Creditor Corner |

Labor Day Edition |

for the week ended August 30, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,600 member subscribers and growing! Sign Up Here |

|

|

CRC Roundtable Discussiononly a few spots remaining! September 10, 2024 |

BREAKING NEWS

Testing Double-dips, Big Lots & Azul hit the skids, big winners in Lumen, net short lender provisions on the rise and much, much more…

FEATURED CONTENT

Bruce Richards on the Markets: Bringing out the Big Guns

|

Scroll through to read all of our content |

|

|

|

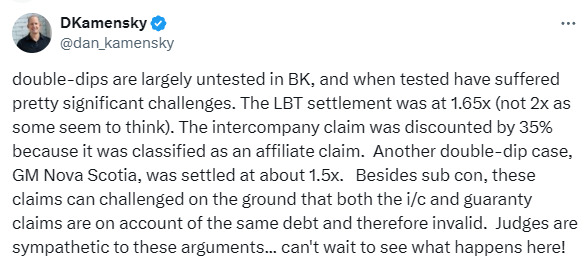

Tweet of the Week |

It’s Labor Day Weekend! |

|

|

|

|

|

Exclusive Content |

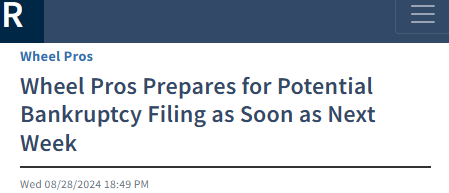

Breaking News! Get set to test Double-Dips! |

|

|

The Original Double-Dip Transaction (graphic below) Sub-con anyone? |

|

|

|

Click Above to Access Content additional registration required |

|

|

|

Exclusive Content

|

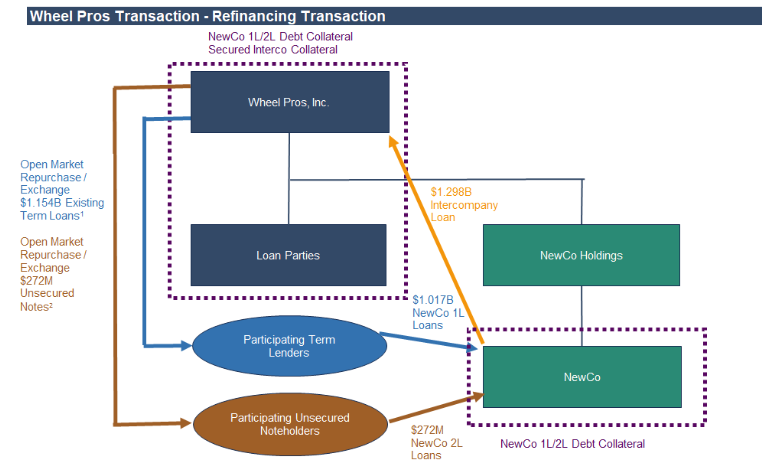

Another retailer hitting the skids… |

|

|

|

|

Click Above to Access Content one-time registration required |

|

|

|

In the news

|

big winners in Lumen |

|

Click Above to Access Content additional registration required |

|

|

|

Exclusive Content

|

Another Brazilian airline hitting the skids… |

|

|

|

|

Click Above to Access Content one-time registration required |

|

|

|

Featured Event |

September 10, 2024Limited Capacity Registration Now Open |

|

|

|

Join the Creditor Rights Coalition and Cooley for a Roundtable Discussion on:

LMEs Revisited: Incora & Robertshaw and their aftermath Emerging retention and independent director issues The Day After: Third-Party releases and Purdue Pharma This event is off the record and Chatham House rules apply to encourage a robust discussion among participants. |

| Register Here |

|

|

|

Exclusive Content |

CCP crying over spilt milk?? |

|

|

|

Click Above to Access Content free access to subscribers |

Our take: It is somewhat comical to see CCP on the sponsor-side of some of the most aggressive LMEs yet complain when they miss the boat in Lions Gate… |

|

|

|

In the news

|

you can’t handle the truth! |

|

|

Click Above to Access Content access free to subscribers |

|

|

|

|

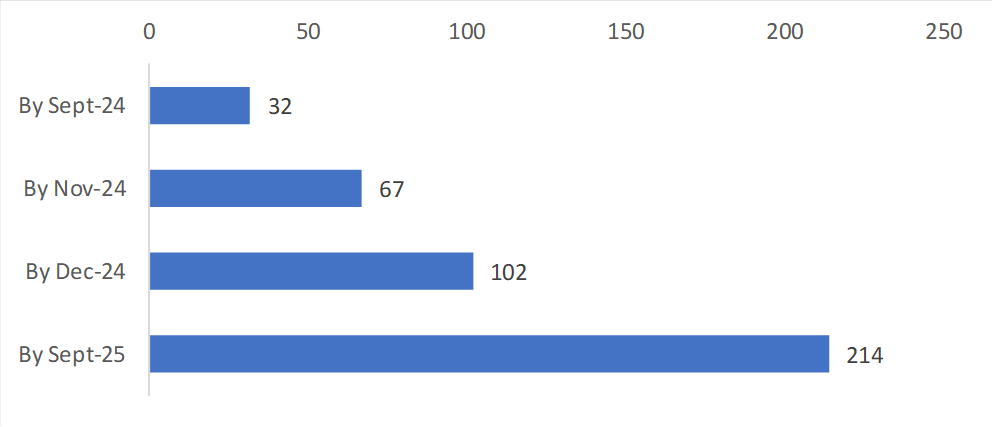

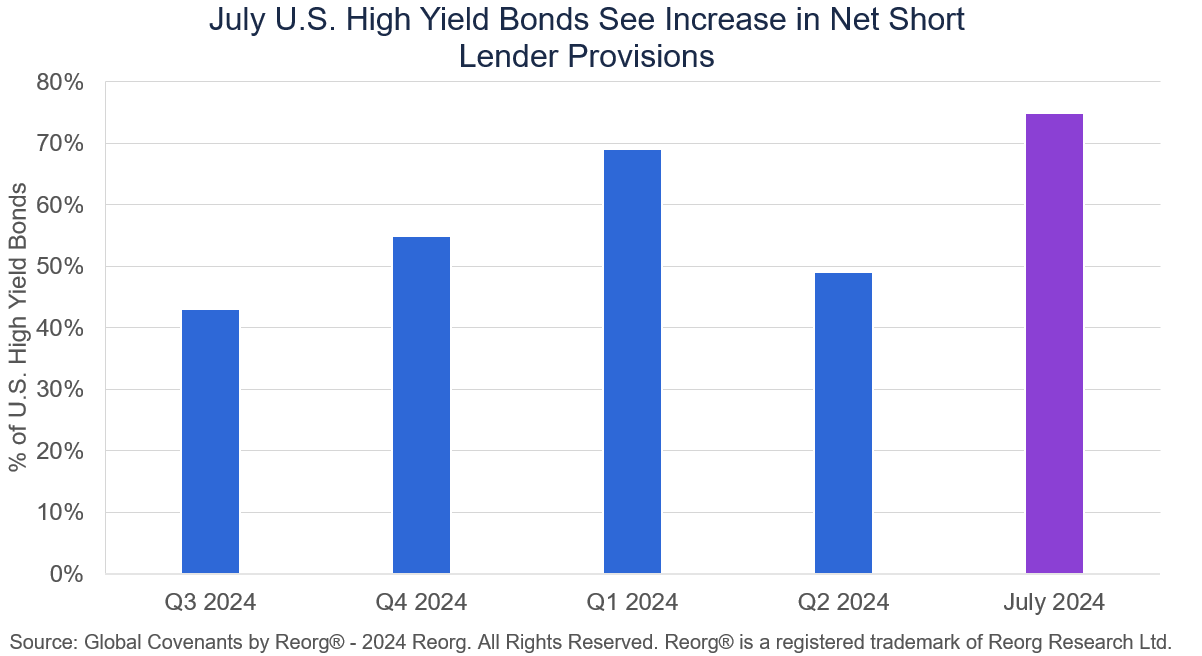

Data Download |

Goldilocks again! |

Market-implied rate cuts (bps) |

|

Source: Bloomberg; as of August 23, 2024; JFL Credit Roundup |

Click Above to view Chart |

|

|

|

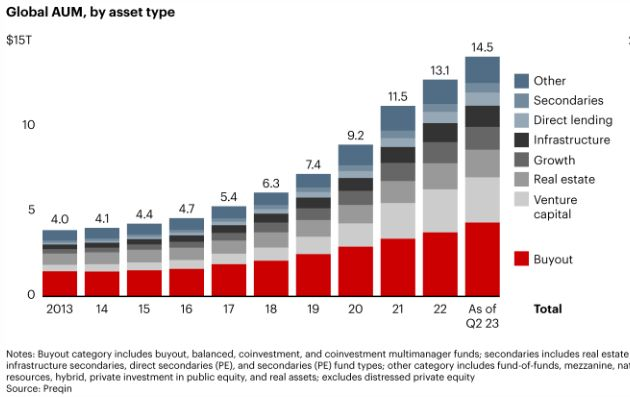

Featured Content |

|

Bringing out the Big Guns

The Fed is about to enter an easing cycle that will prove supportive for Private Equity. While PE sponsors do not hibernate like bears in the winter, sponsors have been quiet from an acquisition/exit standpoint since the past two years have proven difficult given equity valuations and higher financing costs (SOFR rose +525bps). Ditto for perspective homeowners who have bemoaned the fact that home prices/mortgage rates/operating costs make ownership less attainable. But relief is coming. Looking forward, I expect SOFR to gradually decline by 200bps in the next two years as the Fed eases and inflation normalizes. Other considerations will come into focus for LBO sponsors: 1) potential for higher corporate tax rates, 2) changes in supply chain cost structure derived from nearshoring and tariffs, 3) slower economic growth, 4) regulatory scrutiny from FTC and EU that impacts (e.g. technology, healthcare) and 4) valuations have risen to all-time highs. Despite this, PE is sitting on $1.2T of undrawn capital globally. $1.2T of dry equity powder with lower future financing rates as lenders are willing to provide a dollar of debt for every dollar of equity.

During the past two years, PE has focused on value creation with add-on acquisitions, revenue growth, improving operating metrics, technology investment, CapEx, streamlining costs, improving margins all to minimize/offset higher interest charge. By and large, PE has performed admirably despite the higher interest rate regime, and slower deployment/exits. Going forward, I expect greater exits plus dividend recaps to return capital to LPs. The average LBO PE-multiple is 12x EBITDA with stapled financing of 6x debt-to-EBITDA.

LBOs on the rise, the lull coming to an end, the big guns are out and ready for hunt. |

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

Exclusive Content |

Trends in Documentation |

|

|

|

|

Click Above to Access Content free access to subscribers |

Our take: Does putting limits on shorting set a dangerous precedent for the market? Read on… |

|

|

|

Exclusive Content

|

Delaware big winner SDNY big loser |

|

|

|

|

Click Above to Access Content one-time registration required |

|

|

|

|

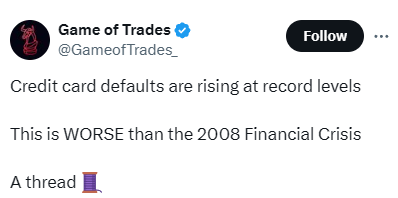

Data Download |

yet… canaries in the coal mine… |

|

|

Click Above to Access Content

|

|

|

|

Featured Event |

|

|

September 10, 2024Limited Capacity Register Now |

Click image above to register now |

|

|

|

|

|

NCBJ: Annual Meeting |

September 18-20, 2024 |

| Learn More |

|

Kramer Levin: The Rise of Cooperation Agreements |

September 18, 2024 |

| Learn More |

|

|

IMN: Distressed CRE Forum |

September 19, 2024 |

| Learn More |

|

ABI: Views from the Bench |

September 24, 2024 |

| Learn More |

|

|

Clifford Chance: Hot Topics in Private Credit and Restructuring |

October 8, 2024 |

| Learn More |

|

GRR: Restructuring in the Americas |

October 15, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Announcing New Data Initiative to Analyze Bankruptcy Costs |

Bringing Transparency to the Bankruptcy Process |

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. Our proprietary analysis supports anecdotal evidence that bankruptcy has gotten more expensive. We will be providing additional analysis in the future to show how other factors affects fees. We hope our database will help make bankruptcy a more efficient forum for all stakeholders. |

|

|

|

Special Feature |

Implications of the Purdue Pharma case |

|

|

|

|

Special Feature |

Recent disqualification decisions and conflicts in BK |

|

|

|

|

Special Feature |

Where we are in the credit cycle |

|

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|