Sovereign debt bill KO’d, pro rata deals at work in Sinclair and Sonrava, Spirit “denies” BK rumors, RAD CEO bonus in cross-hairs, FTX mystery suit, and much, much more… ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Creditor Corner |

for the week ended March June 7, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

2024 Restructuring Symposium Nearly 450 registered already! A must-attend event Network, Learn & More! Register Here

BREAKING NEWS Sovereign debt bill KO’d, pro rata deals at work in Sinclair and Sonrava, Spirit “denies” BK rumors, Fees under pressure (finally!), FTX mystery suit, and much, much more…

FEATURED CONTENT Bruce Richards on the Markets: Broken, Yet Strong as a Rock

|

Scroll through to read all of our content |

|

|

|

Tweets of the Week |

deja vu… |

|

|

|

|

|

Exclusive Content |

Diamond Hands hits Sinclair |

|

|

|

|

Click Above to Access Content |

Our take: While we are always dubious of Chatham (just read the Caesars Palace Coup) we like what we hear when stakeholders call for a fair process… |

|

|

|

|

|

Click Above to Access Content |

|

|

|

|

|

Click Above to Access Content One-time registration required |

|

|

|

In the News |

Fees under pressure (finally!) |

|

|

|

|

|

Exclusive Content |

Right out of an episode of the x-files |

|

|

|

Click Above to Access Content |

|

|

|

In the News |

that was quick… |

|

|

|

|

Exclusive Content |

more cracks… |

|

|

|

|

Click Above to Access Content |

|

|

|

Featured Content |

|

Broken, yet strong as a rock

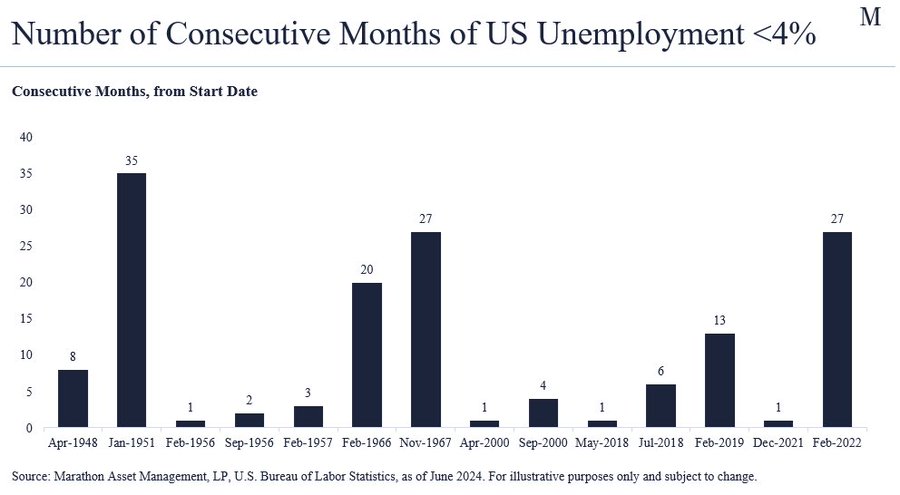

The longest Jobs employment winning streak since 1951 of 27 straight months of unemployment below 4% has finally been broken.

The employment picture remains rock solid with this month’s payroll gain of 272K. Strength in employment is a big contributor to equity market performance, EPS beating expectations, supporting consumer spending and companies both small and large adding to headcount.

The broken streak of 27 straight months under 4% stems from a census adjustment based on new data that revises down prior reports by approximately 80k per month from what was previously reported. The magnitude of revisions sheds light on the lack of handle that the government has on accurately reporting this information in real-time as the complexity of labor accounting has never been harder with the influx of immigration across our southern border.

Despite the revision, the macro picture as it relates to employment remains unchanged as gains are robust accompanied with strong wage growth. It is essential to remember that we’ve never seen a recession when adding jobs to the economy.

Wage inflation has not softened – rising .40% month over month equating to a 4.8% annualized rise, supporting spending and nominal GDP growth.

It is higher for longer given the strength of both the labor markets, the broader economy and corporate earnings.

|

|

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

What We’re Reading |

ISDA asks for feedback on key issues affecting CDS market confidence |

|

|

|

|

|

| Find the Memo Here |

| Find the ISDA Report Here |

Our Take: The CDS market sits in a precarious position between dealers and buysiders trying to maintain its legitimacy and independence while at the same time acknowledging someone’s ox is going to get gored. We applaud ISDA’s efforts but the proof will be in the pudding to ensure the decision-making process for credit events is a truly independent process. |

|

|

|

2024 Restructuring Symposium |

|

|

|

|

|

|

|

III: Annual Conference |

June 10-11, 2024 |

| Learn More |

|

Norton Rose Fulbright: Litigation Funding |

June 12, 2024 |

| Learn More |

|

|

|

INSOL: Singapore Meeting |

August 27, 2024 |

| Learn More |

|

NCBJ: Annual Meeting |

September 18-20, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Special Feature |

|

|

|

|

Special Feature |

|

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|