LME outcomes analyzed, AMC nets full participation, Pluralsight surprises, Glenn’s angry again, WDTX takes over from SDTX, and much, much more… ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Creditor Corner |

for the week ended August 2, 2024 |

|

|

Your weekly curated content from the Creditor Rights Coalition |

Over 2,600 member subscribers and growing! Sign Up Here |

BREAKING NEWS LME outcomes analyzed, AMC nets full participation, Pluralsight surprises, Glenn’s angry again, WDTX takes over from SDTX, and much, much more…

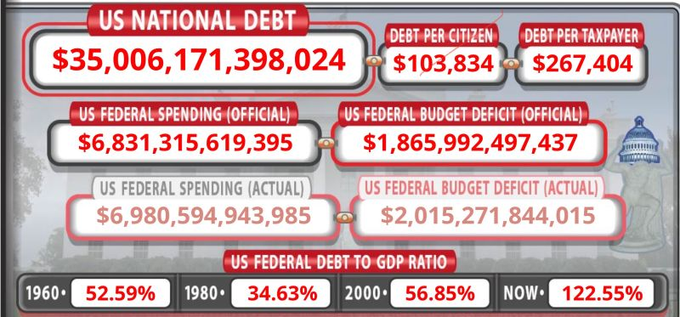

FEATURED CONTENT Bruce Richards on the Markets: Tick-Tock, Tick-Tock, Here is the Debt Clock. When does the alarm go off?

|

Scroll through to read all of our content |

|

|

|

Tweet of the Week |

the ultimate contra-indicator… |

|

|

|

|

|

|

|

Click Above to Access Content access free to subscribers |

Our take: Contrary to market expectation, level of seniority and near-dated maturities may not protect creditors from an adverse LME outcome. As Barclays notes, “this trend may ultimately be viewed as degenerative to market structure.”

We couldn’t agree more.

|

|

|

|

Exclusive Content

|

kinder, gentler works! |

|

|

|

|

Click Above to Access Content one-time registration required |

|

|

|

In the News |

Pluralsight surprises… |

|

|

Click Above to Access Content additional registration required |

|

|

|

Exclusive Content |

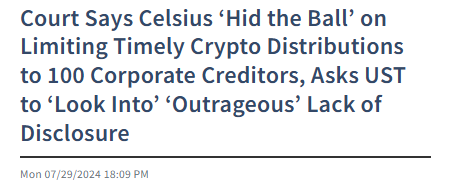

Do not f*ck with Judge Glenn |

|

|

|

|

Click Above to Access Content additional registration required |

Our take: Judge Glenn walks softly and carries a big stick! |

|

|

|

|

|

Click Above to Access Content additional registration required |

Our take: The SDTX has been clutching onto all Jones-related civil/fee proceedings with clenched fingers only to have the Chief Judge pull the rug out from underneath them and transfer all proceedings to the Western District…. what will happen next?? |

|

|

|

Exclusive Content |

at least it’s not a retail liquidation! |

|

|

|

Click Above to Access Content free access to subscribers |

|

|

|

Exclusive Content |

on the chopping block! |

|

|

|

Click Above to Access Content free access to subscribers |

|

|

|

Featured Content |

|

Tick-Tock, Tick-Tock, Here is the Debt Clock. When does the alarm go off?

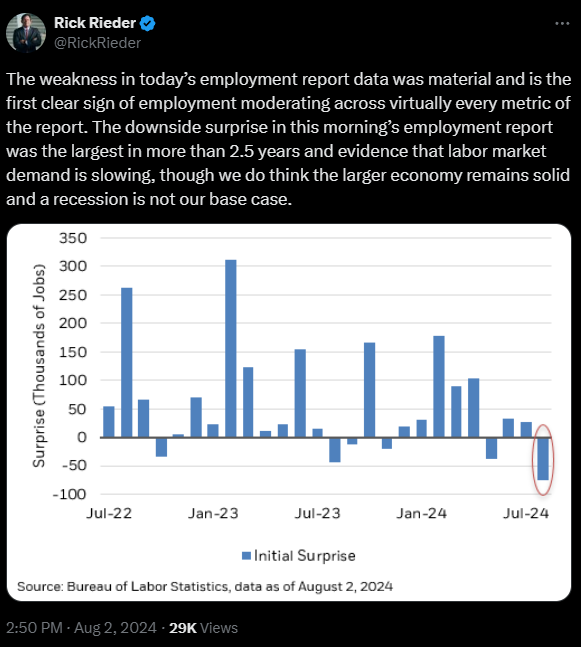

2UST debt rose above $35T this week, a stunning sum, driven by ~$7T annual government spending that drives fiscal deficit of $1,865,992,497,437. With debt issuance soaring and Debt-to-GDP at a record 122% there seems no end in sight to the lack of fiscal discipline.

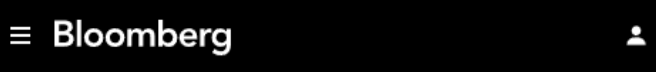

What is so impressive is that despite increased issuance of UST, the 10-year fell below 4% as the entire yield curve shifted lower. The market is looking forward to the Fed cutting rates, but the rally in UST is in response to a reduction in inflationary expectations, and a slowdown in economic activity as job market cools and commodity prices soften. Despite the yield curves continued inversion, I do not believe there will be a recession this coming year, just a softening in growth.

|

|

To follow Bruce’s thoughts on the markets, investing and more, follow @bruce_markets |

|

|

|

Data Download |

weaker employment report raising fears |

|

Click Above to Access Content |

|

|

|

Data Download |

more on employment report |

|

|

|

Click Above to Access Content additional registration may be required |

|

|

|

Upcoming Events |

INSOL: Private Credit (Singapore) |

August 26, 2024 |

| Learn More |

|

|

|

INSOL: Singapore Meeting |

August 27, 2024 |

| Learn More |

|

NCBJ: Annual Meeting |

September 18-20, 2024 |

| Learn More |

|

|

Save the Date: The Creditor Rigths Coalition together with Cooley and Kobre Kim bring you an indepth discussion of: Incora & its Implications Emerging Retention and Independent Director Issues The “Day After”: Third Party Releases after Purdue

Mark your calendars more information to come |

September 10, 2024 |

| more to come soon |

|

|

IMN: Distressed CRE Forum |

September 19, 2024 |

| Learn More |

|

ABI: Views from the Bench |

September 24, 2024 |

| Learn More |

|

|

|

GRR: Restructuring in the Americas |

October 15, 2024 |

| Learn More |

|

|

|

|

|

|

|

|

|

The views of our Contributors should not be attributed to their respective firms or the Creditor Rights Coalition. In addition, the Coalition may take positions as part of its Advocacy efforts that do not necessarily reflect the view of Contributors and should not be attributed to any Contributor. |

|

|

|

Announcing New Data Initiative to Analyze Bankruptcy Costs |

Bringing Transparency to the Bankruptcy Process |

|

|

Click Above to Access The Data Download |

Our Take: The Daily Cost of BK Legal fees Are Increasing. Are we shocked? No. Our proprietary analysis supports anecdotal evidence that bankruptcy has gotten more expensive. We will be providing additional analysis in the future to show how other factors affects fees. We hope our database will help make bankruptcy a more efficient forum for all stakeholders. |

|

|

|

Special Feature |

Implications of the Purdue Pharma case |

|

|

|

|

Special Feature |

Recent disqualification decisions and conflicts in BK |

|

|

|

|

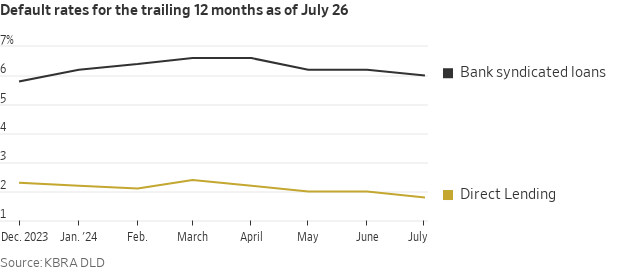

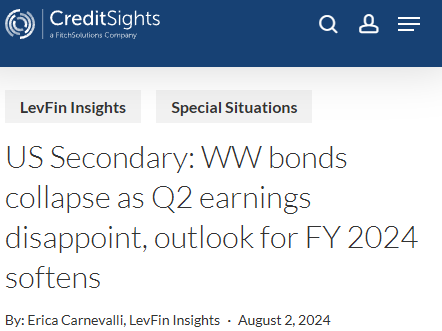

Special Feature |

Where we are in the credit cycle |

|

|

|

|

Meet Our Sponsors |

The CRC is funded through sponsorships from these organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|