Creditor Corner |

|

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,800 member subscribers and growing! Sign Up Here |

|

|

BREAKING NEWS 2025 Symposium Registration is Now Open Market reacts to Serta, Better Health LME raises eyebrows, Coops and more post Serta, Sacklers pony up more $$$$, and JoAnn chapter 22

FEATURED CONTENT Bruce Richards on the Markets: Down is Good (CPI that is…) |

Scroll through to read all of ou?r content? |

|

|

|

Tweet of the Week |

What??????????? Don’t say it’s so…. |

|

|

|

|

|

|

|

Exclusive Content

|

Better Health LME raises eyebrows |

|

|

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content

|

Market reactions to Serta…. |

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content

|

whack-a-mole continues… |

|

Click Above to Access Content One time registration required |

|

|

|

|

|

Exclusive Content |

Another LME road to nowhere… |

|

|

|

Click Above to Access Content One time registration required |

|

|

Remember this…So much for the parade of terribles…. |

|

|

|

|

|

|

|

In the newsSacklers pony up more $$$ |

|

|

Click Above to Access Content |

Our take: who would’ve thought…. |

|

|

|

|

|

Exclusive Content

|

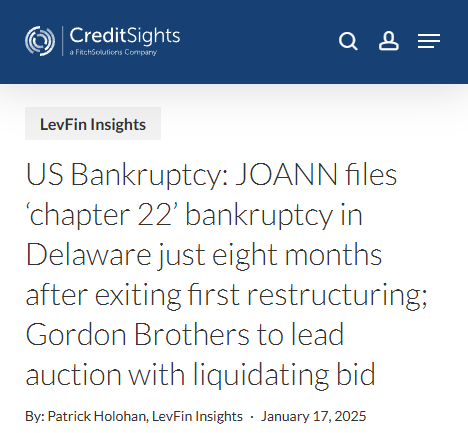

Chapter 22… |

|

Click Above to Access Content Access free to subscribers |

|

|

|

|

|

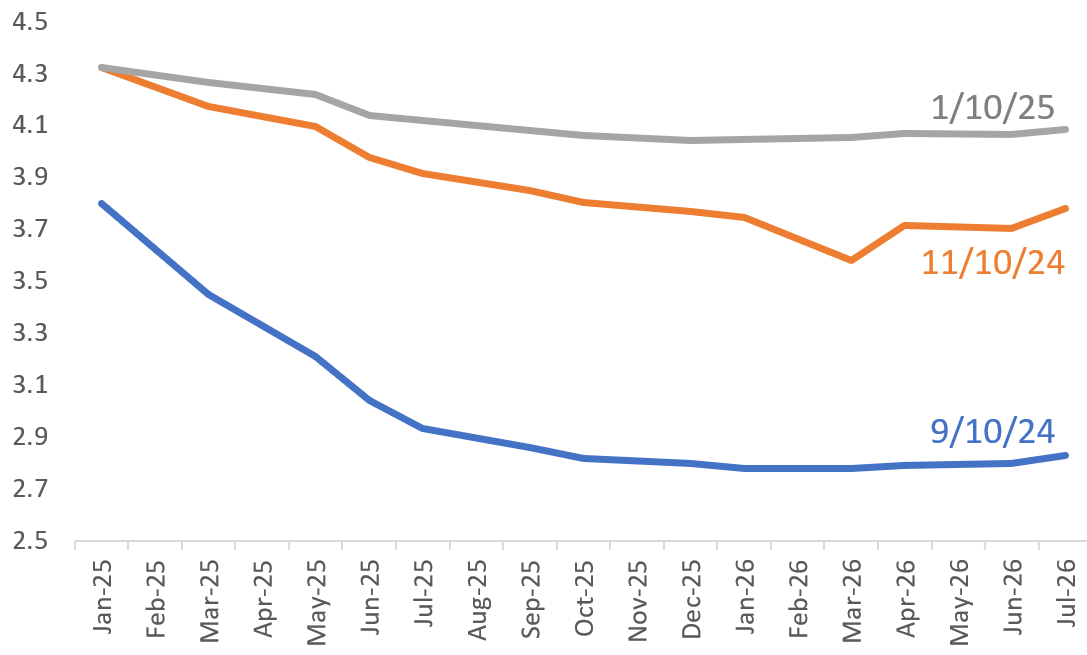

Data downloadSharp repricing of Fed Funds futures resets expectations |

|

|

Source: Bloomberg; courtesy of JFL Credit (Lionel Jolivot) |

|

|

|

|

|

Featured Content |

|

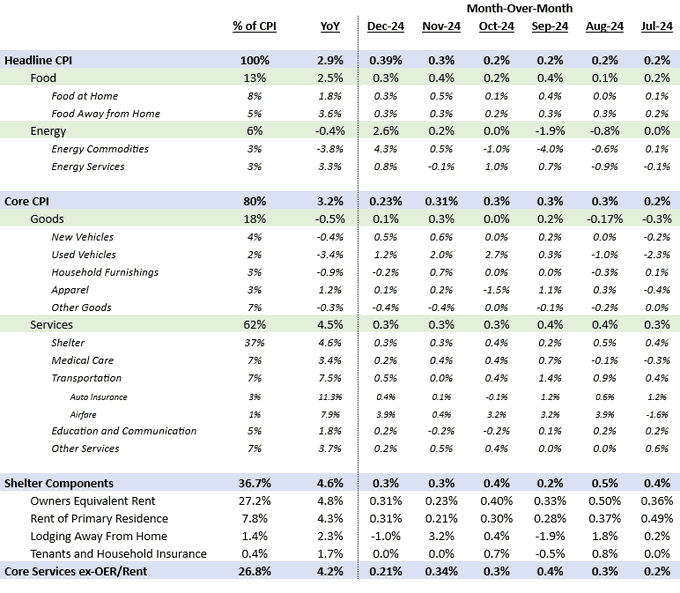

Down is Good

Down is Good Core CPI came in below expectations, and the markets are relieved. CPI was in-line, but the Core rate which is ex-food & fuel were slightly softer than prior months/expectations (see data below). Market savvy traders who were worried that the Fed might be forced to increase rates to battle inflation can now take this risk off the table, as futures are now pricing in 1.5 cuts for 2025, consistent with what I expect. Together with yesterdays PPI print, this lifts a weight off the market. Strong economy, strong jobs data and better news on inflation is Goldilocks. Let’s go! |

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

|

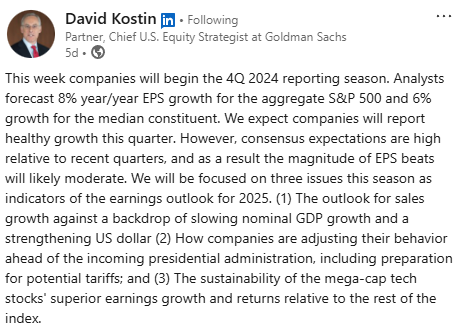

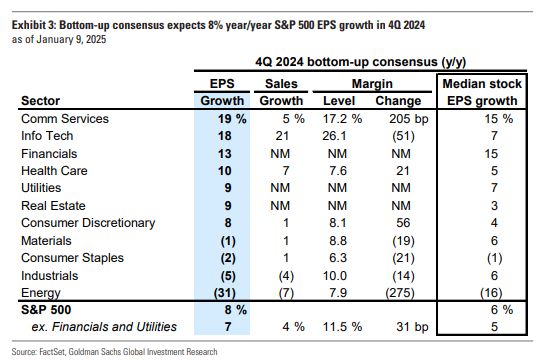

Data downloadEarnings season starts… |

|

|

|

|

|

|

|

|

LSTA: Exploring the Implications of the Serta and Mitel Decisions |

January 21, 2025 |

| Learn More |

|

|

|

Fitch: Short-Term Markets Credit Outlook 2025 |

January 22, 2025 |

| Learn More |

|

|

|

American Bankruptcy Law Journal: Practical Questions for Bankruptcy Scholars |

January 30, 2025 |

| Learn More |

|

|

|

Meet Our 2025 Contributors |

|

|

|

|

|

|

|

The Data Download |

Bringing Transparency to the Bankruptcy Process |

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. Our proprietary analysis supports anecdotal evidence that bankruptcy has gotten more expensive. We will be providing additional analysis in the future to show how other factors affects fees. We hope our database will help make bankruptcy a more efficient forum for all stakeholders. |

|

|

|

Thank You to Our 2025 Sponsors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|