Weekly News – December 22

2024 Sponsorships Now Available

Please Consider Sponsoring CRC’s Content

Click Here

Restructuring pros get ready!

FTX US/Bahamas settlement

Trade rumors

The end of an era…

Our take:

Is the rise of private debt taking its toll on sell-side desks?

Or, is this just a sign of Citi’s dysfunction?

Tell us what you think here

Quote of the Week

Exclusive Content

Uptier Chapter 22

Find it exclusively here on CreditSights

Our take:Â

2nd uptier in 6-months on its way to the next BK… when will distressed borrowers learn that LMEs are a road to nowhere?

Tell us what you think here

Exclusive Content

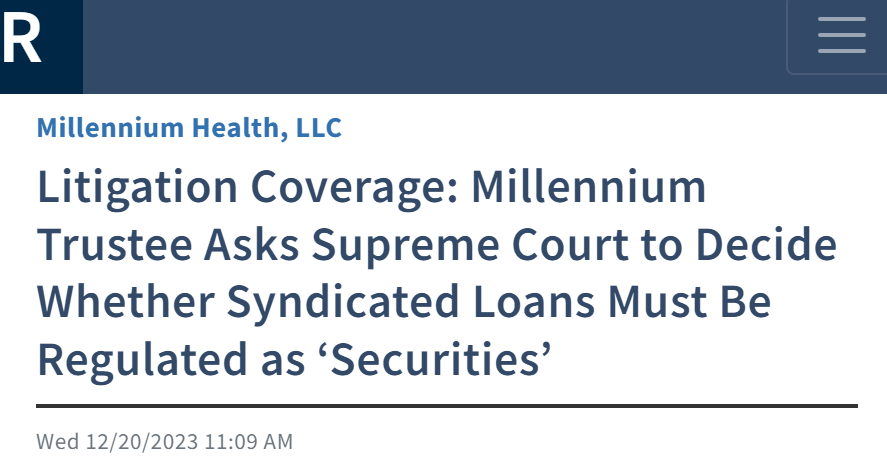

SCOTUS hot potato

Get the Cert petition here ====>

Featured Content

Bruce Richards on the Markets

Bruce Richards, CEO

Marathon Asset Management

insights on markets, investing and more!

My Top 10 Risk Factors for 2024:

1. It’s the Economy: Recession or Stagflation Risk

2. Politics: Geopolitics & Elections

3. The Fed: market will not respond well if Fed does not cut rates in 2024

4. Liquidity Crisis: if Financial Conditions become significantly tighter

5. Escalation in War: Ukraine/Russia & Israel/Hamas

6. Default Rates surge: Commercial Real Estate and highly leveraged U.S. companies

7. 10-year UST rate increases +100 bp

8. China: Property market collapse, banking crisis, deflation w/recession; flashpoint with Tiawan

9. New Basel -3 regulatory requirements imposed on U.S. Banks necessitates more conservative lending

10. Corporate Earnings decline 10% for S&P500

Risk factors with the potential to negatively impact financial markets, liquidity, volatility, portfolio construction, and investment performance require deep and thoughtful analysis.

Let’s also recognize that there’s a significant opportunity cost for those unwilling to taking measured risk.

Cash returns are lagging this calendar year and similarly I do not expect cash to be a top performing asset class in 2024 despite cash generating its best return in a generation.

There is record cash sitting on the sidelines waiting to be deployed (~$7 trillion). 2024 will provide considerable risks, but I believe 2024 will provide amazing opportunity for savvy investors.

I am super excited to invest in 2024, but always approach investing with eyes wide open.

It’s the Golden Era for Credit!

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets

Featured Content

Our Contributors take on DQ provisions

We take on Disqualified Lender provisions. We were shocked by what we learned, Not only are distressed investors targeted but usually weeks if not months after a trade occurs. Serta, Packers and Bijyu’s are the latest examples of a troubling trend.

Read what Contributors Paul Silverstein, Justin Forlenza, Sid Levinson and Jim Millar have to say about this topic.

Some excerpts below:

Aggressive sponsors want the option to disqualify distressed investors from owning their portfolio company’s loans.

a fundamental practical problem lies in the lack of transparency as to who is disqualified from owning a loan because DQ Lists are generally not available at time of trade notwithstanding that many credit agreements provide for the lists to be made available to lenders.

But buyer consent is not obtained until closing, which can be many weeks or even months after the date the trade actually occurred. If the loan buyer is on the DQ List, the borrower can then reject the trade well after-the-fact.

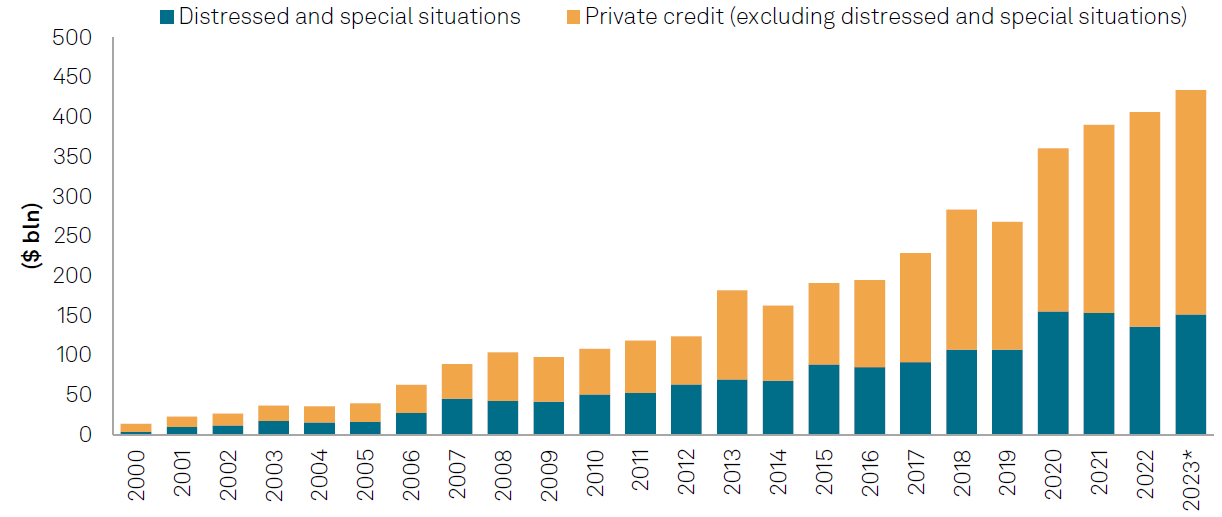

Golden Age of Private Credit

Our take:

Private Credit is rehaping every aspect of the traditional relationship between bank and borrower. We are going back to relationship lending with alternative asset managers replacing banks. Repercussions for secondary market trading and behavior just beginning to be felt.

The trend to watch for 2024!

Credit enjoys the “Powell Pivot”

Source: Bloomberg

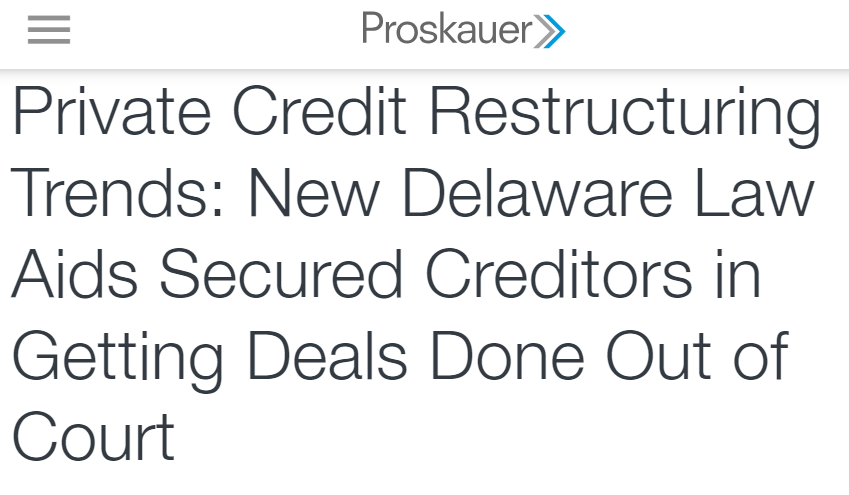

What we’re reading…

Meet our 2023 Sponsors

The CRC is funded through sponsorships from these organizations:

Featured Content

Contributors Speak Up:

Venue Reform in the Spotlight

click here to read the features from our Contributors analyzing Venue Reform

Featured Content

Special Feature: SCOTUS takes on Purdue

click here to read the features from our Contributor analyzing what happened @SCOTUS

CRC weighs in on Serta

Special Feature:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

January 10: Fitch Solutions: Credit Outlook North America

January 17: Arnold & Porter: Exploring Bank Liquidity Requirements

February 13: City Bar Bankruptcy Committee & ACFA: Hot Topics in Bankruptcy