Creditor Corner |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 3,600 member subscribers and growing! We bring you exclusive content from leading data and research providers Sign Up Here |

?In this Week’s Creditor Corner The new Darth Sith emerges, Jonathan Lewinsohn on credit markets, Wachtel’s take on the latest Rx trends, ConvergeOne drives NJ forum selection, AMC LME 3.0, and much, much, more….

Registration Now Open 2026 Credit Opportunities Symposium

Featured Content Bruce Richards on the Markets ?That’s One Expensive Headache |

Scroll through to read all ou?r content? |

|

|

|

|

|

Registration Now Open |

2026 Credit Opportunities Symposiumpresented by: |

|

|

Credit Markets in Flux:Late Cycle Opportunities & Pitfalls

Thursday, March 12, 2026 Reception at 5:30pmFriday, March 13, 2026 All-day Program NYU Stern School of Business CLE Credit Offered

|

| Register Here |

Agenda: |

Keynote Presentation Steve Tananbaum, GoldenTree Asset Management, in conversation with Sara Eisen, CNBC

Managing Credit Risk Across the Corporate Loan Market This panel will explore how the convergence of broadly syndicated loans and private credit is reshaping investment management. Experts will discuss managing credit risk across market cycles and analyze emerging trends in credit and liquidity. Moderated by Ted Basta, LSTA

Free falls, fraud and fun – Chapter 11 in real time This panel of legal experts will explore the latest developments in Chapter 11, including new filings, emerging disputes, and the cases shaping today’s restructuring landscape. Join industry experts for a timely discussion of current events and key trends unfolding in bankruptcy courts. Moderated by Cat Corey, 9fin

LMEs: You Can’t Tell Where You’re Going If You Don’t Know Where You’ve Been

In this session, Jared Muroff, Head of Special Situations at Octus, will discuss recent developments in liability management exercises with a focus on their impact on potential future transactions.

LME Tools of the Trade: Recent Developments and Hot Topics In Loan Market Documentation. This panel will examine recent loan market developments in the context of liability management, including DQ list flexibility, anti-cooperation and anti-advisor provisions, antitrust challenges, syndicate control, and other evolving liability-management technologies that are reshaping the playing field. Moderated by Ian Feng, CreditSights

How is AI reshaping our world (and credit as well…) This panel will include various perspectives of how AI is impacting the credit ecosystem, from data analytics to security selection and portfolio management. Moderated by Steve Miller, Fitch |

For more information, including sponsorship opportunities, email info@creditorcoalition.org |

|

|

|

|

|

What we’re watching |

there’s always a distressed cycle somewhere |

|

Click above to access content |

|

|

|

|

|

What we’re reading |

From ConvergeOne to Exclusive Opportunism a Must Read! |

|

|

Click above to access content Reprinted with Permission |

|

|

|

|

|

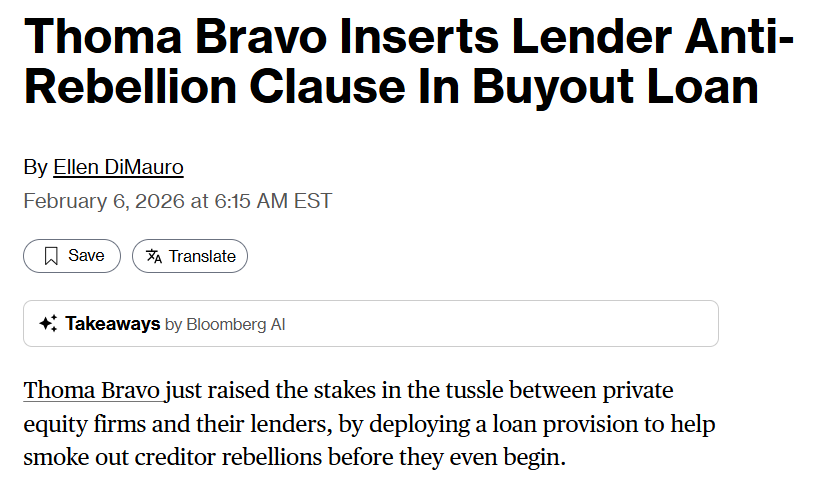

In the news |

more doc shenanigans…. |

|

|

|

Click above to access content |

|

|

|

|

|

Exclusive Content |

New Jersey’s ascendence |

|

|

Click above to access content One-time registration required |

Our take: With pushback coming from the SDTX to non pro rata DIPs, we are seeing the District of New Jersey’s emergence as the forum of choice. Will the baby get thrown out with the bath water?? |

|

|

|

|

|

Exclusive Content |

Simmering DIP battles… |

|

Click above to access content |

Our take: The District of New Jersey is in the driver’s seat as Judge Kaplan pushes the parties to resolve their differences while Bruce Bennett continues the fight against the insider DIP and venue selection. |

|

|

|

|

|

Exclusive Content |

New Jersey! |

|

|

Click above to access content One-time registration required |

Our take: New Jersey also grappling with how to interpret non pro rata uptier transactions that pit creditors against each other… |

|

|

|

|

|

Exclusive Content |

LME coming down the pike… |

|

Click above to access content |

|

|

|

|

|

Featured Content |

|

Software Skyfall: When Multiples Meet Gravity The average software stock is down 25% over the past year. That underperformance reflects a market waking up to AI-driven disruption across SaaS. Generative tools are enabling cheaper, more efficient, and more robust functionality, pressuring traditional subscription models and compressing once-premium margins. Investors are now reassessing exposure and asking harder questions about durability.

Private credit faces meaningful pressure given its heavy exposure to software and SaaS borrowers. This harsh assessment can be categorized into three separate and distinct outcomes:

Scenario 1: The company adapts and thrives. AI becomes an accelerant, creative destruction strengthens the franchise, and lenders are repaid at par.

Scenario 2: The business survives, but valuation multiples compress 50–60%. Equity is wiped out, refinancing proves elusive, and lenders take control through restructuring (see chart below)

Scenario 3: The company fails to adapt, its moat narrows, competitive intensity rises, margins erode, and when it files BK, recoveries disappoint.

Sharp enterprise value declines are already triggering refinancing challenges. Significant maturities over the next two years will intensify this dysfunctional dynamic. AI disruption, point to rising defaults as a growing list of software credits hit the wall. Investors must be very selective, as this becomes an increasingly important risk factor to analyze.

This is a growing concern for the BSL Market too. News that leading banks are unable to offload a recent deal from top-tier PE sponsors with deep software expertise weighs heavily while greater than 35% software names in BSL market trade below 95. Public BDCs are down 18% over the past 12 months vs. S&P 500 which is up 16% over this period. With roughly 25% exposure to software, BDCs are trading poorly with 90% trading below NAV.

Takeaways: 1) Firms like Marathon Asset Management have lived through harsh market forces and structural changes and have come out stronger, this includes the dot com bubble at the turn of the century, sub-prime crisis during the GFC, collapse in energy sector in 2016, and damage to CRE market when financing rates rose 500+ bps in 2022-2023 resulting in harsh times for CRE market, 2) AI is young, the market has finally woken up to potential for disruption in software sector, which is now underway, 3) significant investment opportunities will arise, patience, discipline, expertise and experience will be key, 4) stay underweight software, 5) Direct Lending is under the spotlight, seasoned portfolios with low leverage to stable companies and little/no software exposure is your ideal candidate, 6) Opportunistic Credit and ABL should be the standout performers in the current cycle.

I have been publicly warning about the disruption in the software sector for over a year and Marathon is well positioned with minimal software exposure given this view. |

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

|

|

Exclusive Content |

opt outs battleground |

|

Click above to access content |

|

|

|

|

|

Scholar’s Corner |

|

|

Click above to access content Reprinted with Permission |

|

|

|

|

|

What we’re watching |

More on the latest themes in themarket |

|

Click above to access content One time registration required |

|

|

|

|

|

|

Wharton Conference: Restructuring in the Age of Private Credit |

February 20, 2026 |

| Learn More |

|

|

|

ABI: Duberstein Moot Court Reception |

March 2, 2026 |

| Learn More |

|

|

|

CRC: 2026 Credit Opportunities Symposium |

March 13, 2026 |

| Learn More |

|

|

|

EMTA Forum: 2026 EM Corporate Bond Outlook in Boston |

April 23, 2026 |

| Learn More |

|

|

|

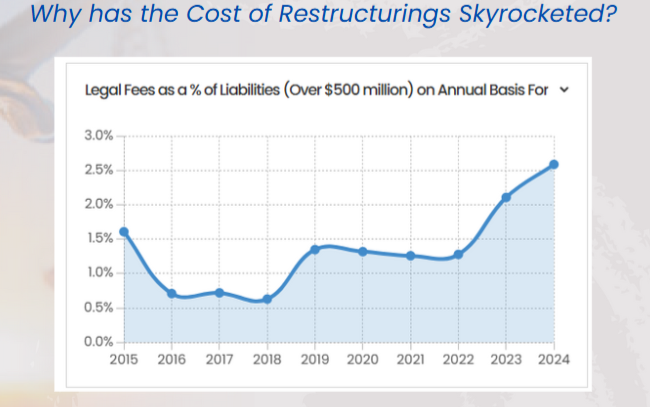

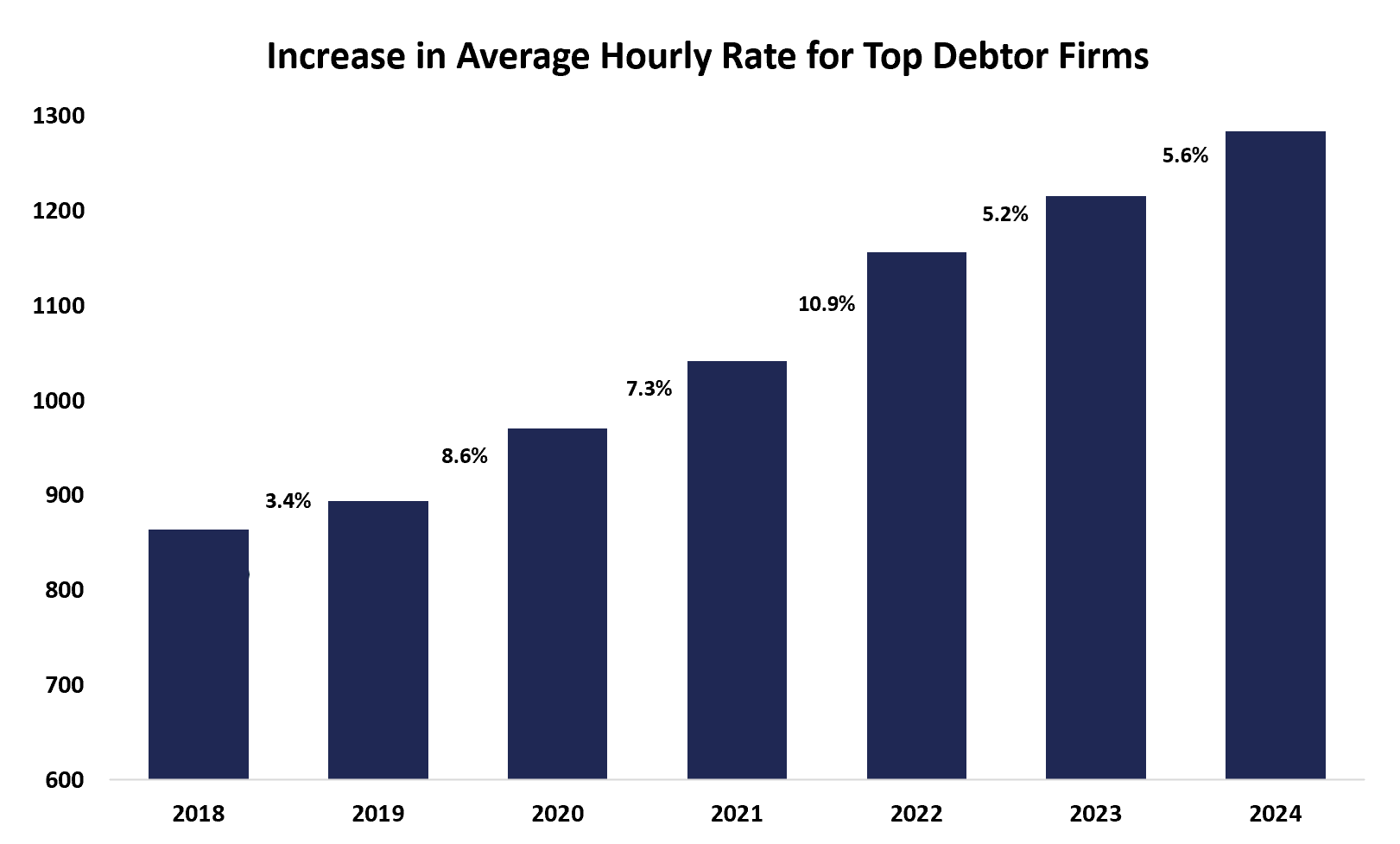

The Data Download |

Bringing Transparency to the Bankruptcy Process |

|

|

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. We took a deep dive to see what is driving up the daily cost of restructurings and the culprit: Increasing Legal Hourly Rates. We analyzed final fee apps for top debtor law firms from 2018 to 2024 and found average hourly legal fees have increased by over 65% since 2018. Maybe a little bit of sunlight is the right disinfectant to help remedy the problem…. |

|

|

|

|

|

|