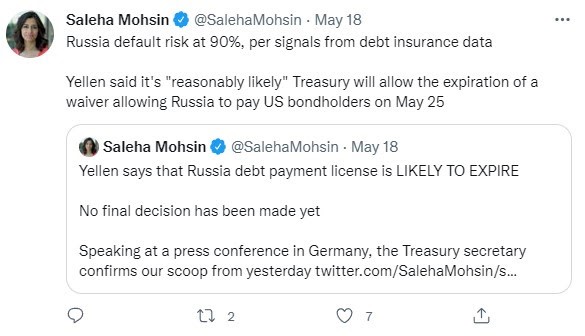

Russian Default Risk at 90%!

SCOTUS in the news…

SCOTUS takes up another bankruptcy case

Kick-Butt Restructuring Review

Clifford Chance Restructuring Review is worth a view

“The best we can hope for is a tougher look at the independence of independent directors in bankruptcy cases”

We hope you’re right!

Upcoming Events

June 10: American Bankruptcy Institute New York City Bankruptcy Conference

June 15: Secured Finance Network Women in Secured Finance Conference 2022

June 21: Creditor Coalition & LSTA: Intra-Creditor Class Warfare Symposium

June 26-28: INSOL London 2022

September 6-7: International Insolvency Institute Annual Conference

September 22: LSTA Annual Conference

Send us your next event or

Check out upcoming events