Creditor Corner |

|

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,800 member subscribers and growing! Sign Up Here |

|

|

BREAKING NEWS Over 350 Registered for our Upcoming 2025 Credit Symposium! Last Chance to Register!

The Master Class in LMEs, and more LMEs, Bausch options analyzed, Trump tariffs, private credit meets the open market purchase, and much, much more….

FEATURED CONTENT

Bruce Richards on the Markets Atlanta Fed GPN Now |

Scroll through to read all of ou?r content? |

|

|

|

Tweet of the Week |

I wanna sit at the cool kids table! |

|

|

|

|

|

|

|

Exclusive Featured Content

|

the Master Class in Analyzing on LMEs |

|

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content

|

a kinder, gentler LME… |

|

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content

|

The Double Dip becomes the Chapter 22 LME… |

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content

|

analyzing the Bausch proposals…. |

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content

|

These are gonna be the best tariffs ever! |

|

|

Click Above to Access Content One time registration required |

|

|

|

|

|

In the newsRegional sports network woes…. |

|

|

|

|

|

|

|

In the newsprivate credit meets the open market purchase! |

|

|

|

|

|

|

|

|

Exclusive Content

|

more retail pain…. |

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Featured Content |

|

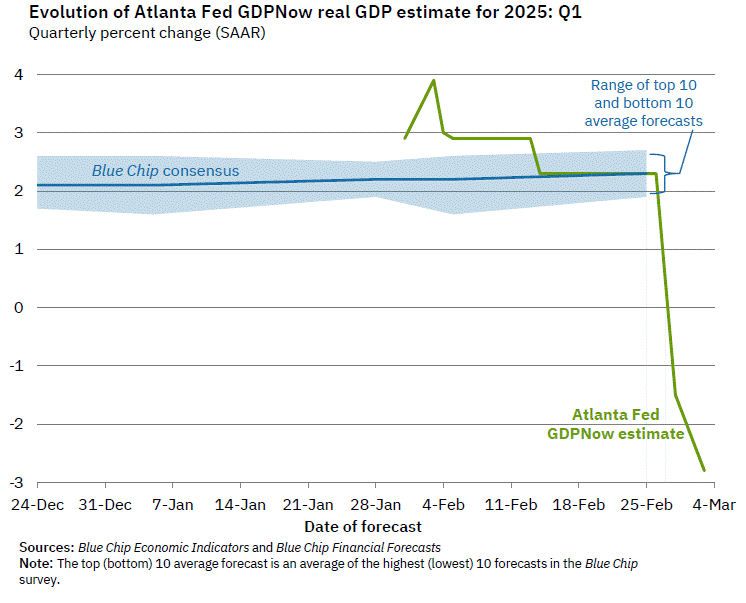

Atlanta Fed GDPNow Q1 Live Update: The Federal Reserve GDPNow just revised to -2.8% in Q1, a further revision downward in their forecast model from -1.5% reported on Friday (one business day ago). Just 1 week, the Fed forecasted +2.3% growth in Q1 GDP. I do not agree with their model, let’s hope this is not the case. But, if you want to get interest rates lower, this will do it

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

|

In the newsThe Golden Age of Credit |

|

|

Click Above to Access Content |

|

|

|

|

|

Data DownloadGrowth scares…. |

|

Click Above to Access Content |

|

|

|

|

2025 Credit Opportunities Symposium |

March 14, 2025 |

| Learn More |

|

Grants: Opportunity in Distress |

April 29, 2025 |

| Learn More |

|

|

|

The Data Download |

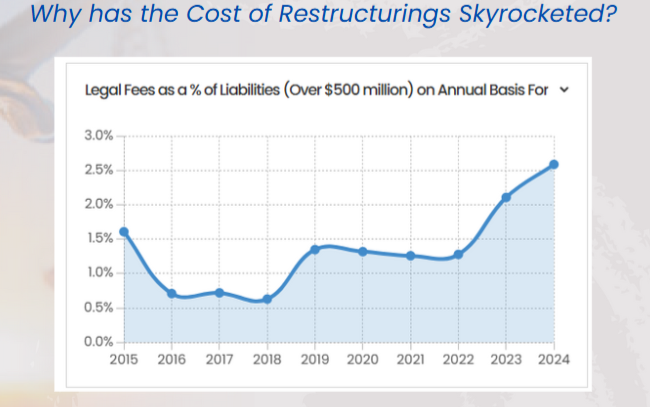

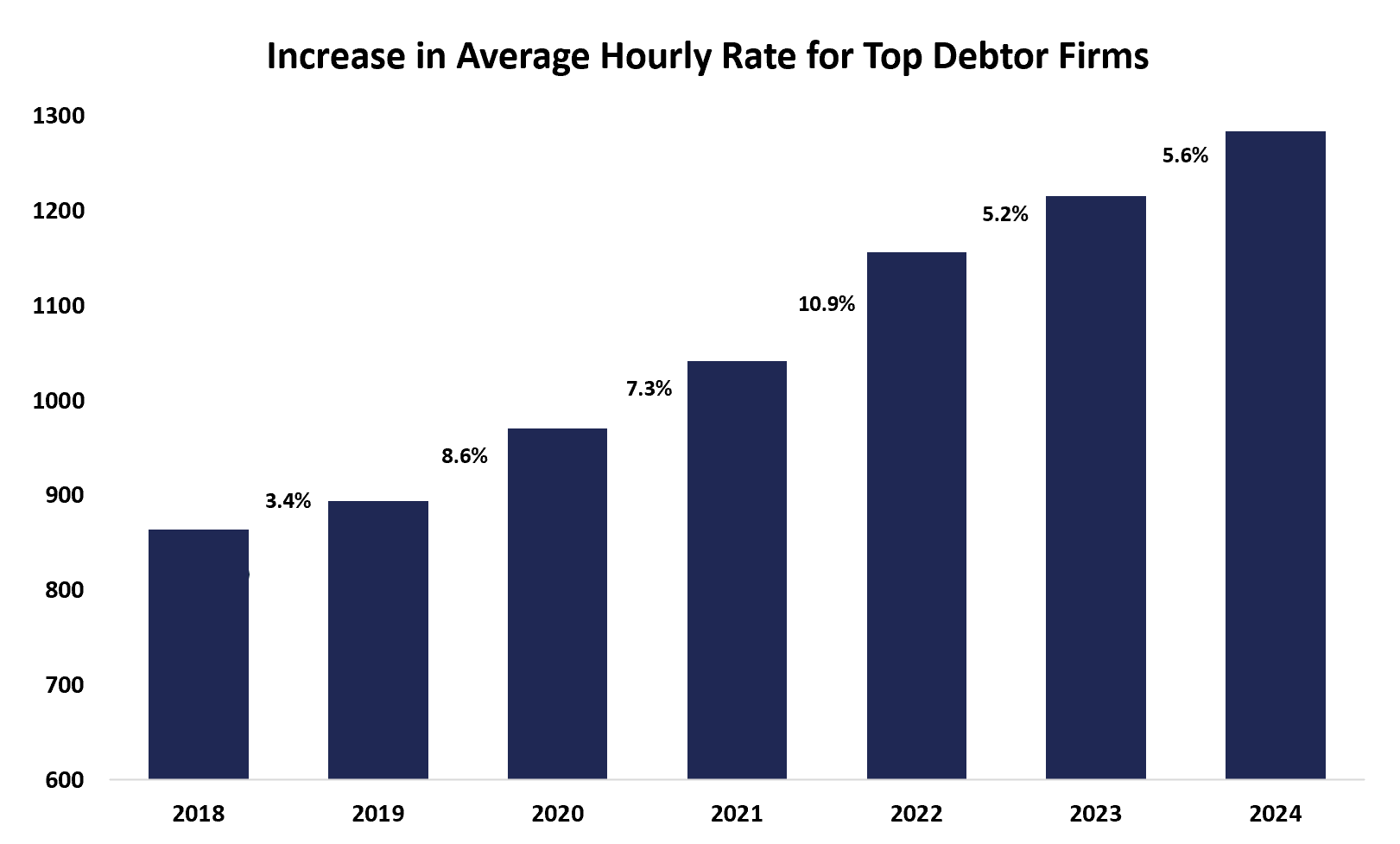

Bringing Transparency to the Bankruptcy Process |

|

|

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. We took a deep dive to see what is driving up the daily cost of restructurings and the culprit: Increasing Legal Hourly Rates. We analyzed final fee apps for top debtor law firms from 2018 to 2024 and found average hourly legal fees have increased by over 65% since 2018. Maybe a little bit of sunlight is the right disinfectant to help remedy the problem…. |

|

|

|

|

|

Meet Our 2025 Contributors |

|

|

|

|

|

|

|

Thank You to Our 2025 Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|