Creditor Corner |

|

|

Special Edition: Year in Review and What to Expect in 2025 |

Over 2,800 member subscribers and growing! Sign Up Here |

|

|

|

|

|

SAVE THE DATE 2025 CRC Annual Credit Opportunities Symposium March 13 & 14, 2025

INTRODUCING OUR 2025 CONTRIBUTORS

SPECIAL FEATURE Why have restructuring costs skyrocketed?

FEATURED CONTENT ?Covenant Review’s Ian Feng on 2024 Cooley’s Daniel Shamah & Evan Lazerowitz on Purdue & Beyond Bruce Richards on the Markets: 2025 Outlook and Reflections on this week Edward Altman’s Default Outlook for 2025 |

Scroll through to read all of ou?r content? |

|

|

|

|

|

It’s that time of year again. We asked our Contributors for their picks and pans for 2024 and what to expect in 2025. 2024 was full of surprises. The restructuring field never ceases to amaze us. From the outcomes in Incora and Robertshaw to Jones-gate, the headlines just kept coming and coming and coming…. Let’s peer into our crystal ball to see what changes we might expect in 2025. Read what our contributors have to say about the shifts, turns and changes to expect during 2025.

|

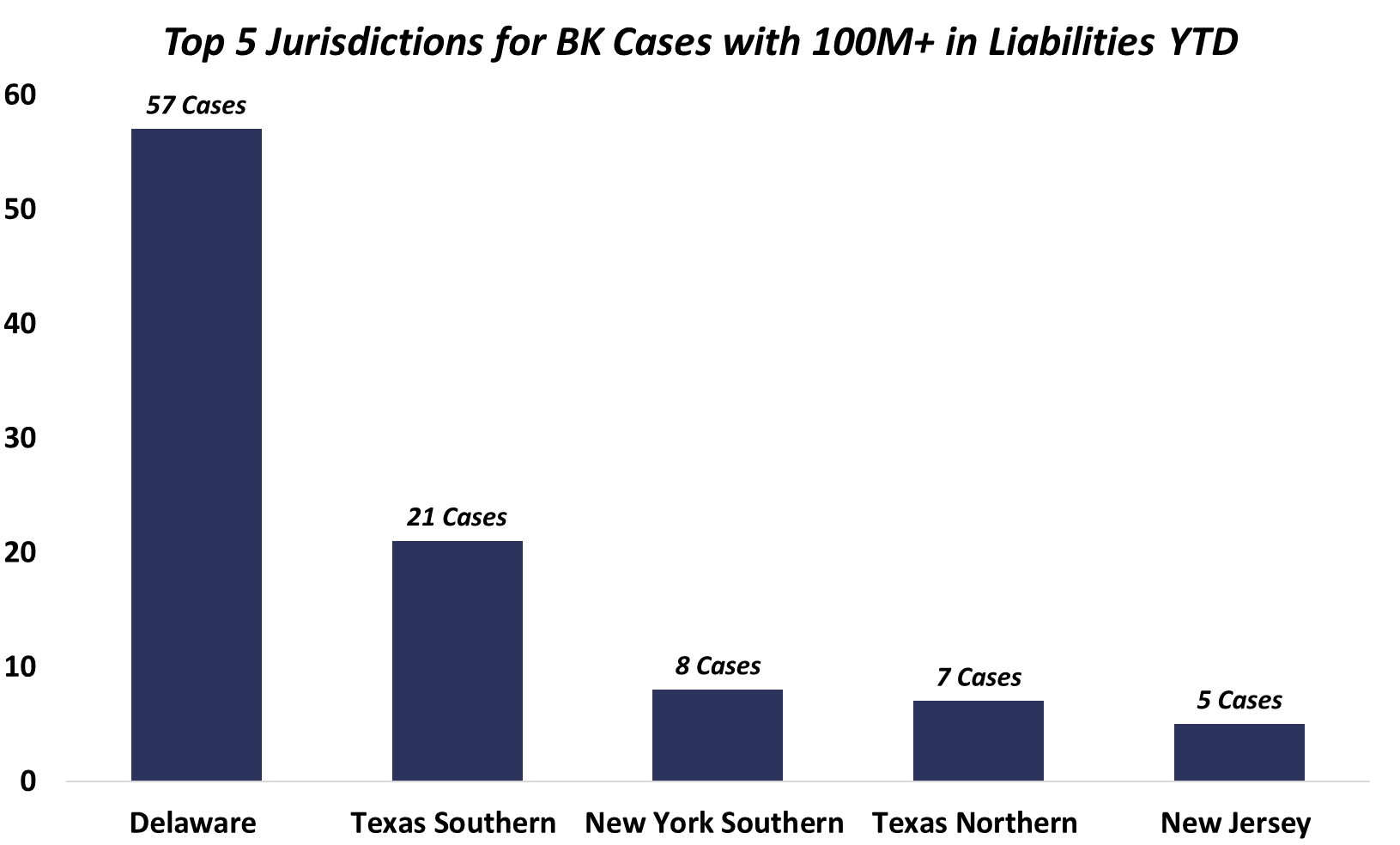

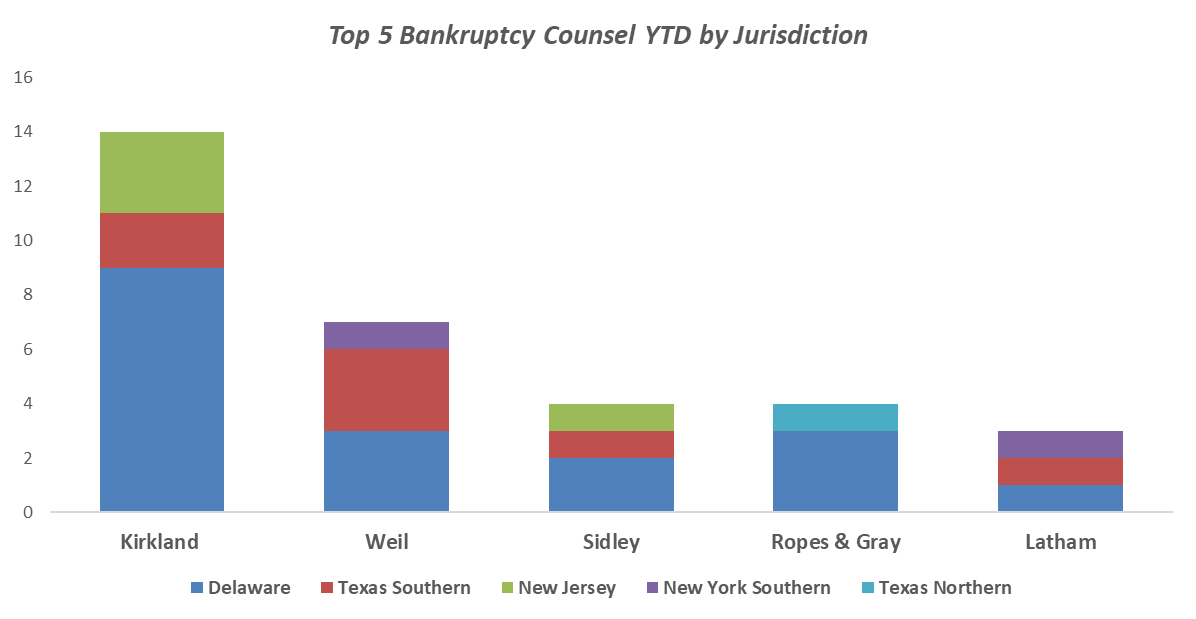

Will Delaware keep its top spot? |

|

|

Rachel Albanese & Daniel Shamah nearly in unison: Delaware. Back to basics.

Kevin Eckhardt. Houston, nowhere else is safe and they clearly want to keep the party going.

Josh Feltman: I don’t see any reason for things to change all that much. New Jersey may correlate with retail, but beyond that…..

Mark Lightner. Southern District of Texas.

Jennifer Selendy: Here’s hoping it’s SDNY.

Paul Silverstein: It is clear that Houston and Delaware will continue be the two principal venues for large complex chapter 11’s in 2025. The fallout over “Jonesgate” seems to be ending and Houston is ultra “predictable” with its complex case assignment rules that either Judge Perez or Lopez will preside (much like a filing in the SDNY’s White Plains division used to be assured of getting former Judge Drain).

Cliff White: How is it possible that the Southern District of Texas will retain or exceed its position as the number 2 bankruptcy filing haven in the United States (behind only Delaware) while the Jones-gate scandal goes unredressed?

|

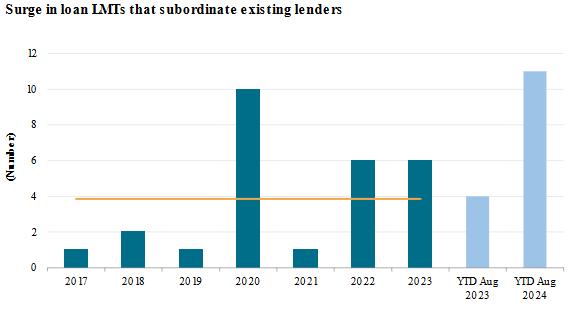

LMEs dominated in 2024. Will the trend continue? |

|

|

LMEs. Covenant Review tracked over 30 transactions year to date that involved LME elements in 2024. In contrast, less than 20 comparable LMEs were tracked in 2023. More and more of these subordinate existing lenders according to S&P. How many do you expect in 2025?

Rachel Albanese: 50? The better question is how many will have a lasting, net positive impact?

Kevin Eckhardt. I expect over 100, because every refinancing/recap transaction now features some element of LME-ness. Unless Serta gets reversed, then there will be zero because truly abusive transactions will feature some new label. Bring back Jones’ “PET.”

Josh Feltman: A lot: euphoric markets will lead sponsors to take advantage and stock acorns for winter; i.e., cash in on loose covenants in pre- (or only modestly) distressed situations by putting cash on the balance sheet, even at the expense of covenant flexibility that could drive discount down the line.

Jennifer Selendy: 30+

Daniel Shamah. 43.2

Paul Silverstein: It’s obviously difficult to put a precise number on LMEs for 2025, but we will likely see as many, if not more, in 2025 than in prior years.

|

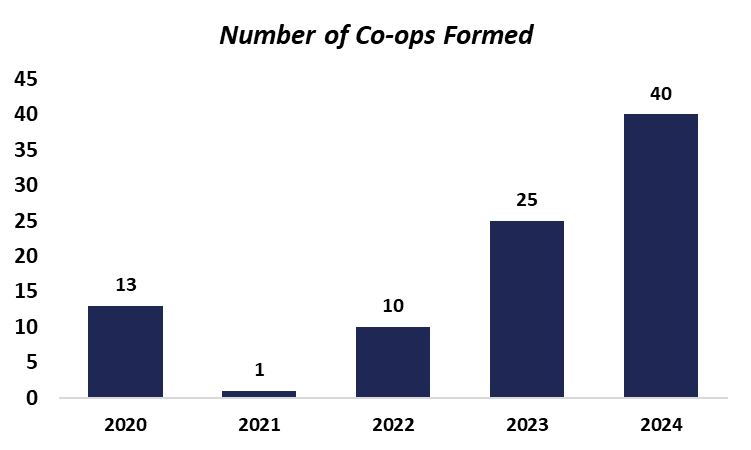

Co-Ops: Good or Bad? |

|

Rachel Albanese. Good if used to maximize value instead of throw bombs.

Kevin Eckhardt. Good, if they get enforced in bankruptcy. The less litigation among creditors the better. We’ll see how Houston views them when a debtor objects (spoiler: Houston will not enforce).

?Josh Feltman. Good, if open to all; bad if used by a 51% group to consolidate power at the expense of the minority; and indifferent in many situations, as existing covenant flexibility makes voting-control blocks irrelevant and companies can do deals with financing sources other than existing lenders.

Mark Lightner. Both. They can stymie unfriendly LMEs (good), but also create unfair divisions between favored creditor groups at the expense of those creditors who are not parties to the agreement (potentially bad).

Jennifer Selendy: It depends. If used to enforce pro rata rights that exist and address breaching transactions, good. If used tactically to create leverage where it otherwise doesn’t exist or effectively renegotiate terms, bad.

Daniel Shamah. Neither. They may encourage more consensus. But they also just as often lock people out of deals, making it even harder to achieve consensus

Paul Silverstein. Both+. If you’re an excluded lender, they’re bad. If you’re a lender in the coop group, they’re good. If you’re the group’s counsel, they’re very good.

|

Will Serta be reversed by the 5th Circuit? |

Rachel Albanese. Yes

Kevin Eckhardt. No. I think circuit court got its frustrations with Houston out of its system with the Jones complaint and Ultra.

Josh Feltman. Soorrrrrt of… I predict a referral to a New York court.

Jennifer Selendy. Yes. If there is any justice, the 5th Circuit will reverse.

Daniel Shamah. Yes. I think the Fifth Circuit will reverse and remand for further factual development.

Paul Silverstein. Yes. While the Fifth Circuit has not been quick to decide the appeal, I certainly hope/think that we will see a reversal of Judge Jones “open market ruling” in Serta.

|

Is Restructuring Dead? |

Rachel Albanese. No. In time, LMEs hopefully will become one of the tools in our restructuring toolbox, not a sideshow.

Kevin Eckhardt. No. Restructuring is “liability management.” Always has been (astronauts in space with gun meme). LMEs are just bankruptcy-style one-sided restructurings crammed down on minority creditors and dissidents before a petition is filed. In other words: Restructuring is not only not dead, it is a fungus slowly spreading and taking over all other forms of life.

Josh Feltman. Not all out of court activity is “LM” rather than “restructuring”. I believe the sophistication of the parties and the enormity of the pools of capital in consolidated hands means less in-court activity overall; and I believe some LM will succeed in preventing restructurings that even 10 years ago might have been necessary, for want of other means of obtaining liquidity; but LM won’t fix a broken business model or even, in most cases, a fundamentally over-levered balance sheet.

Sydney Levinson. As liability management has increasingly become synonymous with creditor-on-creditor violence, the need has arisen for a new euphemism to describe our industry. If I were to take a crack at it, I’d suggest something like “financial redecorating” or “balance sheet renewal.” That said, this is probably a job best left to the same investment bankers who devise clever code names for projects (my personal favorite was Project Rubicon, the code name used for the Caesars restructuring). Or perhaps a contest sponsored by the Creditor Rights Coalition with a suitable prize for the winner.

Mark Lightner. Restructuring is not dead, and the existence of weak covenant protections has facilitated the recent surge in LMEs and out-of-court restructurings. Although many believe that the chapter 11 process has become too expensive and unwieldy, there will always be a need for more formal restructurings.

Jennifer Selendy. Parties will continue to be creative in finding ways to avoid or delay filing.

Daniel Shamah. We go by “solvency strategists.” We’re still workshopping it!

Paul Silverstein. Restructurings are not dead, and never will be dead; but the trend will continue to be “amend and pretend”. |

|

|

Copyright 2024 Creditor Rights Coalition The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. |

|

|

|

|

|

|

|

|

|

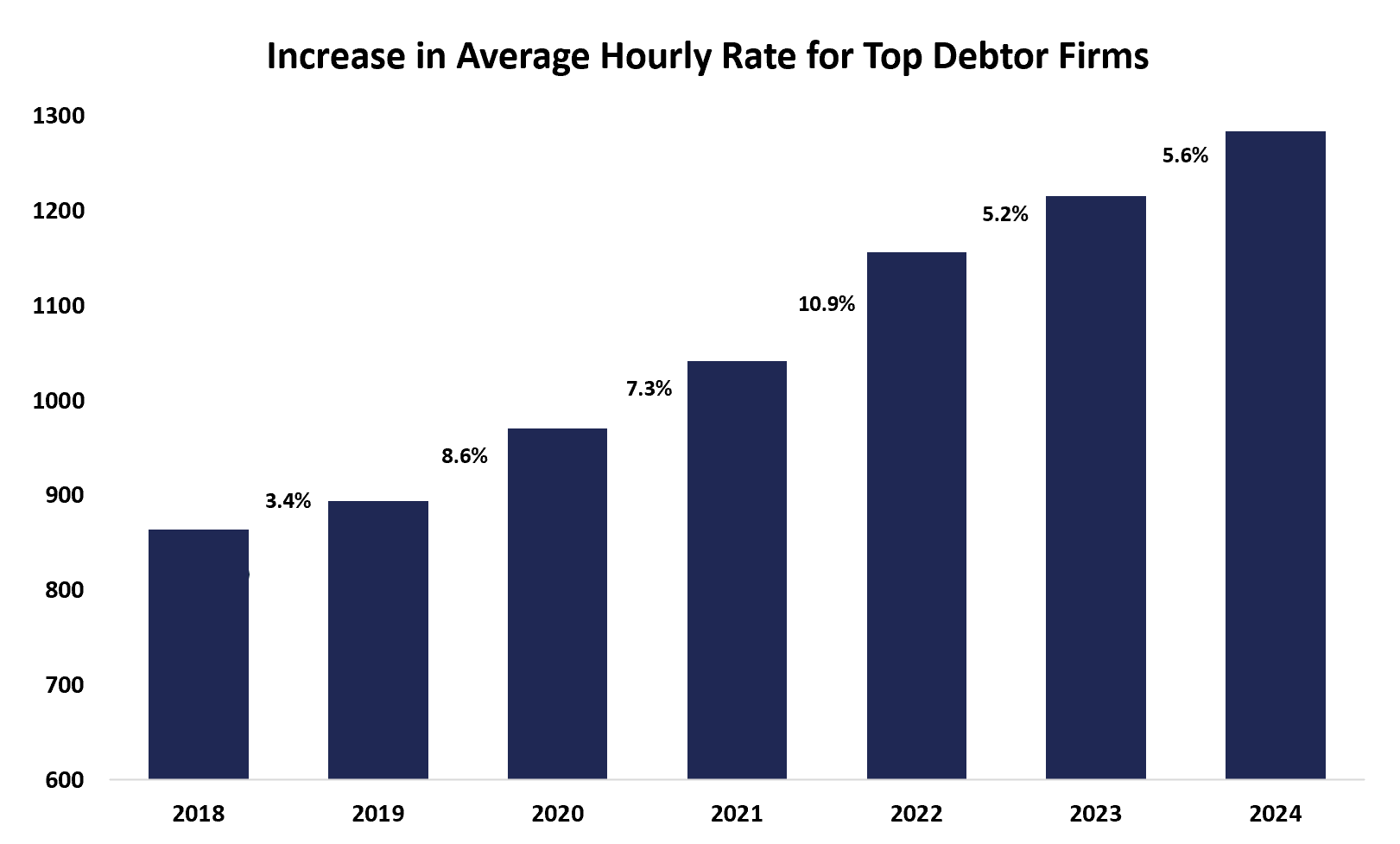

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. We took a deep dive to see what is driving up the daily cost of restructurings and the culprit: Increasing Legal Hourly Rates. We analyzed final fee apps for top debtor law firms from 2018 to 2024 and found average hourly legal fees have increased by over 65% since 2018. Maybe a little bit of sunlight is the right disinfectant to help remedy the problem…. |

|

|

|

|

|

|

Ian Feng of Covenant Review weighs on key developments during 2024 for the Creditor Rights Coalition. Read on for what he has to say:

For the leveraged loan market, 2024 was a year of incremental changes when it came to liability management exercises (LMEs), not bold evolution. Distressed borrowers and their advisors continued to follow the tried-and-true trichotomy of dropdown / uptier / double dip (including “pari-plus”), with the occasional combination of two or more of these approaches. However, 2024 was not without excitement as some salient trends illustrate.

“Consensual” uptiers. 2024 was the year that uptiers emerged from secretive backrooms into the light of day with affected lenders often given the bona fide opportunity to participate in new priming paper. Unfortunately, “bona fide” does not always mean “fair,” with several transactions illustrating significant deltas between the “haves” (those in the steering group) and “have-nots” (everyone else). Indeed, minority lenders could be offered less than ideal economics, including PIK terms and/or significant haircuts. The rise of such voluntary exchanges can be tied to a number of factors, including (1) the growing prevalence of “Serta blockers” (which sometimes include a ROFR exception) and (2) an attempt by borrowers to litigation-proof their LMEs (via broad waiver language).

Co-op agreements. 2024 also saw an increasingly proactive approach taken by lenders to get ahead of potential LMEs, with co-op agreements being reported in a significant number of distressed names, including Altice, Astound Broadband, Multi-Plan, among others. These “loyalty pacts” (as they are sometimes known) in theory inhibit lender-on-lender violence by establishing a unified bloc against borrower-led LMEs. On the other hand, co-ops can also exacerbate majority-minority splits by freezing out those lenders not party to such agreements. Potential side effects also abound, as handcuffing borrowers in this manner may result in more scorched earth restructuring proposals.

|

An unwelcome debut. In June 2024, Pluralsight reportedly transferred material IP to a restricted non-guarantor subsidiary. Vista (Pluralsight’s sponsor) then extended a loan backed by the IP to finance the interest payment at the parent level. While the nature of the transaction was distressingly familiar, the context was not, with many observers calling Pluralsight’s maneuvering as the first publicized instance of an LME in the private credit (PC) market. Is Pluralsight a sign of things to come for the PC market or an outlier? The future is hazy but note that “lender-on-lender violence” is arguably less likely to occur in PC deals given that lender groups tend to be more unified and covenant terms stronger than in their BSL counterparts.

Qualified court wins. On the judicial front, key decisions came down in 2024 addressing LMEs in RobertShaw and Incora (the latter an oral decision). Both cases were broadly viewed as creditor friendly (in contrast to earlier decisions like Serta). In Incora, Judge Isgur voided a 2022 LME, admittedly on the esoteric issue of “vote rigging.” In RobertShaw, Judge Lopez found the borrower to have violated its superpriority credit agreement, though this time, the holding turned on a technical argument as to which entities constituted “Required Lenders.” Thus, neither case broached LME legality as a general matter, and both cases’ somewhat narrow take on post-LME remedies may have a chilling impact on future litigation. With several LME-adjacent cases still pending (including AMC and a written opinion in Incora), it is far from clear whether 2025 will carry on creditors’ recent judicial “win” streak. |

|

|

|

|

|

|

Third Party Releases – Purdue and Beyond Sometimes the obvious answer is the right one. The Supreme Court’s decision in Purdue Pharma was the most important and consequential development in the restructuring industry in 2024, and potentially in the past 40 years. By now, your readers are familiar with the holding of Purdue— “nonconsensual third-party releases” in favor of non-debtors are now impermissible. With the stroke of a pen, the Supreme Court ended a bedrock feature of countless mass tort bankruptcy plans. The bombshell decision had ripple effects throughout the industry:

Existing deals that were either teed up for approval, or were up on appeal—most prominently the Boy Scouts bankruptcy plan, but also the scores of mass tort debtors currently in bankruptcy around the country—suddenly faced substantial uncertainty on whether their plans would be unwound or rejected

In face of this uncertainty, the notion of consent—and specifically whether consent can only be manifested through an affirmative act—has taken on newfound significance in bankruptcy cases across the country. Purdue did not resolve a preexisting split of authority over whether non-debtor releases can be approved on a consensual basis if a plan contains an opt-out mechanism, or if a party must opt in to the third-party release. Whether a plan is an “opt in” or an “opt out” plan can make all the difference: An opt-out plan provides for non-debtor releases if a party receiving a ballot or a nonvoting party (such as a shareholder deemed to reject a plan or an unimpaired creditor) receiving notice does not vote at all, or if it does not select a box indicating that the party does not wish to grant a non-debtor release. In some cases, parties that vote in favor of a plan are also deemed to consent even if they opt out. An opt-in plan, in contrast, requires a party to affirmatively check a box to grant a release. Not surprisingly, debtors—and the third parties looking to get the benefit of a release—typically advocate for an “opt out” plan in the hopes that most people won’t bother to check the box to opt out of the release. Prior to Purdue, lower courts split over the permissibility of opt-out releases, with limited circuit-level authority addressing the issue. That split has generally continued notwithstanding Purdue, with courts either approving opt-out releases (e.g., Judge Lopez in Robertshaw), or requiring debtors to modify their plans to contain an opt-in mechanism (e.g., Judge Goldblatt in Smallhold). And still others have crafted a middle ground, for example Judge Horan in Fisker finding that creditors can be bound by opt-out releases because they receive some consideration under the plan, while shareholders who get no recovery under the same plan cannot similarly be bound. The conflicting decisions on this issue among, and even within, judicial districts over opt-out releases may also exacerbate the ongoing trend for debtors to file their cases in venues that debtors believe will maximize their chances of obtaining favorable rulings on important case issues. Until appellate courts resolve this issue with binding precedent, we expect debtors to continue to push for opt-out plans to obtain the benefit of broad consent for third-party releases.

Copyright 2024 Creditor Rights Coalition |

|

|

|

|

|

Contributor Cliff White comments on two of the most vexing issues in Chapter 11 excerpted below. You can find his full feature here.

A lot of important things have happened in the world of bankruptcy this year. But a number of significant matters await resolution in 2025 – if not beyond. Following is a description of two such matters: Will Legal Actions in the Jones-Gate Scandal Ever Conclude? In late 2023, Bankruptcy Judge David Jones in the Southern District of Texas admitted in response to reporting by the Wall Street Journal that he was living with a lawyer whose firm frequently appeared before him. As the scandal unraveled, it turned out that Judge Jones had approved millions of dollars in legal fees for his romantic interest and her law firm. He even mediated disputes in which she represented one of the parties. After the Fifth Circuit found “probable cause” that he committed serious ethical violations, Judge Jones resigned. In November 2023, the United States Trustee (UST) began filing 33 actions to disgorge or deny more than $20 million in fees that Jones awarded to the Jackson Walker (JW) law firm where his romantic interest had been a partner. The UST alleged multiple legal violations by JW, including conflicts of interest, failure to disclose, and other ethical breaches. Most observers thought that this matter, called Jones-gate by some pundits, would be handled with dispatch so the scandal did not fester any longer than necessary. But it is not turning out that way, to say the least.

It is highly ironic that this fee disgorgement dispute may end up taking two years or more to resolve by the same bankruptcy court that has prided itself on confirming mega-chapter 11 cases in as little as one day. Can Venue-Shopping Get Even Worse? A lot has been written about the loose bankruptcy venue laws that seem to let corporate chapter 11 debtors file about anywhere they choose regardless of their state of incorporation or where their base of operations or assets are located. Just when one might have thought it could not get worse, Red River Talc filed in the Southern District of Texas (case no. 24-90505). The parent company in this case is the behemoth Johnson & Johnson (J&J) corporation which seeks a third-party release for its alleged asbestos liability. The venue problem is that this is the third bankruptcy case filed in three districts over three years seeking essentially the same relief. The Third Circuit twice has ruled that previous filings were made in “bad faith” because the debtor itself was a shell without any “financial distress” of its own. In a transparent attempt to evade the Third Circuit decisions, J&J incorporated Red River Talc (as the successor entity to the previous debtor known at LTL) in Texas so it could file in the SDTX under the place of incorporation prong in 28 USC 1408. The UST and creditors moved for transfer of venue under the interests of justice and convenience of the parties standards contained in section 1412. The bankruptcy court said “no,” it was keeping the case. Even prominent Fifth Circuit Judge James Ho and Northern District of Texas Judge District Judge Reed O’Connor, who have expressed misgivings about imposition of proposed national case assignment rules, have decried what Judge Ho called alleged “forum selling” in bankruptcy cases. As Judge Ho said, “We expect lawyers to favor their clients. We expect judges to favor nobody.” |

|

|

Copyright 2024 Creditor Rights Coalition Cliff White served as head of the Justice Department’s bankruptcy watchdog, the United States Trustee Program, for seventeen years before retiring last year. He is currently an executive with a financial technology company. The views expressed are those of the author only. |

|

|

|

|

|

Featured Content |

|

2025 Outlook and Reflections on this week

1. Inflation higher for longer; core-CPI in the 3% – 3.5% range (not 2%, the Fed has given up on 2% inflation at the current juncture).

2. U.S. GDP in the 3% range, firmly above its long-term average of 2%.

3. Fed dots have moved higher with only 2-cuts priced in 2025 (down from 4).

4. 1, 2, 3 (above) combined is not necessarily bad for equities (despite full multiplies, and the huge decline on Fed Day), I expect equities to recoup this 1-day loss.

5. 1, 2, 3 should not negatively impact credit spreads, expect credit spreads to remain tight as long as GDP remains strong.

6. 1, 2, 3 is negative for US treasuries, steeper curve with 10yr UST at fair value (10yr UST likely to retest key-support level of 5% next year).

7. Portfolio construction favors Private Equity & Private Credit balanced with Public Markets (allocate S&P500 gains to Private Equity + allocate Fixed Income exposure to Private Credit).

8. 50% Public + 50% Private will lead to a stronger outcome and wealth creation, I believe (Manager Selection/Tactical Allocations are important determinant).

9. 2025 should be a strong vintage year for PE & Private Credit, and an average year for public equities and fixed income.

10. 12% for Alts, 7% S&P500, 7% for Public High Yield Credit portfolio (diversified, fixed-floating).

While no one can predict with certainty how markets will perform in the future, a strong understanding of fundamental developments, coupled with sound investment advice, can provide valuable insights, and guide strategic decision-making. By focusing on key trends, economic indicators, and market forces, investors can better position themselves to navigate uncertainty and identify opportunities for long-term wealth creation.

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

|

Featured Content |

|

?Outlook for Default Rates in 2025

My outlook for Default rates in the three areas of Leveraged Finance are as follows:

High Yield Bonds * For 2025 the HY Bond Default Rate is between 1.4% and 2.4% depending upon whether we have a soft or hard landing US economy.

Leveraged Loans * For the floating rate Leveraged Loan, or BSL market, my forecast is an eye-opening 4.5% to 6.0%, depending upon a soft or hard landing economy in 2025.

Private Debt * For the Private, non-bank loan, floating rate market, the default rate will increase to 2.0%-3.0% based on the existing measure of defaults in this more opaque market given a soft or hard landing. If the extended forbearance situation or PIK Toggles usage will constitute a default, default rates will grow beyond these rates.

For a discussion of my methodology used over the past 40 years to predict default rates, please see my prior Outlooks prepared for the Creditor Rights Coalition here. |

|

|

|

|

|

Featured Content |

CreditSights Gives Its Outlook for 2025 |

|

|

One time registration required |

|

|

|

|

|

|