Creditor Corner |

for the week ended March May 17, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

2024 Restructuring Symposium Reserve Your Spot Before Registration Closes! Over 325 registered already! Register Here

BREAKING NEWS Red Lobster on the chopping block, Judge Isgur stepping down, ConvergeOne exclusive opportunism, Diamond Sports behind in the count, cracks in private credit, and much, much more…

FEATURED CONTENT Bruce Richards on the Markets: Stay Bullish, My Friends |

Scroll through to read all of our content |

|

|

|

Tweet of the Week |

the golden age of credit… |

|

|

|

|

|

|

|

Click Above to Access Content One time registration required |

|

|

|

Exclusive Content |

changing of the guard… |

|

|

|

Click Above to Access Content |

|

|

|

Exclusive Content |

“standing in front of the confirmation express train” |

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

Our take: It is not “bad policy” to subject exclusive investment opportunities to a market test… it is much worse policy to allow subsets of lenders to siphon value from other lenders, see below: |

|

|

|

In the News |

exclusive opportunism hits recoveries… |

|

|

|

Key Quote: “For companies exiting bankruptcy so far in 2024, first-lien recoveries have been roughly 50%, he said, compared with an average of 74% in 2021 and 2022.” |

|

|

|

In the News |

cracks in private credit… |

|

|

|

Our take: Are we seeing cracks in the private credit universe?? Are private lenders struggling to source product?? |

|

|

|

Exclusive Content |

behind in the count in the 9th inning… will they make it?? |

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

|

|

Podcast of the Week |

|

Armen Panossian co-CEO of Oaktree & Josh Clarkson of Prosek |

| Listen Here |

|

|

|

|

|

Exclusive Content |

Private Credit Primer |

|

|

|

|

Click Above to Access Content |

|

|

|

Exclusive Content |

Next major default interest case… |

|

|

|

|

Click Above to Access Content |

|

|

|

Featured Content |

|

Stay Bullish, My Friends

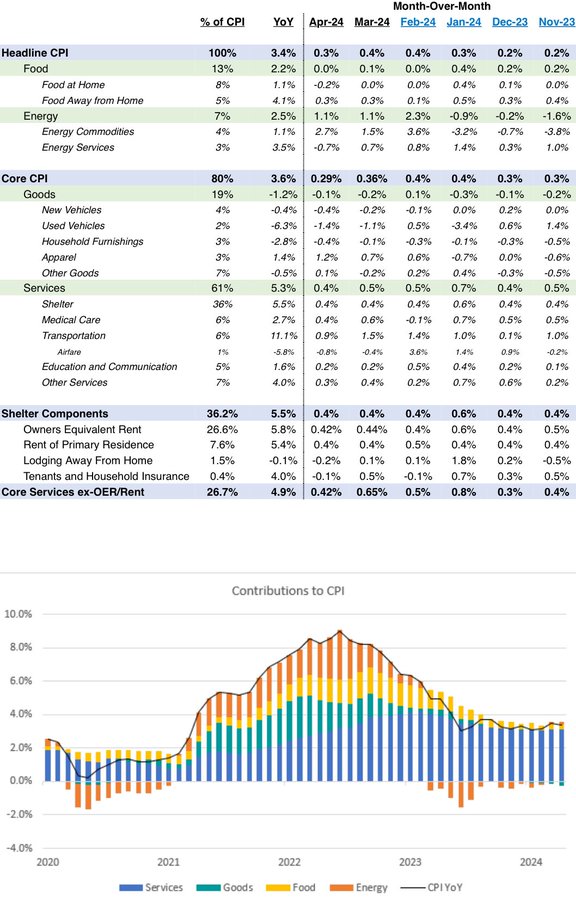

CPI gave the market exactly what it needed, in line with expectations after 3 months of worsening above line #’s. CPI YoY results for headline/core are 3.4%/3.6%, respectively.

Core goods continues to be disinflationary, led by a significant drop in the price for used vehicles.

Services inflation is at a slower pace than the last three months, including OER which is continuing to slowly subside. Although there are signs that the pace of inflation may be abating, the 3-month annualized pace of core services ex-OER/rent is still 6.3%.

The 3-month annualized pace of Core CPI is also still far above Fed target at 4.1%, so we would need to see continued disinflation for a sustained period to get back down towards 2%.

When the Fed does begin to cut its Funds rate, they will go slowly, and then hold for a longer period than markets expect, before taking their next baby step. Expect a higher R* in the future v. what we observed over the past decade. Net-net, number is bullish, yet the Fed will stay Higher for Longer. It’s Goldilocks for Credit.

|

|

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

Data Download |

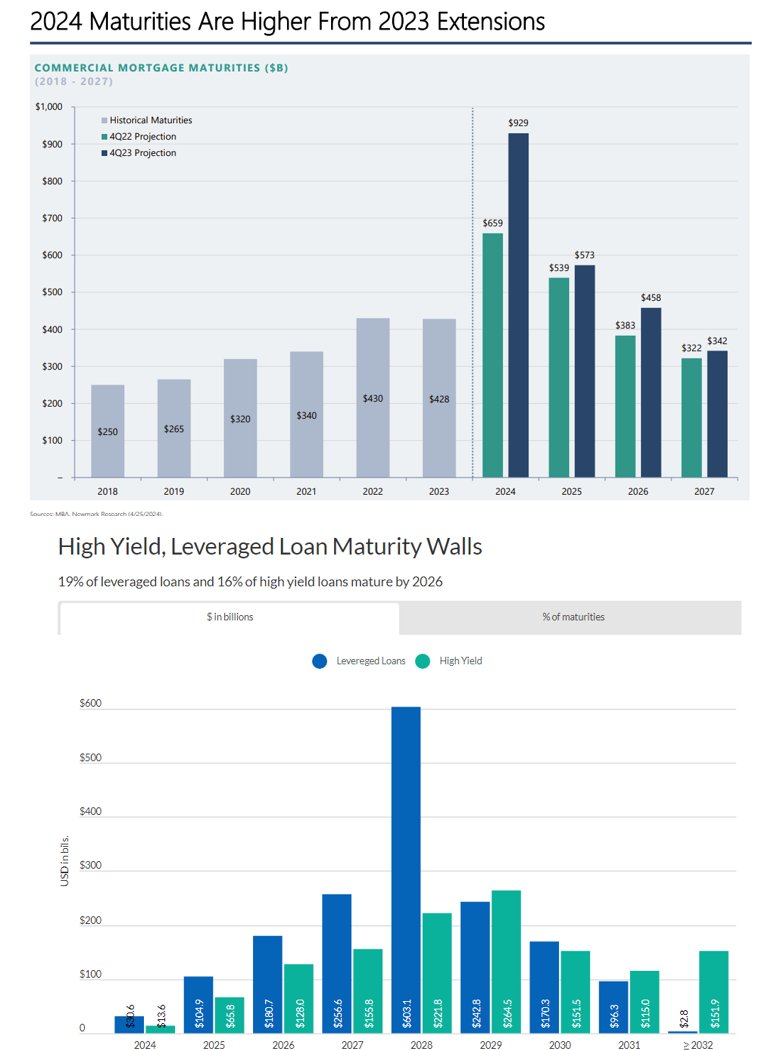

CRE Maturity Wall versus HY Maturity Wall |

|

|

|

|

|

2024 Restructuring Symposium |

Registration Filling Up Fast Over 325 Registered To Date

|

|

|

|

|

|

NYU Stern Bankruptcy Workshop |

Over 30 Registered To Date Register Now! Space is Limited |

|

|

|

An unprecedented opportunity for young legal & finance professionals to learn in-depth fundamental credit and legal analysis through seminar and case-study format over intensive 3-day format.

Network with participants from Citadel, Oak Tree, Houlihan Lokey, Franklin Mutual, among others.

Taught at NYU Stern from August 5 to 7, 2024.

Participants will receive Certificate of Completion from NYU Stern and in-depth reference materials for their future careers. Participants already include leading asset managers and law firms.

Workshop program here.

Expert Faculty: Edward Altman, Dan Kamensky, Donald Bernstein, Ronen Bojmel, Saul Burian, Judge Robert Drain (ret.), Christian Fischer, Michael Friedman, Max Frumes, Michael Gatto, Larry Halperin, Mo Meghji, Andy Rosenberg, David Smith, Robert Stark, Nick Weber, Jay Weinberger with featured speakers: Lisa Donahue, Holly Etlin, Lauren Krueger & Jared Parker

Registration fees apply |

| Register Here |

|

|

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|