Creditor Corner |

|

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 3,400 member subscribers and growing! We bring you exclusive content from leading data and research providers Sign Up Here |

|

|

In this Week’s Creditor Corner big news out of Texas on exclusive opportunism, First Brands the latest dumpster fire, Packers uptier going belly up, government takes out Omnicare, Radio Shack ponzi, dealer’s choice, and much much more

Featured Content Bruce Richards on the Markets ?From Dislocation to Opportunity: The Maturity Wall & How Private Credit Is Stepping In As Banks Pull Back |

Scroll through to read all of ou?r content? |

|

|

|

Tweet Of The Weekmonkey with a gun |

|

|

|

|

|

|

|

Exclusive Content |

Big news out of Texas…. |

|

| Read the Opinion Here |

Click above to access content |

Our take: Judge Hanen’s ruling — that exclusive backstop premiums to preferred lenders violates the equal-treatment requirement under Section 1123(a)(4) — could significantly level the playing field in bankruptcy.

We have commented on the perils of exclusive opportunism multiple times on these pages. What we have said before is particularly prescient today:

“In recent years, a troubling pattern has emerged in how debtors obtain support for plans of reorganization. Increasingly, debtors make, in effect, a side payment to a subset of creditors in the form of an exclusive opportunity to participate in equity or debt financing on favorable terms.

This benefits the controlling coalition at the expense of creditors who are not part of it and creates perceived, if not actual, conflicts for management teams (and their advisors). Exclusive opportunism goes hand in hand with other hostile out-of-court restructuring tactics that pit similarly situated creditors against one another. These transactions – whether inside or outside of bankruptcy – strain intercreditor dynamics, create new fault lines, and amplify distributional concerns among similarly situated creditors.”

We hope to see further clarity from the Courts on this important issue.

For further background on exclusive opportunism, you can read Contributor Paul Silverstein’s take on the Supreme Court’s decision in Bank of America Nat. Trust and Savings Assoc. v. 203 N. LaSalle St. Street Partnership, 526 US 434 (1999) and how exclusive opportunism violates Section 1123(a)(4). Or, Contributor Phil Anker’s argument that offering some but not all creditors in the fulcrum class the right to invest in the reorganized debtor (or the right to backstop an offering) under a plan can violate the same treatment requirement for confirmation.

|

Learn More Here: |

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

|

|

|

Exclusive Content |

The latest dumpster fire!! |

|

|

|

Click above to access content |

|

|

|

|

|

|

Exclusive Content |

Another 2025 uptier going belly up… |

|

Our take: Another 2025 vintage uptier transaction looks to be heading to BK… need we say more? |

Click above to access content |

one time registration required |

|

|

|

|

|

|

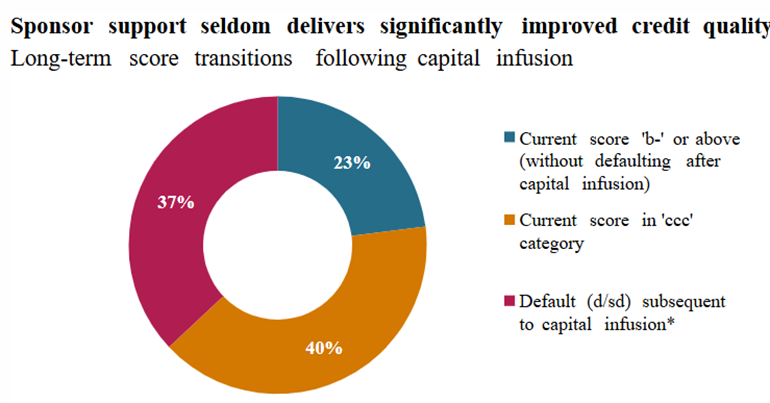

Data download |

is it any surprise that sponsors are torching new money…. |

|

|

Click above to access content |

|

|

|

|

|

In the news |

sales hitting the brakes!! |

|

|

Click above to access content |

|

|

|

|

Exclusive Content |

government takes down Omnicare… |

|

|

|

Click above to access content |

one time registration required |

|

|

In the news |

extra extra, bankruptcy ponzi scheme exposed |

|

|

Click above to access content |

additional registration required |

|

|

Exclusive Content |

Sponsors care more about creditors on a list than leverage on a B/S |

|

|

|

|

|

|

Featured Content |

|

From Dislocation to Opportunity: The Maturity Wall & How Private Credit Is Stepping In As Banks Pull Back

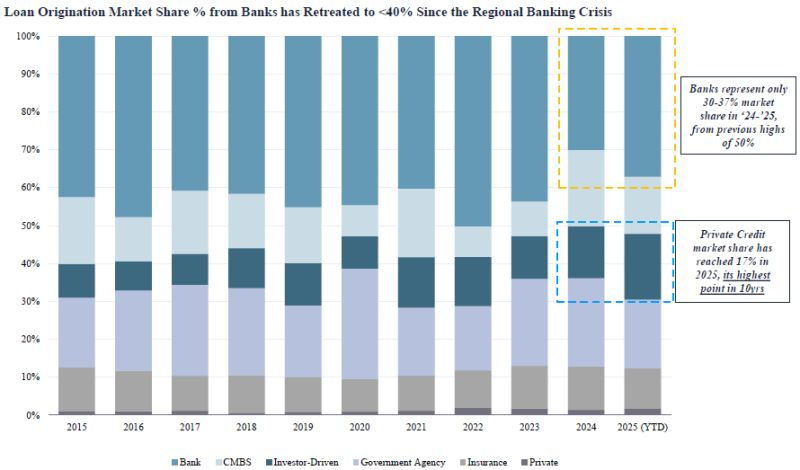

When the Federal Reserve raised rates by over 525 basis points during 2022–2023, the commercial real estate (CRE) sector came under significant pressure. Financing costs surged, and cap rates followed suit. Banks, which traditionally held nearly 50% of all CRE loans on their balance sheets (as shown in the first chart below), started dialing back their exposure. This retrenchment created a liquidity vacuum that Private Credit and the CMBS market have stepped in to fill. Despite the considerable volume of troubled loans still working through the system, the CRE property market is stabilizing, aided by the Federal Reserve’s shift toward a new easing cycle. In short, CRE is healing.

However, a massive maturity wall and financing gap looms with over $1.5 trillion in CRE debt maturing by the end of 2026. This represents an unprecedented refinancing challenge.

Marathon Asset Management, along with other credit managers equipped with strong CRE lending teams (sourcing, underwriting, structuring, asset management), will be incredibly active in the coming years.

Our strategy has been two-fold: 1. In the $1T+ CMBS market: Capitalize on the fallout to acquire securities that are senior to the fulcrum tranche. With 1,600 securitizations and 9,000+ tranches, this highly inefficient and fragmented market offers opportunity for those with differentiated data, proprietary tech, and deep credit/asset-level insight to generate alpha and absolute returns. 2. In the broader CRE loan market (~5x the size of CMBS), my recommendation is to partner with world-class real estate sponsors, owners, and operators to originate loans backed by prime, well-located assets with stable cash flows and growth potential.

As the CRE market recalibrates, those with deep real estate credit expertise, flexible capital, and relationship/strategic partnerships will be best positioned to lead this next cycle. |

|

Click above to access content To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

|

|

|

Data download |

Docs are on a Diet |

|

|

Click above to access content |

Our Take: Dealer’s choice, pick your favorite, and let us know at info@creditorcoalition.org: – Sponsors have turned covenants into collector’s items — nice to look at, but you’ll never see one in the wild. – Loan docs read like sponsor wish lists: leverage up, safeguards down, credit protections nowhere to be seen. – Covenants are the new distressed paper — rare, illiquid, and trading at a premium if you can find one. – Sponsors are underwriting like covenants are non-GAAP: adjusted right out. – Credit risk used to be priced in; now it’s just papered over. |

|

|

|

|

|

Linklaters European and Asian Private Credit (New York) |

October 8, 2025 |

| Learn More |

|

|

|

|

*New Event* Octus: Healthcare Webinar (London) |

October 9, 2025 |

| Learn More |

|

|

|

*New Event* GRRLive: Restructuring in the Americas (New York) |

October 16, 2025 |

| Learn More |

|

|

|

LSTA: Annual Conference (New York) |

October 22, 2025 |

| Learn More |

|

|

|

|

Octus: London Credit Seminar (London) |

October 23, 2025 |

| Learn More |

|

|

|

ABI: 2025 International North American Insolvency Symposium (New York/ Skadden) |

November 5, 2025 |

| Learn More |

|

|

|

The Data Download |

Bringing Transparency to the Bankruptcy Process |

|

|

|

|

Click Above to Access The Data Download |

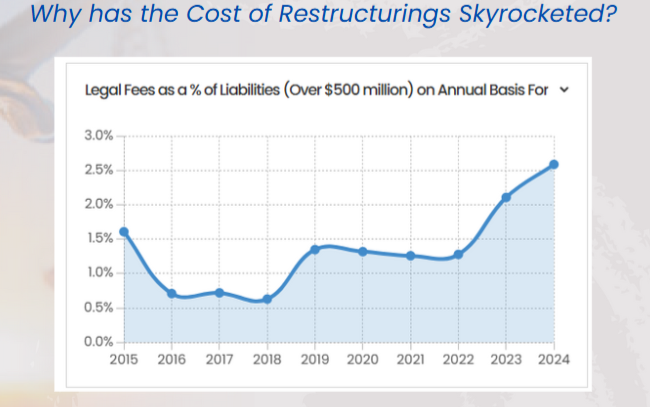

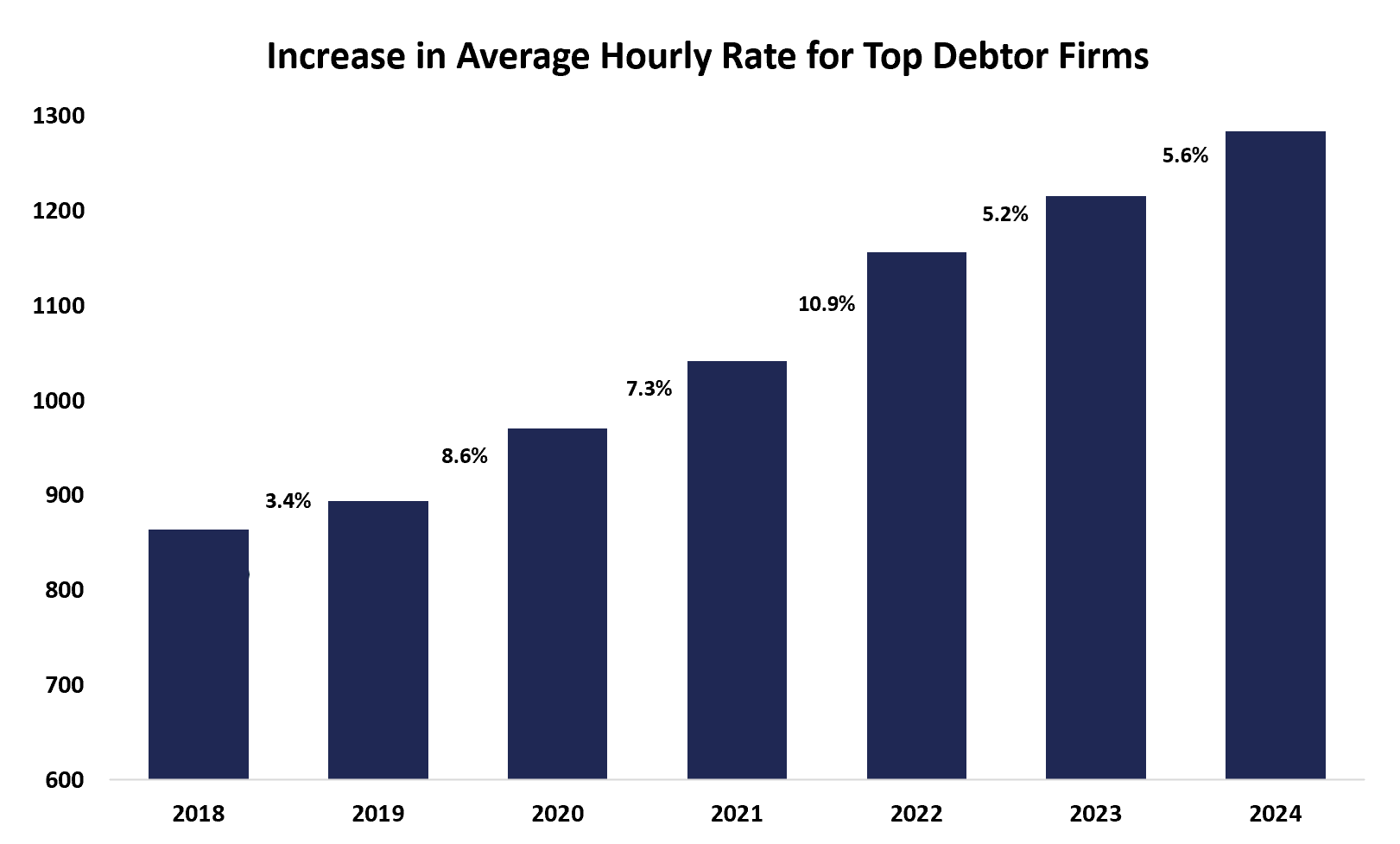

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. We took a deep dive to see what is driving up the daily cost of restructurings and the culprit: Increasing Legal Hourly Rates. We analyzed final fee apps for top debtor law firms from 2018 to 2024 and found average hourly legal fees have increased by over 65% since 2018. Maybe a little bit of sunlight is the right disinfectant to help remedy the problem…. |

|

|

|

|

|

Meet Our 2025 Contributors |

|

|

|

|

|

|

|

Thank You to Our 2025 Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|