Creditor Corner |

for the week ended March May 24, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,500 member subscribers and growing! Sign Up Here |

2024 Restructuring Symposium Welcome Sujeet Indap of the Financial Times Over 375 registered already! Register Here

BREAKING NEWS What brought down Red Lobster? RAD fees under pressure, Bad policy afoot in Albany, CITGO on chopping block (finally), Fresh Direct & Bayer under Pressure, S&C still in hot seat, and much, much more…

FEATURED CONTENT Bruce Richards on the Markets: Weighing You Down

SPECIAL FEATURE Professor Edward Altman Where Are We in the Credit Cycle and Outlook for 2024 |

Scroll through to read all of our content |

|

|

|

Tweet of the Week |

Looking for that Retention Bonus

|

|

|

|

|

|

In the News |

Let the probes begin… |

|

|

|

|

In the News |

Professionals feeling the heat… |

|

|

|

Our Take: New Jersey risks becoming the home of the $20 million CEO bonus that took down the company… |

|

|

|

In the News |

bad policy afoot…. |

|

|

|

Our take: How can NY consider itself a financial hub when it is actively looking to strip creditor rights?? |

|

|

|

In the News |

Luckily this one is in Delaware… |

|

|

|

|

|

|

Click Above to Access Content One Time Registration Required |

|

|

|

|

In the News |

RX pros licking their chops! |

|

|

|

|

Exclusive Content |

S&C not out of the doghouse…. yet… |

|

|

|

Click Above to Access Content |

|

|

|

In the News |

please make it stop… |

|

|

|

|

|

|

Click Above to Access Content |

|

|

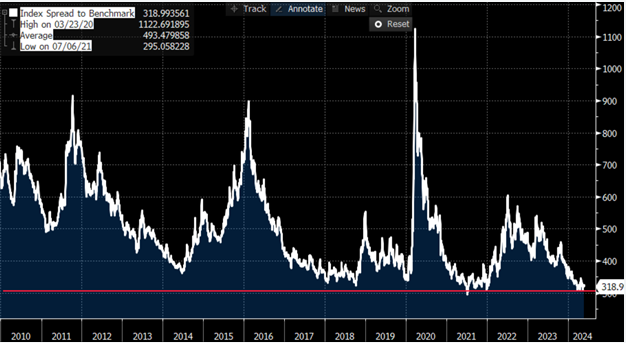

Our Take: Although high yield is at the tights (see below), CCC is under pressure and dispersion is at the wides (per JFL Credit). A trend likely to continue… |

|

|

|

|

Featured Content |

|

Weighing you down

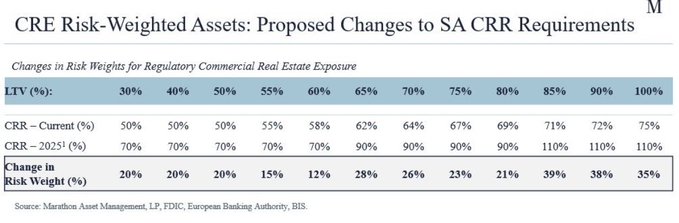

The new Capital Requirements proposed under Basel III Endgame will prove onerous for Banks & Borrowers, alike.

Today, I examine the Commercial Real Estate sector since this asset class is highly reliant on banks (and vulnerable) and the CRE market is contending with a huge pending maturity wall. Banks account for ~50% of the CRE debt market, representing the largest collective lender to CRE – this equates to nearly $3T in the U.S. alone.

Below, I have constructed a table that very clearly states (my source from various federal documents that include: Note 20.86 on the Basel Framework (BIS) & Page 164 of September 2023 FDIC Proposed Rules notice) how a bank must measure its cash reserve requirements (CRR) for a given loan. Notice the change in risk weightings required for a given LTV. For a given loan, ~+20% higher risk weighted capital will be required that will soon be subject to this new measurement for risk. The bank lender will be required to hold additional capital for a given loan, or alternatively, simply extend less credit when writing a new loan as they apply more conservative detachment points (e.g. $50M loan vs. $100M asset value which is 50% LTV vs 80% LTV previously). If the bank does not want to increase its CRR, it must reduce the amount of credit it extends for a given asset/borrower. The delta is stark; this is a paradigm shift that will crack the door wide open for Private Credit Lenders.

Banks will differentiate, take a more discerning eye when extending credit, with greater discipline going forward under Basel III Endgame. The new Basel III Endgame capital guidelines required by federal banking regulators and implemented in 2025 will break down risk-weighted assets by blending what is considered senior-secure risk v. unsecured risk (within a single unitranche loan). Regulators are confident that by imposing stricter capital requirements and more onerous stress tests when reporting liquidity, assets, operations, capital requirements, large banks (30 banks in U.S. with assets greater than $100B) will become less risky and less prone to failure. Banks are with their regulators to push back on Basel III Endgame capital charges; I am sure Banks will find a middle-ground with their regulators, but it will still result in additional and significant costs and more conservative lending practices.

Private Credit firms such as Marathon Asset Management will provide a critical role in filling the void, to partner with banks and originate a plethora of investment opportunities that arise:

– Mezz debt loans to fill the capital gap as banks roll loans at lower LTVs

– Private Credit gaining more market share as banks reduce ABL exposure, for all ABL segments (not just CRE)

– Asset Sales by banks

– CRT/SRT transactions as private capital allows banks to offload risk

– Private Capital & Bank Investment

– Management Partnerships

The current ratios vs. the proposed ratios are starkly contrasted in this table below:

|

|

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

Special Feature |

|

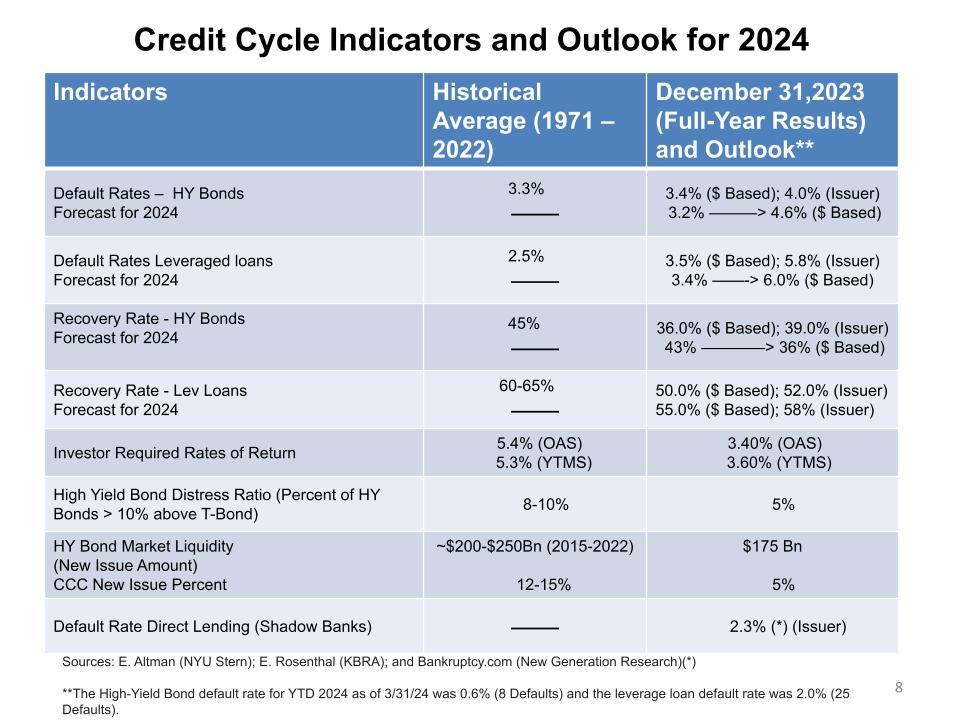

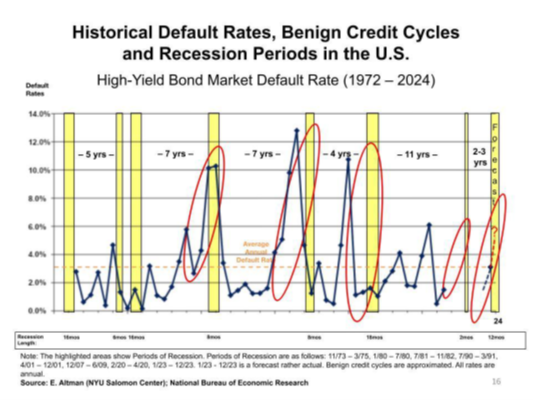

An Average Current Scenario in 2023 — But Was It Really Average?

There are certain times in our economic and financial environment when it makes sense to assess carefully and dispassionately where we are in the credit cycle and how this cycle relates to the business cycle. Now, in early 2024, is one of those times, as the economic uncertainties are at substantial levels. This note reflects my long history of studying credit cycles going back to the early 1970s. My current assessment is that the Benign Credit Cycle we have enjoyed since 2010, with the exception of a few months in early 2020, ended in 2023. We recently reached an inflection point to an Average credit risk scenario. This assessment is based on analysis of a number of historical indicators

over the last 50 years. This conclusion is tempered by the possibility that the U.S. credit picture will continue its heightened risk trend toward a Stressed Scenario by the end of 2024, and if we continue to incur unexpected shock catalysts, similar to the recent Crypto and Silicon Valley Bank crises, other banking meltdowns, or geopolitical crises, combined with a “hard-landing” economic recession, we could witness another financial-credit crisis, with non-financial corporate risky debt default rates rising to perhaps 8-10%, or more, over one or two years. While this scenario is unlikely as GDP in the U.S. has been unexpectedly resilient, especially in the second half of 2023, we should continue to be vigilant as to corporate distress. Indeed, in Q1 of 2024, corporate

Chapter 11 bankruptcy filings have spiked significantly compared to the comparable 2023 period, with increases of 46% compared to the similar quarter of 2023 and 36% more than the average number of filings for the period of 2018-2024. Indeed, even higher than during the comparable GFC periods.

Other Excerpts:

The expected default rate for more interest-sensitive leveraged loans is higher than for high-yield bonds and, as such, has a lower correlation to the historical experience since 2005 (0.92 correlation). For 2024, the leveraged loan default rate could hit as high as 6.0%!

Th[e] recovery rate was an above average 60% in 2022 when the default rate was a below average of 1.3%, but fell to 36% in 2023, indicating increased risk in 2023 and likely beyond. My forecast for 2024, if default rates remain about average, is an increase to close to the historical level of 45% for bonds and 60-65% for loans.

* Professor emeritus at the NYU Stern school of business and cofounder and senior advisor to Wiserfunding, LTD., A Fintech based in London and Mumbai specializing in credit risk analytics for small and medium size firm analysis.

copyright 2024 Creditor Rights Coalition

|

| Click Here for the Full Feature |

|

|

|

|

Congratulations Ed for Acknowledgment as

#1 Ranked Scholar in Bankruptcy by ScholarGPS |

|

|

|

|

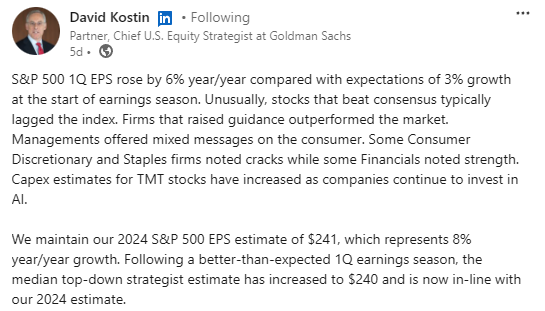

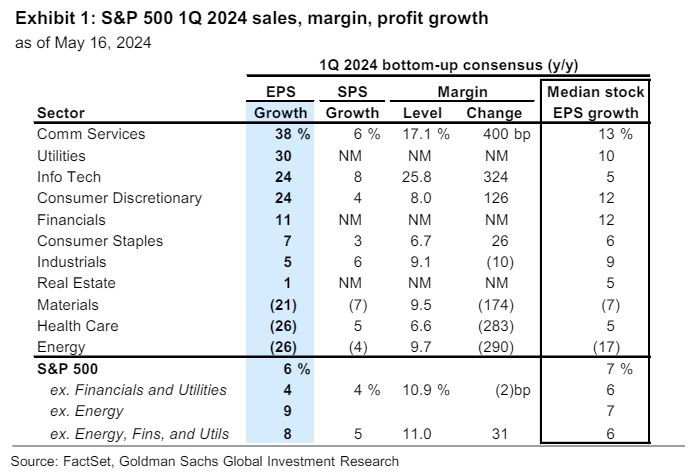

Data Download |

While earnings strong, S&P looking fully valued per GS |

|

|

|

|

|

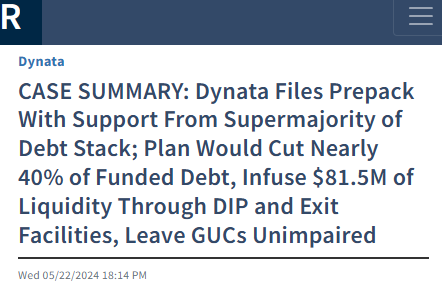

Exclusive Content |

Dynata hits BK… check out this Report from Reorg… |

|

|

|

Click Above to Access Content |

|

|

|

2024 Restructuring Symposium |

Registration Filling Up Fast Over 375 Registered To Date |

|

|

|

|

|

NYU Stern Bankruptcy Workshop |

Over 30 Registered To Date Register Now! Space is Limited |

|

|

|

An unprecedented opportunity for young legal & finance professionals to learn in-depth fundamental credit and legal analysis through seminar and case-study format over intensive 3-day format.

Network with participants from Citadel, Oak Tree, Houlihan Lokey, Franklin Mutual, among others.

Taught at NYU Stern from August 5 to 7, 2024.

Participants will receive Certificate of Completion from NYU Stern and in-depth reference materials for their future careers. Participants already include leading asset managers and law firms.

Workshop program here.

Expert Faculty: Edward Altman, Dan Kamensky, Donald Bernstein, Ronen Bojmel, Saul Burian, Judge Robert Drain (ret.), Christian Fischer, Michael Friedman, Max Frumes, Michael Gatto, Larry Halperin, Mo Meghji, Andy Rosenberg, David Smith, Robert Stark, Nick Weber, Jay Weinberger with featured speakers: Lisa Donahue, Holly Etlin, Lauren Krueger & Jared Parker

Registration fees apply |

| Register Here |

|

|

|

|

|

INSOL: Singapore Meeting |

August 27, 2024 |

| Learn More |

|

NCBJ: Annual Meeting |

September 18-20, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|