Weekly News – August 4

UST 10-yr climbs

Threatening equity rally…

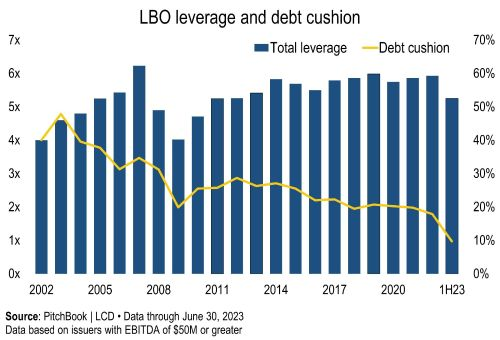

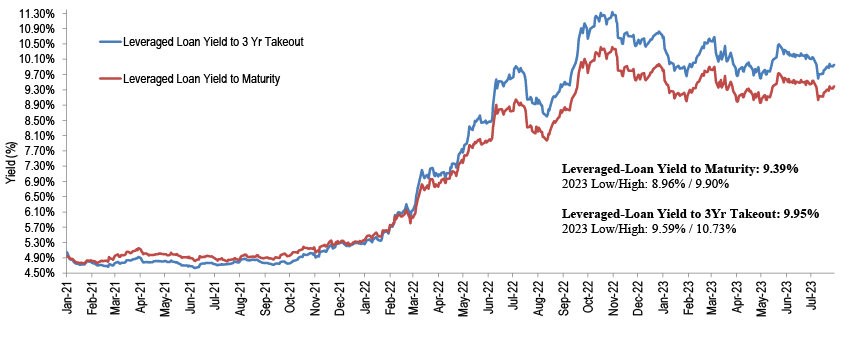

Hurting borrowers…

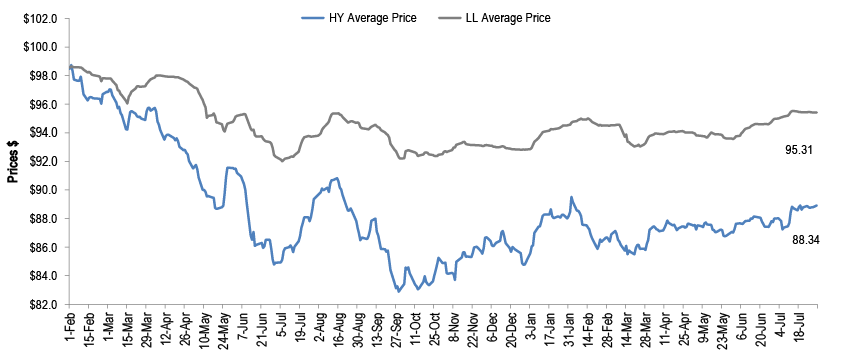

But opportunity lurks…

Renal Care: the latest uptier/downtier

Brought to you by our friends @Petition

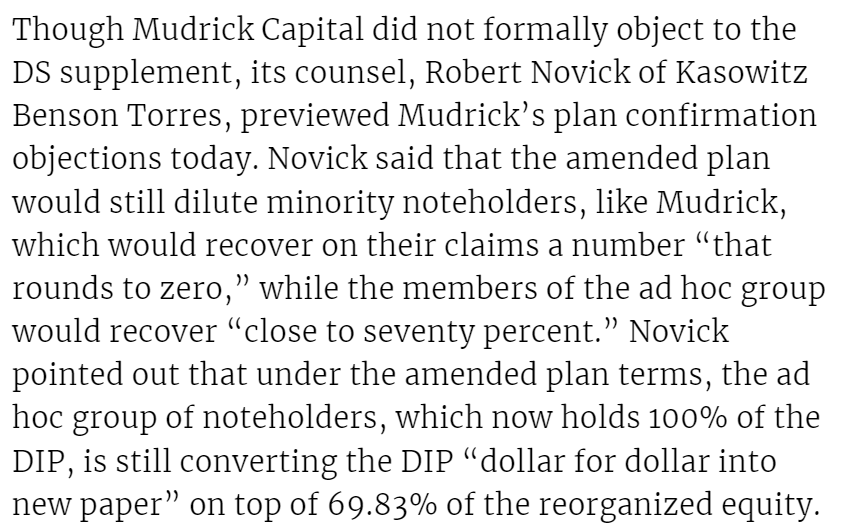

Mudrick previews plan objections

Exclusive Content

Our take

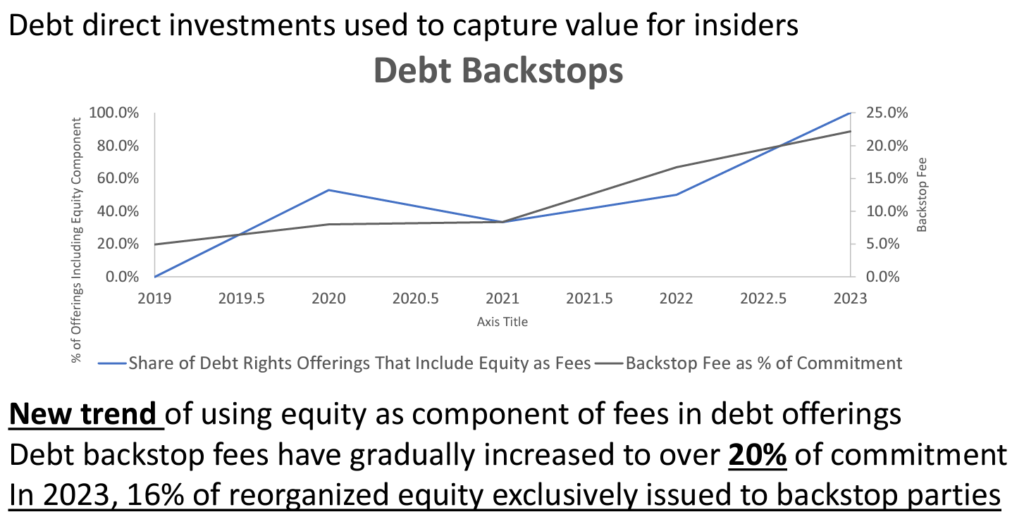

The trend of equitizing DIPs at indeterminate valuations and discounts to plan value is highly troubling when it comes at the expense of fulcrum claims. This is another trend in the expanding toolkit of Exclusive Opportunism. Academics are taking notice, and we look forward to read Prof. Robert Miller’s article on Loan-to-Own 2.0 coming out soon.

As we noted at our recent conference:

FTX 2.0 coming to theaters soon

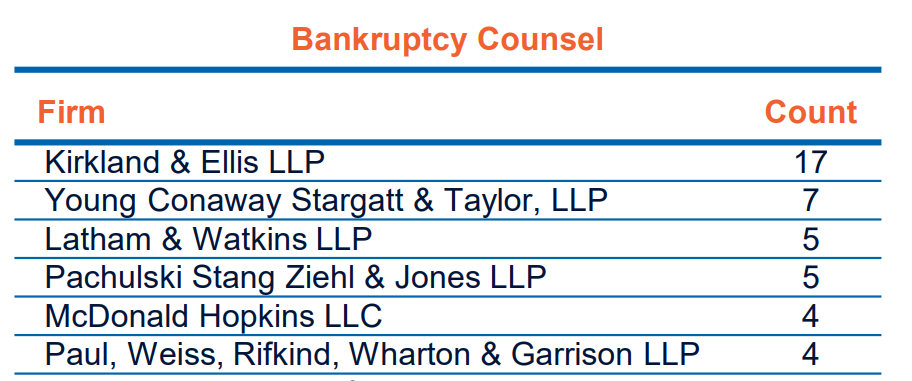

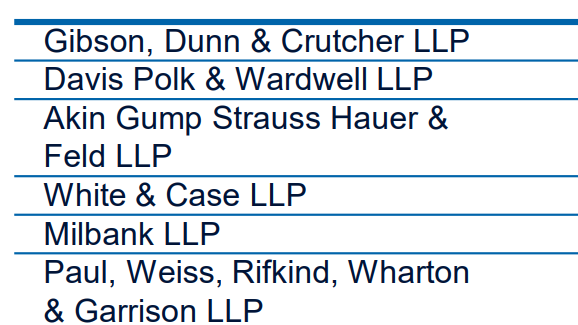

League Tables Out!

Gibson Dunn takes suprising lead in ad hocs

Purdue SCOTUS appeal heats up

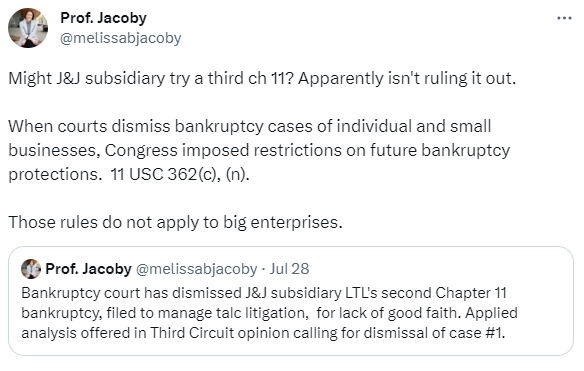

3rd time a charm??

What we’re listening to…

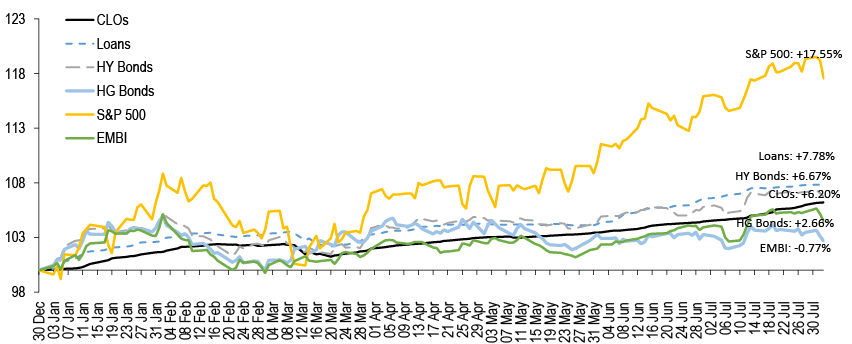

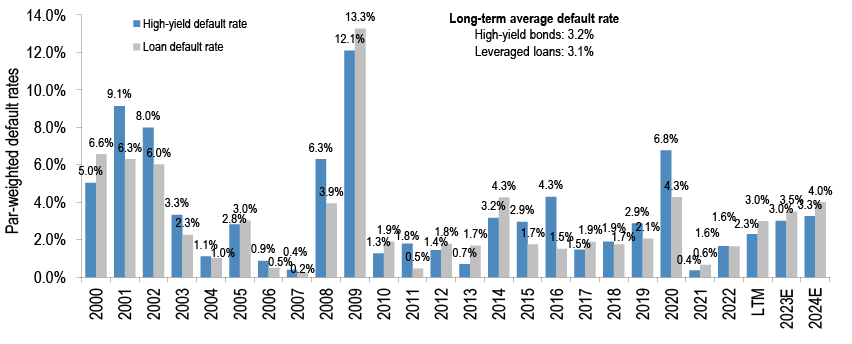

High yield in charts

2023 CRC Allocators Conference

CRC weighs in on Serta

Contributors Speak Up

What to expect in the next default cycle

We asked Contributors Bradford Sandler and Sidney Levinson to weigh in on what we should expect in the next default cycle.

Professor Edward Altman recently noted in a paper published with the Creditor Rights Coalition that the Benign Credit Cycle is over. He sees a reversion to the mean in terms of defaults and recoveries in 2023. But he also sees many risks on the horizon making a Stress or even in a “hard-landing†scenario a possibility (with 8-10% default rates). Put your prediction caps on. What do you see and expect? Where do you expect restructuring activity to increase? Are we in for more bankruptcies? Or, more (yawn yawn) extend and pretend? Will RSAs rule the day? Or, will we see more traditional in-court restructurings? What will this new environment look like?

Read our recent coverage:

Where Are We In The Credit Cycle?

Read our recent coverage:

Third party releases

click through to read the features from our Contributors

Look out for more great features from our Contributors

Look Out for our New Feature

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

August 22: ABI/NCBJ: Tackling Emerging and Recurring Mortgage Issues in Individual Bankruptcy Cases

September 29: ABI: Views from the Bench