Weekly News – December 8

Meet our 2023 Sponsors

The CRC is funded through sponsorships from these organizations:

2024 Sponsorships Now Available

Please Consider Sponsoring CRC’s Content

Click Here

Debtwire Restructuring Forum Miami:

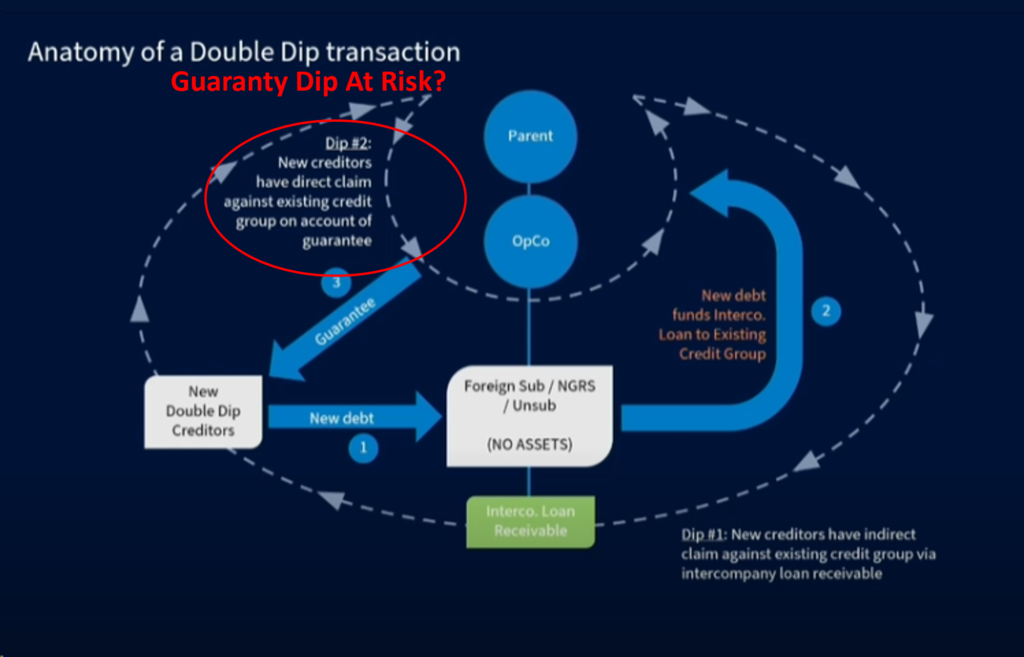

Are Double Dips in Trouble?

At the Debtwire Restructuring Forum, Judge David S. Jones (SDNY) commented on the use of the double-dip financing technique:

[Double-Dips] raises some questions about bankruptcy administration, particularly the bankruptcy system is always fundamentally focused on making sure that like situated creditors get like treatment and avoiding double payments. I think if you are a new lender participating in a double – dip, you have potentially got a non – debtor source of funding and that’s great — you may get paid fuller, faster — but as a bankruptcy court you are going to be focused on making sure that this isn’t an improper pathway to double compensation or a potentially subordinatable use of debtor assets. So, particularly you may look at the debtor guarantee directly to the new lenders and other parties in the transaction or other parties in interest in the bankruptcy might look hard to see what remedies might they have to try and break that dotted line and try to minimize the use of estate assets to compensate these new lenders who might have some other vehicle…. That’s just a quick take on what I would be worried about as a bankruptcy judge looking at this. Fundamentally make sure there’s not a double dip and make sure estate assets are actually being used for a legitimate purpose.

Watch it here at 14:23:

He added all the necessary qualifications that his comments do not represent a view on any particular case.

Our take:

Can Judge Jones (SDNY) comments be the canary in the coal mine? Are creditors now on notice that their claims could be challenged?

Tell us what you think here

GM double-dip cut in half

Can history repeat itself?

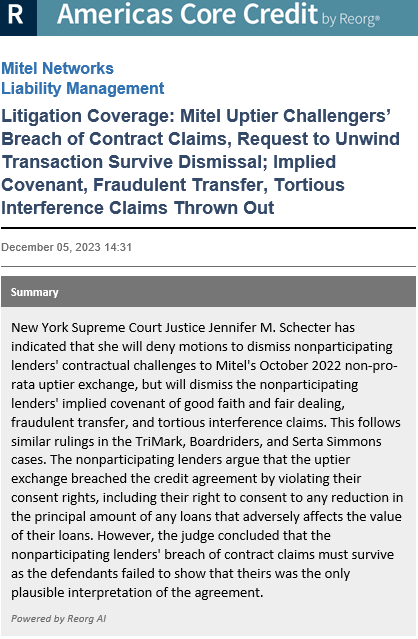

New York courts continue to question uptiers

Exclusive Content

Click here to view it on Reorg

Delaware rejects $21 million legal fee

Consequences for future filings in Delaware?

Neiman part deux?

Exclusive Content

Find it here on LevFinInsights

Creditor Rights Coalition

Special Feature: SCOTUS takes on Purdue

click here to read the features from our Contributor analyzing what happened @SCOTUS

Exclusive Content

CreditSights view

Michael Milken revisited

Listen to the interview with Richard Sandler with Michael Gatto presented by:

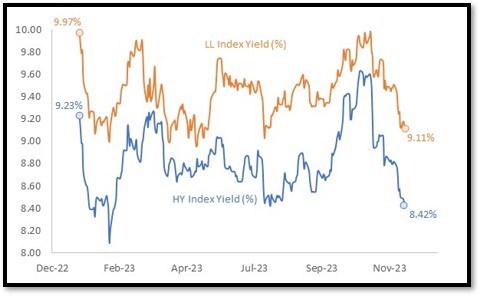

JPM LevFin update

HY and LL yields are closing the year materially inside where they were at start of 2023

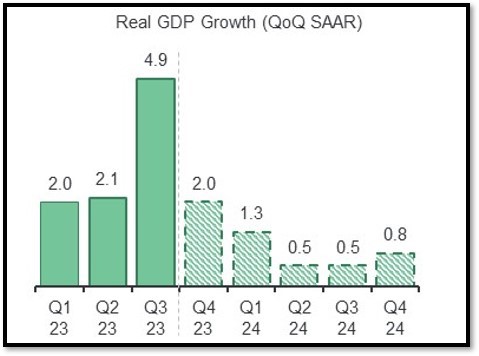

GDP growth below-trend but positive in 2024

JPM rate projections for 2024

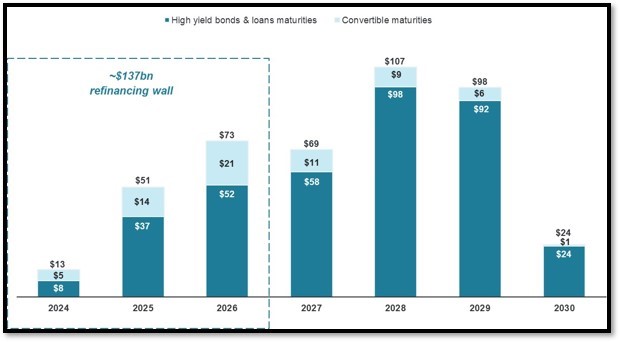

A significant Tech maturity wall will be going current over the course of 2024

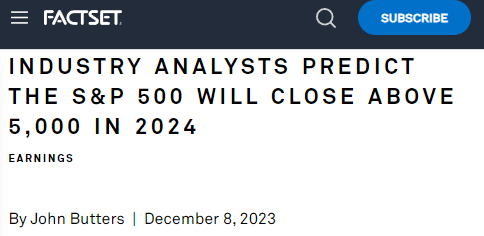

Predictions…

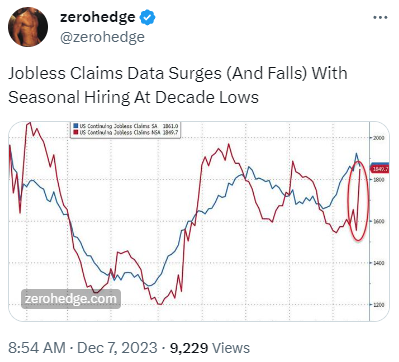

fed pivot?

CRC weighs in on Serta

Read our recent coverage:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events

December 12-13: Fitch Solutions: Leverage Finance Credit Outlook

December 14: Goodwin: Litigation Financing Demystified: Insights from Funders and Counsel