Weekly News – December 15

2024 Sponsorships Now Available

Please Consider Sponsoring CRC’s Content

Click Here

New Weekly Feature

Bruce Richards on the Markets

Bruce Richards, CEO

Marathon Asset Management

insights on markets, investing and more!

That ‘90s Show.

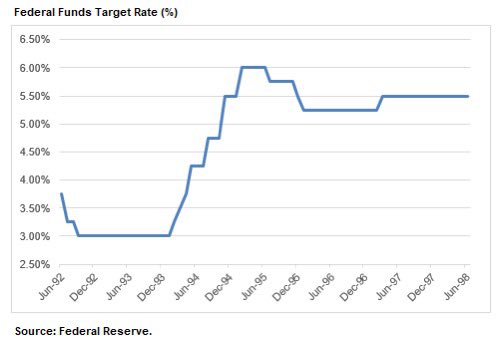

Chairman Powell wrapped up the final Federal Reserve meeting of 2023 and what is on everyone’s mind is when the Fed will lower rates and by how much.

Let’s turn back the page to February 1994, when the Fed moved abruptly to raise rates by 300bps within a 1-year period as Chairman Alan Greenspan’s concern about inflation combined with strong growth was the catalyst. Notice what then happened next, as the Fed lowered rates the following year by 75bps from 6% to 5.25%, then raised by 25bps to 5.5%, which put the market on notice.

Fed Funds remained between 5% to 6% for ~4 years. Fed Funds was 5.5% exactly where it is today.

Only time will tell how this rate cycle plays out, however, I believe firmly the market is pricing in too aggressively how much the Fed will lower cut its funds rate in 2024.

While history rarely repeats, it often rhymes.

To follow Bruce’s thoughts on markets, investing, and more follow @bruce_markets

Our take:

Is the market getting ahead of itself?

What should Bruce weigh in on next week?

Tell us what you think here

“double-dip” BK

PREIT files 2nd BK!

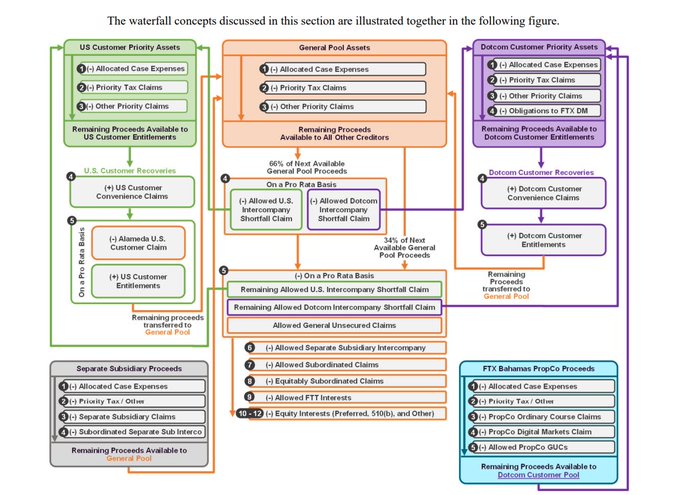

FTX plan filed

Hope springs eternal

Exclusive Content

Hope springs eternal!

Hope hits a snag…

Exclusive Content

Argy in the news

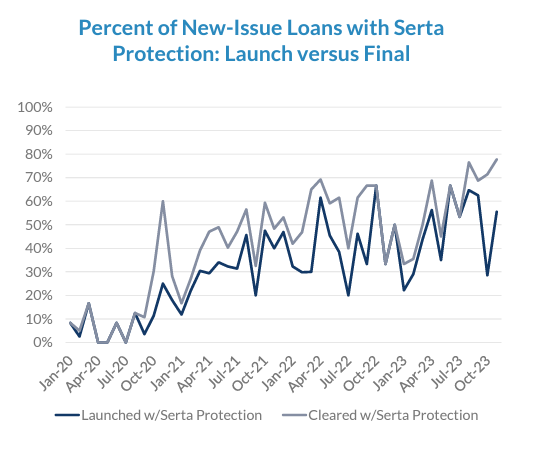

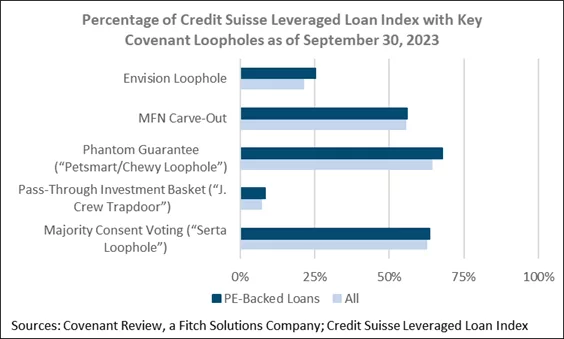

Uptiers face pushback in the primary market

but 60% of entire market still contains loopholes

Exclusive Content

Our take:

Even though nearly all new deals coming to market limit uptiers, it will still take a few years for older documentation to become obsolete. In the meantime, enterprising lawyers will continue to come up with ways to siphon value away from creditors.

Whack-a-mole continues!

Learn More:

Exclusive Content

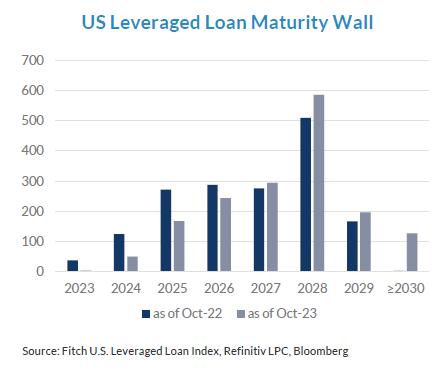

Debt recoveries trending lower

Find it here on S&P Global

Access requires one-time registration

Exclusive Content

Contributor Cliff White Speaks with 9fin

Find it here on 9fin — our newest content provider!

Exclusive Content

CreditSights Conference Slides

Meet our 2023 Sponsors

The CRC is funded through sponsorships from these organizations:

Creditor Rights Coalition

Contributors Speak Up:

Venue Reform in the Spotlight

click here to read the features from our Contributors analyzing Venue ReformÂ

Special Feature: SCOTUS takes on Purdue

click here to read the features from our Contributor analyzing what happened @SCOTUS

CRC weighs in on Serta

Read our recent coverage:

Where Are We In The Credit Cycle?

Look out for more great features from our Contributors

Have something interesting to share?

email us at info@creditorcoalition.org

Upcoming Events