Weekly News – January 26

Featured Event

Lumen going pro rata!

Exclusive Content

Our take:

The TSA made several non-pro rata provisions available to all lenders.

A sign of a new trend?

Tell us what you think here

Gol nose dives

Pari passu is back

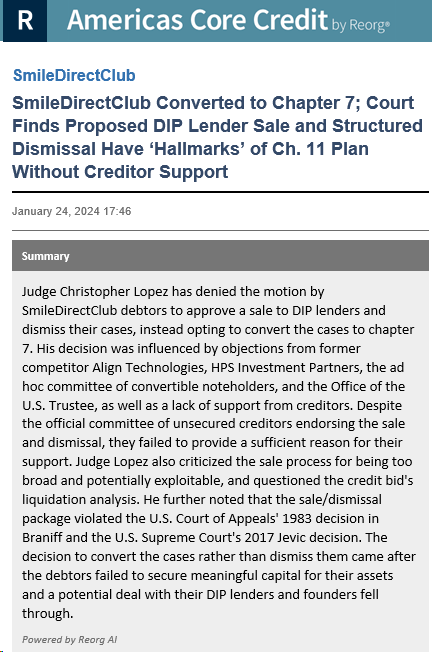

Another SDTX creditor-friendly decision

Exclusive Content

Full Report for registered users only here

Evergrande back in court

Texas Two-Step under scrutiny

Exclusive Content

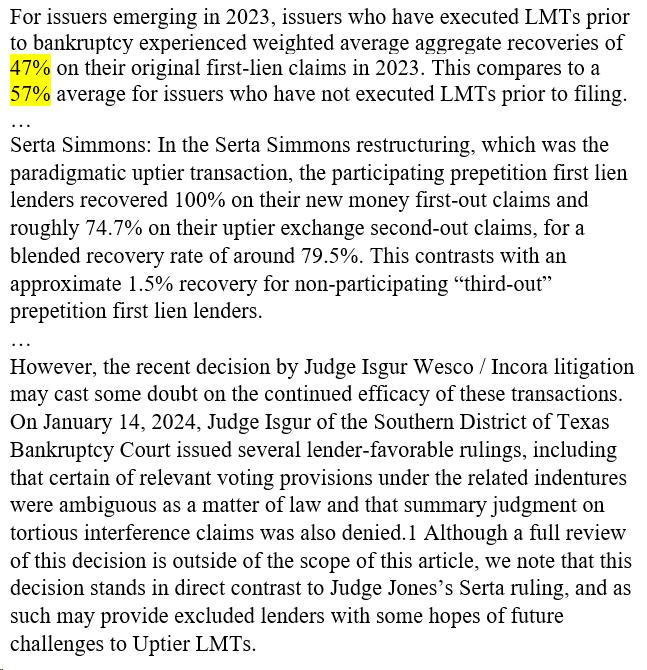

Covenant Review on LMEs

Full Report for registered users only here

Next shoe to drop…

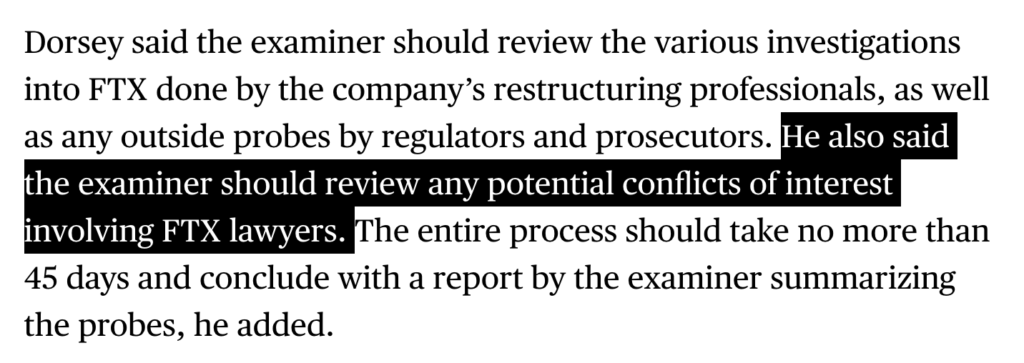

IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION

In re:

Professional Fee Matters Concerning the Jackson Walker Law Firm

UNITED STATES TRUSTEE’S REPLY TO JACKSON WALKER RESPONSE TO THE U.S. TRUSTEE’S MOTIONS TO WITHDRAW THE REFERENCE

Ftne 4. Moreover, as the U.S. Trustee’s investigation has continued, lawyers and litigants have raised questions and provided information about other cases that have expanded the scope of the U.S. Trustee’s investigation beyond those cases initially identified in Exhibit 6 A–D to the Rule 60(b)(6) Motions.

The US Trustee’s response is worth a read here.Â

Where will all this lead?

Tell us what you think here

Call us skeptics

Featured Content

Bruce Richards on the Markets

Bruce Richards, CEO

Marathon Asset Management

insights on markets, investing and more!

Can Someone Deliver Me the Index, Please!?

The U.S. High Yield Bond Index delivered a 13.45% return in 2023, largely driven by the monster Q4 rally that saw interest rates decline and credit spreads tighten. While it was a great year for credit, industry studies show that performance metrics for most managers were sub-par as they were not able to deliver index returns.

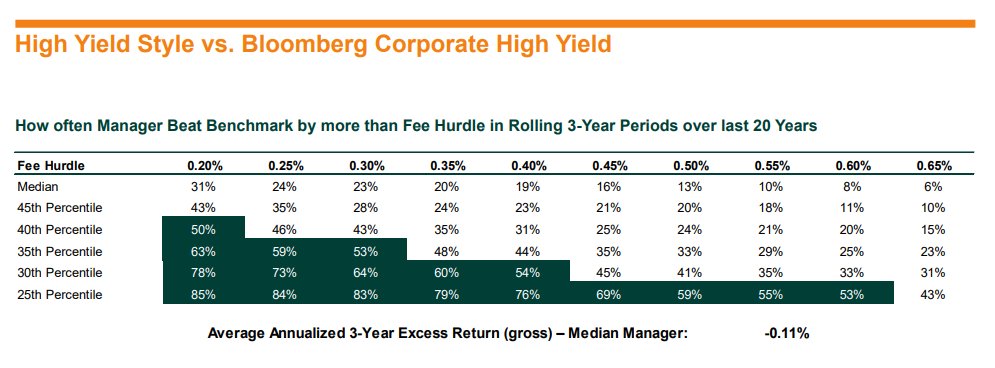

It’s no small feat to deliver index-like returns without significant tracking error, given the breath of issuers and bonds make it hard to replicate (~950 issuers and ~1,900 bonds are in the BofA High Yield Index). The data shows that the median high yield manager provides a gross IRR that is 11 basis points behind the index annually over the past two decades. Net of fees and expenses, the median performance is closer to 71 basis points worse than the HY index in a “normal†year. And as 2023 was not a normal year, actively managed HY funds lagged the index even more in 2023, as the index returned ~110 basis points more than the median of 127 funds of scale with comparable attributes. The two large HY ETFs (HYG & JNK), which are passively managed, also lagged by ~100 bps on average. It is typically only the top-quartile of mangers that deliver the index on a gross basis.

Callan specializes in providing investment and portfolio management advice to institutional investors and has a dedicated group known as the Callan Institute for Research. A recent Callan Institute report measures the frequency by which managers historically beat the benchmark by more than the fee hurdle. Below is the table from page 51 (64-page report) that highlights this exact point. So, I guess that I am not the only one that is asking this question: “Can someone deliver me the index returns, pleaseâ€!?

With all the golfers (managers) that play the game, only a few consistently shoot par (deliver the index).

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets

WeWork getting complicated

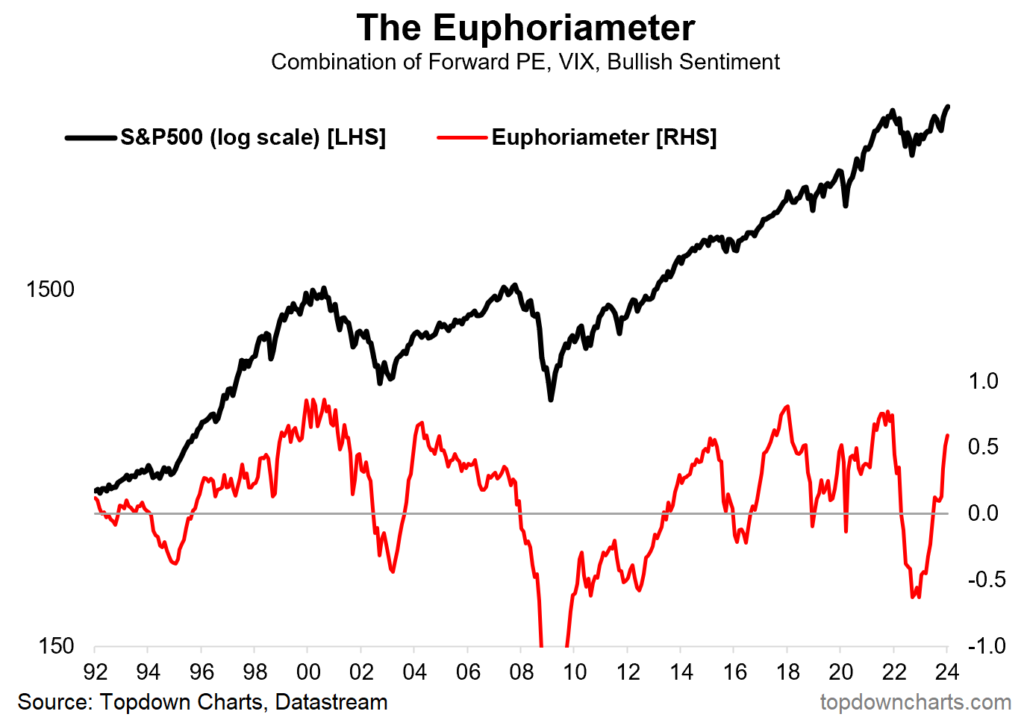

Sentiment is surging

Featured Content

Contributors Speak Up:

Our Contributors weigh in on the Incora decision

Contributors Andrew Dunlap & Samuel Kwak of Selendy, Gay, Elsberg and Dan Kamensky of the Creditor Rights Coalition weigh in on the Incora decision

Read our quick-take on the surprising Incora decision, which declined to follow recent bankruptcy decisions, most notably fellow former Judge Jones, in finding triable issues of fact for trial.

Read on for what our Contributors see as a significant development.

General Disclaimer:

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition.

Featured Content

Contributors Speak Up:

Our Contributors take on DQ provisions

We take on Disqualified Lender provisions. We were shocked by what we learned, Not only are distressed investors targeted but usually weeks if not months after a trade occurs. Serta, Packers and Bijyu’s are the latest examples of a troubling trend.

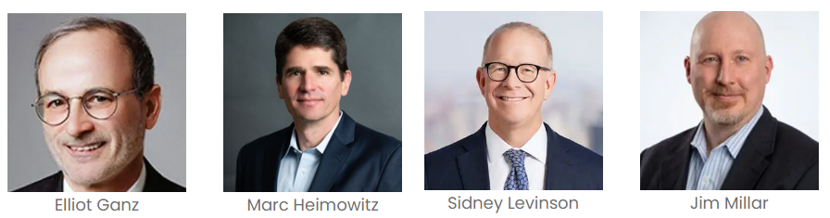

Read what Contributors Paul Silverstein, Justin Forlenza, Sid Levinson and Jim Millar have to say about this topic.

Featured Content

Contributors Speak Up:

Venue Reform in the Spotlight

click here to read the features from our Contributors analyzing Venue Reform

Featured Content

Contributors Speak Up:

SCOTUS takes on Purdue

click here to read the features from our Contributor analyzing what happened @SCOTUS

Special Feature:

Where Are We In The Credit Cycle?

CRC weighs in on judge shopping

General Disclaimer:

The Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of any particular Contributor or Board Member and should not be attributed to any Contributor or Board Member.

CRC weighs in on Serta

Look out for more great features from our Contributors

Meet our 2023 Sponsors

The CRC is funded through sponsorships from these organizations:

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

January 31: NYIC: 17th Annual Women in Achievement Awards

February 6: SFNET: Las Vegas Asset-Based Capital Conference

February 7: Arnold & Porter: Navigating Issues in Distressed Real Estate

February 8: TMA: 2024 Las Vegas Distressed Investing Conference

February 13: City Bar Bankruptcy Committee & ACFA: Hot Topics in Bankruptcy

February 15: ABI: Paskay Tampa Memorial Bankruptcy Seminar

February 23: Featured Event: Wharton Restructuring Conference

March 14: ACFA: Liability Management Transactions Program

March 21: ABF Journal: 15th Annual Philadelphia Restructuring Summit